XPO Logistics Announces Third Quarter 2018 Results

- Reports 11.5% revenue growth, led by contract logistics and freight brokerage

- Closes $918 million of new business in the quarter, up 43% year-over-year

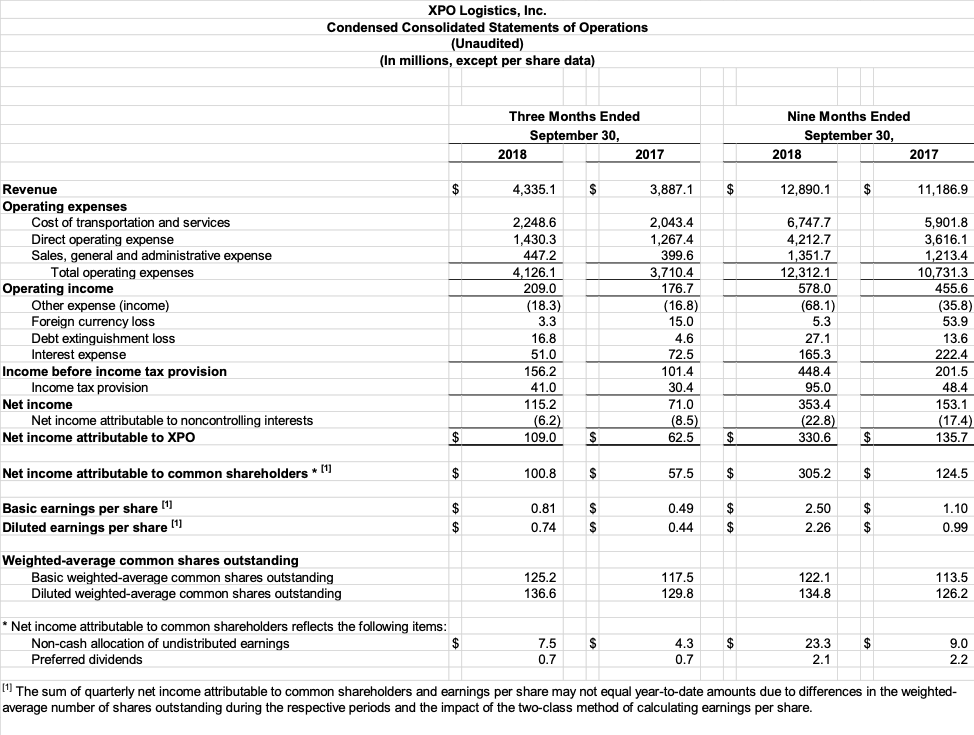

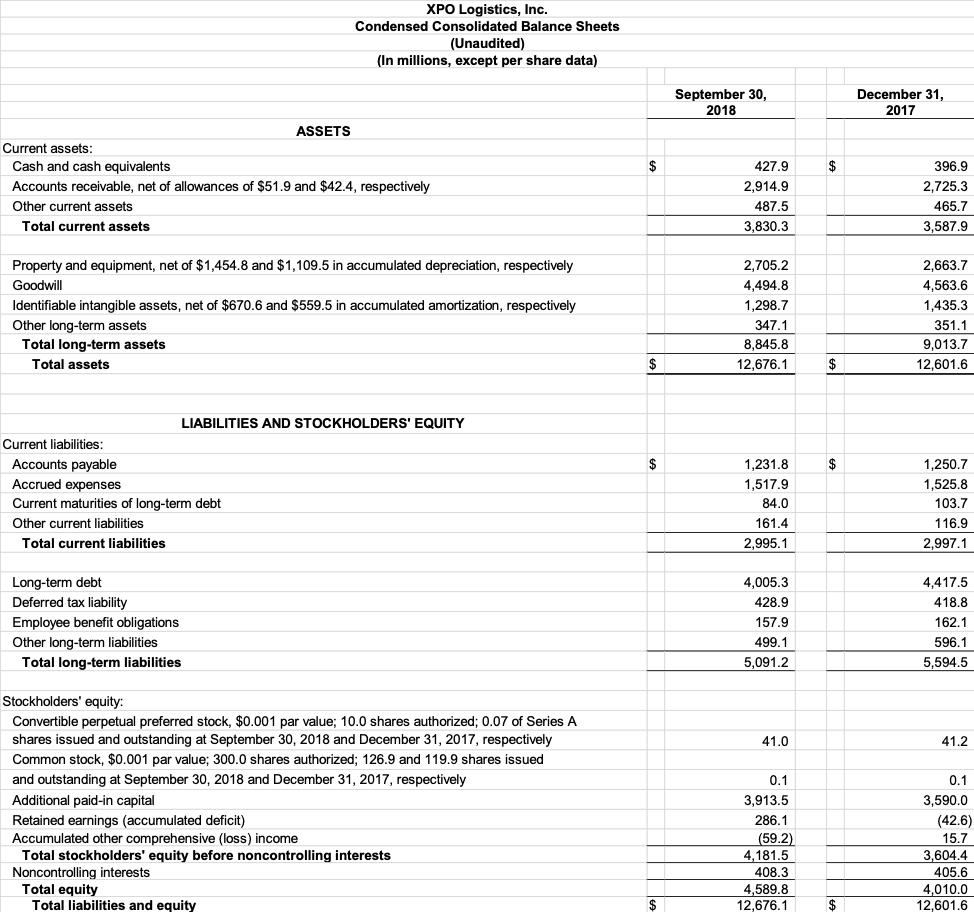

XPO Logistics, Inc. (NYSE: XPO) today announced financial results for the third quarter 2018. Revenue increased 11.5% year-over-year to $4.34 billion. Net income attributable to common shareholders was $100.8 million for the quarter, compared with net income attributable to common shareholders of $57.5 million for the same period in 2017. Earnings per diluted share was $0.74 for the quarter, compared with $0.44 for the same period in 2017.

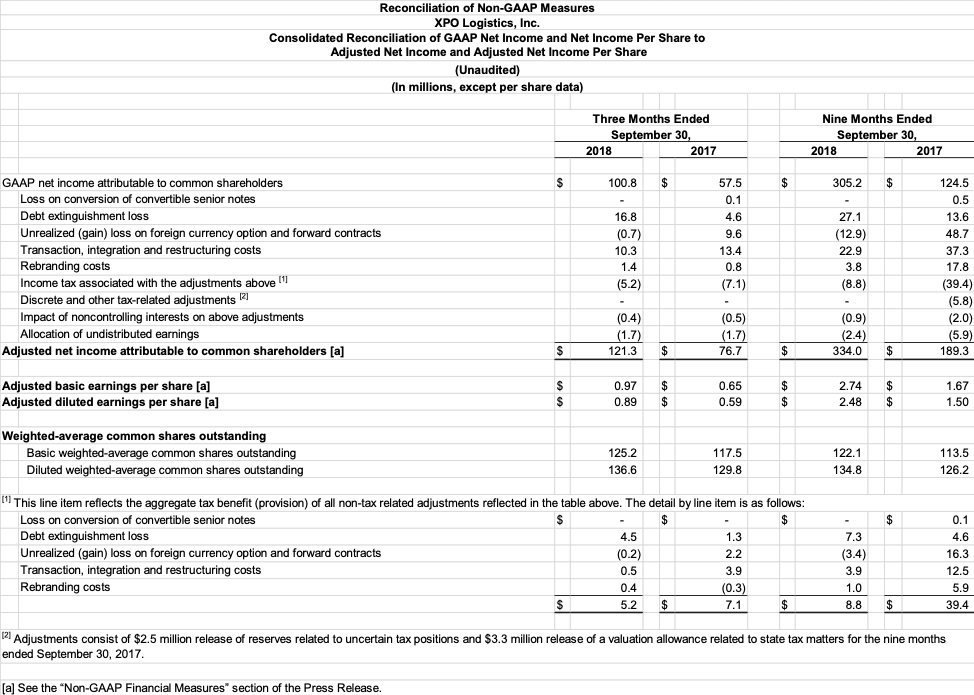

Adjusted net income attributable to common shareholders, a non-GAAP financial measure, was $121.3 million for the quarter, compared with $76.7 million for the same period in 2017. Adjusted earnings per diluted share, a non-GAAP financial measure, was $0.89 for the quarter, compared with $0.59 for the same period in 2017. EPS and adjusted EPS for the third quarter 2018 were decreased by $0.07 due to a charge of $15.6 million, or $11.4 million after-tax, related to a customer bankruptcy. Adjusted net income attributable to common shareholders and adjusted earnings per diluted share for the third quarter 2018 exclude: $16.8 million, or $12.3 million after-tax, of debt extinguishment costs; $11.7 million, or $10.8 million after-tax, of integration and rebranding costs; and a benefit of $0.7 million, or $0.5 million after-tax, of non-cash unrealized gains on foreign currency contracts. Reconciliations of non-GAAP financial measures used in this release are provided in the attached financial tables.

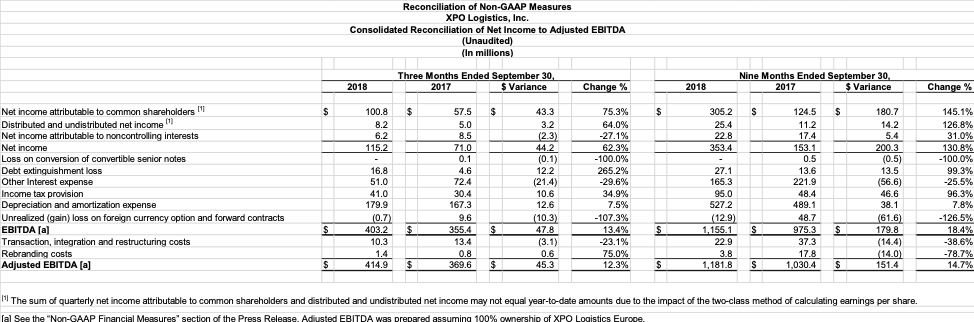

Adjusted earnings before interest, taxes, depreciation and amortization ("adjusted EBITDA"), a non-GAAP financial measure, increased to $414.9 million for the third quarter 2018, compared with $369.6 million of adjusted EBITDA for the same period in 2017. Adjusted EBITDA for the third quarter 2018 excludes integration and rebranding costs of $11.7 million. Adjusted EBITDA in the quarter reflects the impact of a $15.6 million charge related to a customer bankruptcy.

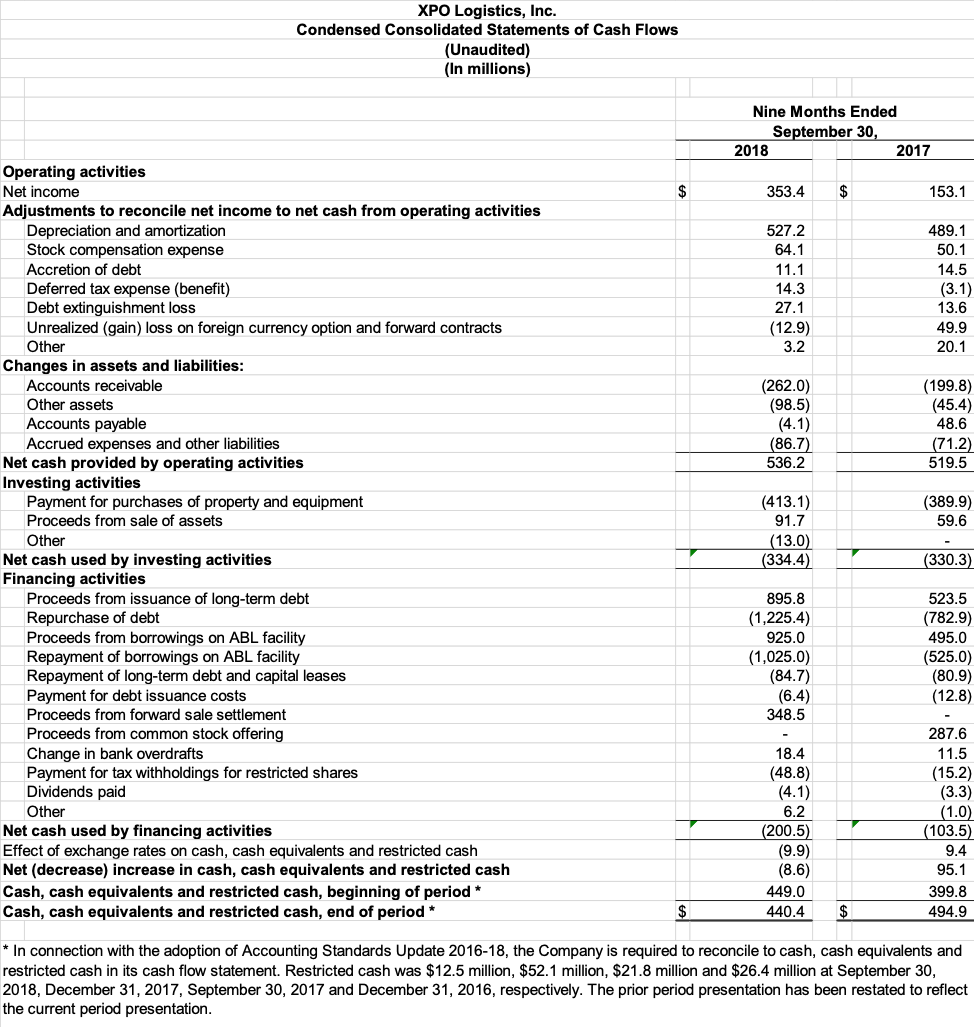

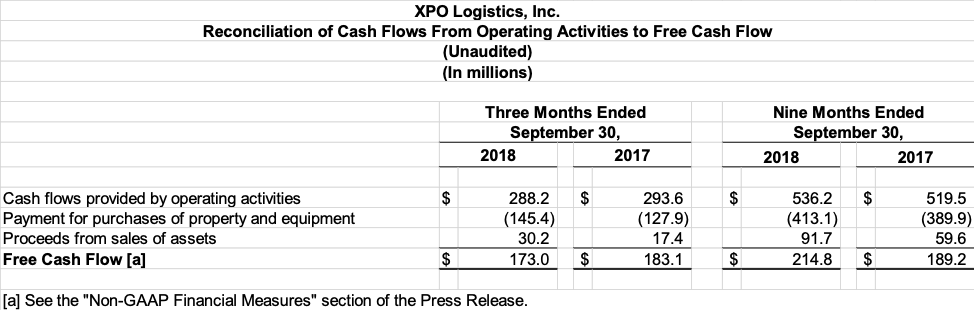

For the third quarter 2018, the company generated $288.2 million of cash flow from operations and $173.0 million of free cash flow.

Updates Financial Targets

The company has updated its full-year 2018 target for adjusted EBITDA to approximately $1.585 billion, from at least $1.6 billion. The revised target for adjusted EBITDA primarily reflects the impact of a customer bankruptcy in the third quarter. The company has reaffirmed its 2017–2018 target for cumulative free cash flow of approximately $1 billion.

CEO Comments

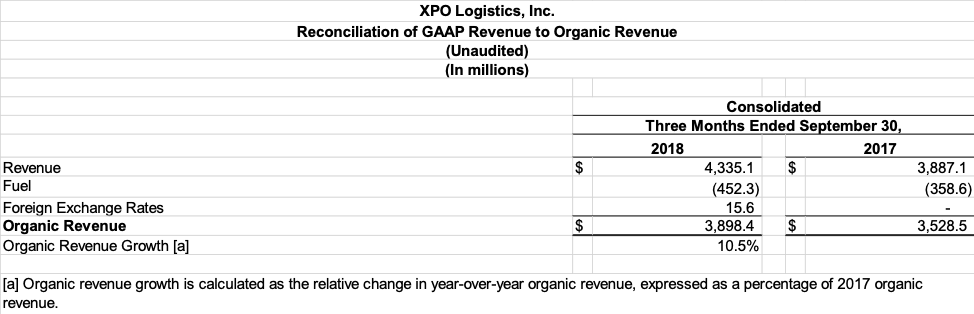

Bradley Jacobs, chairman and chief executive officer of XPO Logistics, said, “Our robust organic growth of 10.5% in the quarter was led by strong demand for e-commerce logistics and freight brokerage. In our North American LTL business, we improved the adjusted operating ratio by 220 basis points from a year ago. Companywide, we again grew profitability faster than revenue, despite the impact of a customer bankruptcy.

“Our disciplined investments in growth over the past 18 months are gaining traction. We closed $918 million of new business in the quarter, up 43% from last year, due in large part to our expanded sales organization and proprietary technology. In contract logistics, we implemented a record 90 customer contracts through September, enabled by intelligent automation. And in North American brokerage, we used dynamic freight-matching algorithms to realize 18% revenue growth and 370 basis points of margin improvement with fewer people. This is the same technology used by XPO Connect, our digital freight marketplace.”

Jacobs continued, “Our leading positions in sectors such as e-commerce, as well as our capacity for innovation, should keep us growing faster than the industry in any macro environment. We’re continuing to explore acquisition opportunities that will further accelerate our trajectory."

Third Quarter 2018 Results by Segment

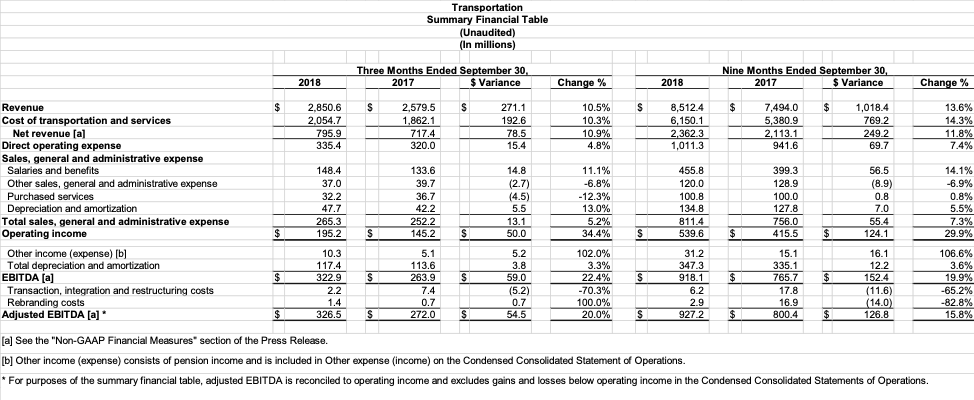

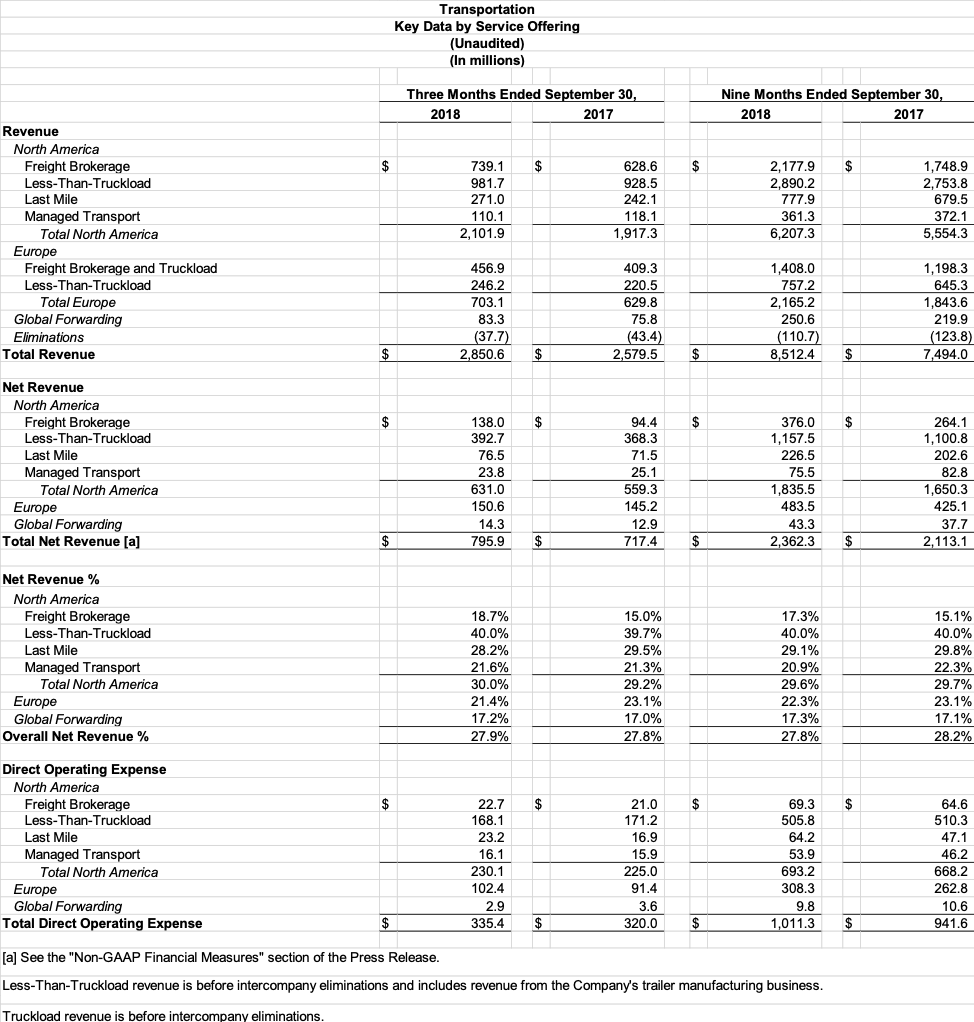

- Transportation: The company's transportation segment generated revenue of $2.85 billion for the quarter, a 10.5% increase from the same period in 2017. Segment revenue growth was led by increases in freight brokerage and last mile in North America, as well as dedicated truckload transportation in the UK and France.

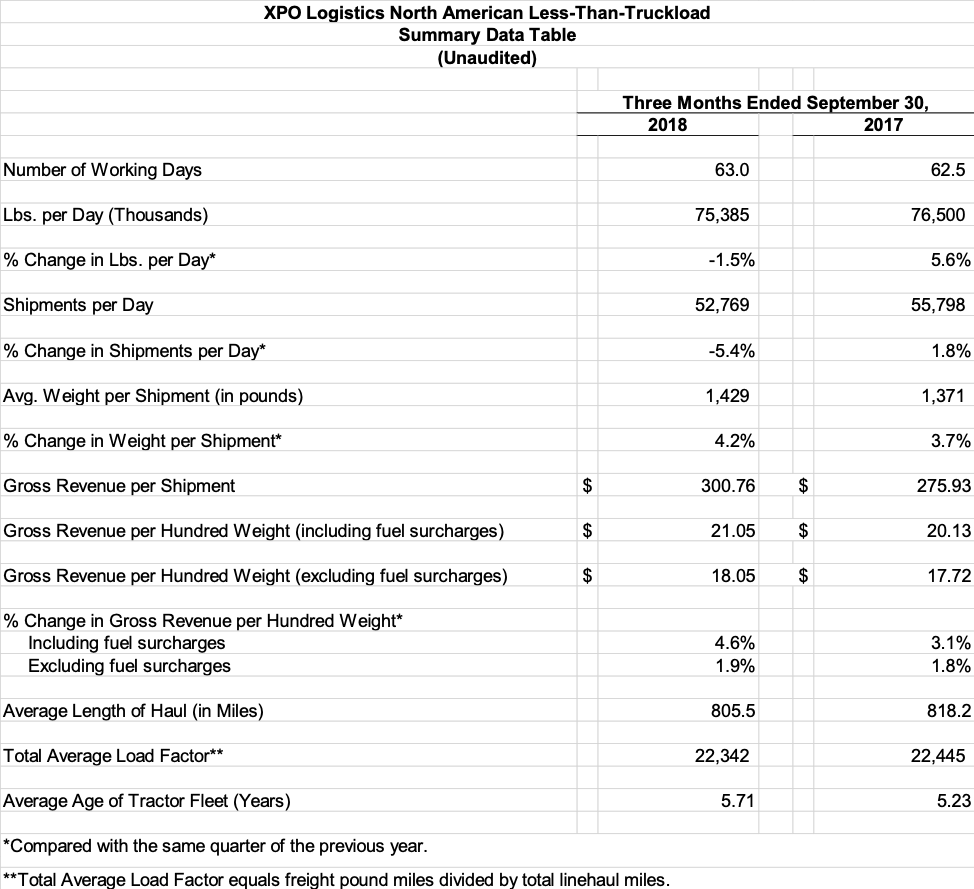

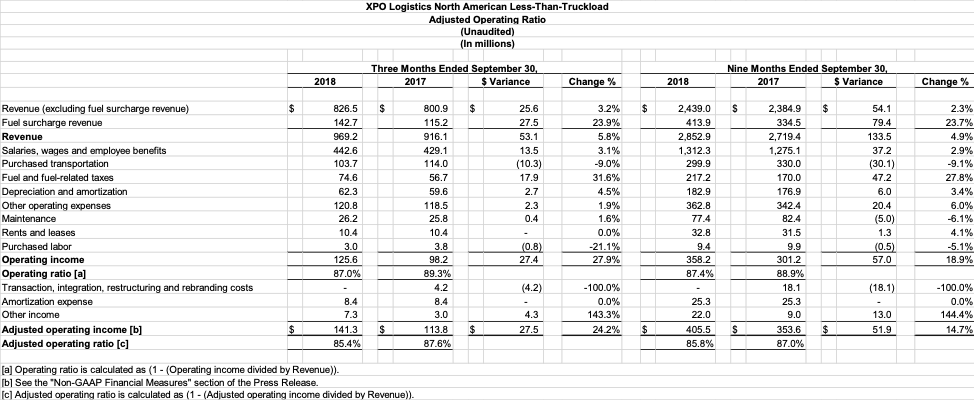

Operating income for the transportation segment increased to $195.2 million in the quarter, compared with $145.2 million for the same period in 2017. Adjusted EBITDA for the segment improved to $326.5 million, an increase of 20.0% from a year ago. The increases in operating income and adjusted EBITDA primarily were due to growth in global freight brokerage, less-than-truckload (LTL) operating margin improvement in North America, and growth in dedicated truckload in Europe. Within the North American less-than-truckload unit, the operating ratio was 87.0%. The adjusted operating ratio was 85.4%, a 220 basis point improvement from 87.6% for the third quarter 2017.

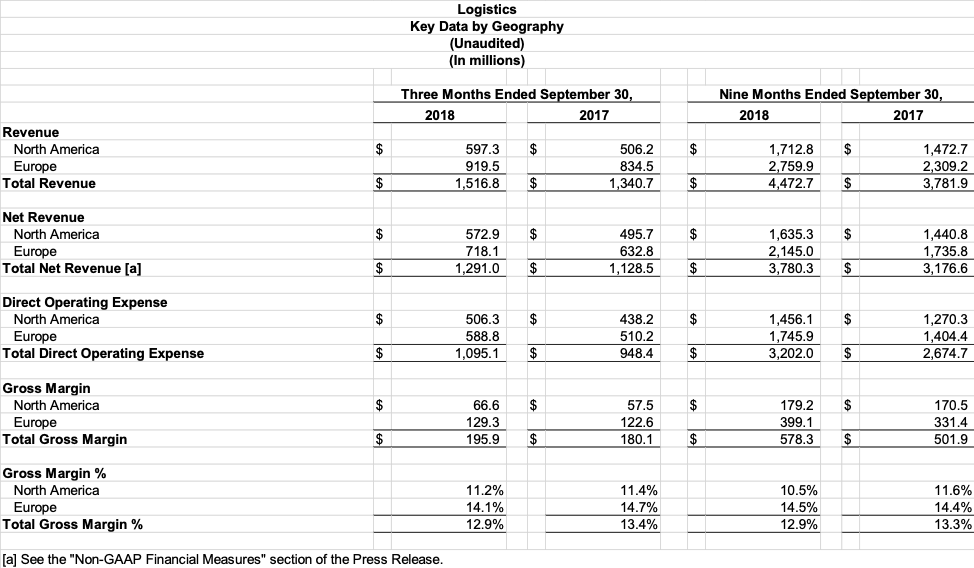

- Logistics: The company's logistics segment generated revenue of $1.52 billion for the quarter, a 13.1% increase from the same period in 2017. Segment revenue growth was led by rising demand for e-commerce logistics globally, as well as by the consumer packaged goods and food and beverage sectors in North America and the fashion sector in Europe.

Operating income for the logistics segment decreased to $59.5 million, compared with $67.3 million for the same period in 2017. Adjusted EBITDA for the segment was $128.0 million, unchanged from a year ago. The decrease in operating income primarily was due to a $15.6 million charge related to a customer bankruptcy, and to a record number of contract start-ups year-to-date: 46 in Europe and 44 in North America.

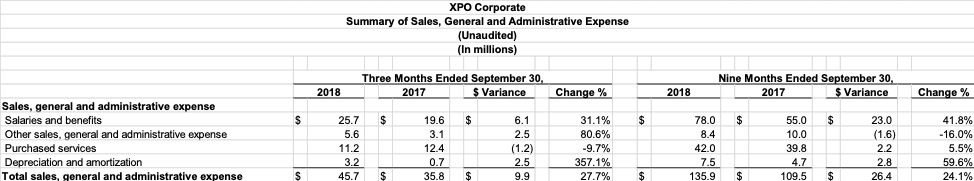

- Corporate: Corporate SG&A expense was $45.7 million for the quarter, compared with $35.8 million for the same period in 2017. The increase in corporate expense primarily reflects an increase in share-based compensation expense tied to the increase in the share price of XPO stock, as well as increased corporate headcount and information technology associated with the centralization of shared services from field operations.

Nine Months 2018 Financial Results

For the nine months ended September 30, 2018, the company reported total revenue of $12.89 billion, a 15.2% increase from the same period in 2017. Net income attributable to common shareholders was $305.2 million for the first nine months of 2018, compared with $124.5 million for the same period in 2017. Earnings per diluted share was $2.26 for the first nine months of 2018, compared with $0.99 for the same period in 2017.

Adjusted net income attributable to common shareholders, a non-GAAP financial measure, was $334.0 million for the first nine months of 2018, compared with $189.3 million for the same period in 2017. Adjusted earnings per diluted share, a non-GAAP financial measure, was $2.48 for the first nine months of 2018, compared with $1.50 for the same period in 2017. Adjusted net income attributable to common shareholders and adjusted earnings per diluted share for the first nine months of 2018 exclude $27.1 million, or $19.8 million after-tax, of debt extinguishment costs; $26.7 million, or $21.8 million after-tax, of integration and rebranding costs; and a benefit of $12.9 million, or $9.5 million after-tax, from non-cash unrealized gains on foreign currency contracts.

Adjusted EBITDA for the first nine months of 2018, a non-GAAP financial measure, improved to $1.18 billion, compared with $1.03 billion for the same period in 2017. Adjusted EBITDA for the first nine months of 2018 excludes $26.7 million of integration and rebranding costs.

Conference Call

The company will hold a conference call on Thursday, November 1, 2018, at 8:30 a.m. Eastern Time. Participants can call toll-free (from U.S./Canada) 1-877-269-7756; international callers dial +1-201-689-7817. A live webcast of the conference will be available on the investor relations area of the company’s website, www.xpo.com/investors. The conference will be archived until December 1, 2018. To access the replay by phone, call toll-free (from U.S./Canada) 1-877-660-6853; international callers dial +1-201-612-7415. Use participant passcode 13683596.

Non-GAAP Financial Measures

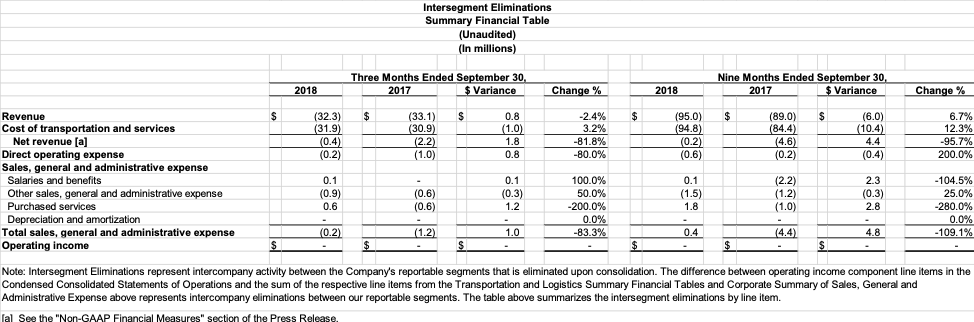

As required by the rules of the Securities and Exchange Commission ("SEC"), we provide reconciliations of the non-GAAP financial measures contained in this press release to the most directly comparable measure under GAAP, which are set forth in the financial tables attached to this document. This document contains the following non-GAAP financial measures: earnings before interest, taxes, depreciation and amortization ("EBITDA") and adjusted EBITDA for the three and nine-month periods ended September 30, 2018 and 2017, on a consolidated basis and for our transportation and logistics segments; free cash flow for the three and nine-month periods ended September 30, 2018 and 2017; adjusted net income attributable to common shareholders and adjusted earnings per share (basic and diluted) ("adjusted EPS") for the three and nine-month periods ended September 30, 2018 and 2017; net revenue for the three and nine-month periods ended September 30, 2018 and 2017 for our transportation and logistics segments and intersegment eliminations; adjusted operating income and adjusted operating ratio for our North American less-than-truckload business for the three and nine-month periods ended September 30, 2018 and 2017; and organic revenue growth for the three-month periods ended September 30, 2018 and 2017, on a consolidated basis.

We believe that the above adjusted financial measures facilitate analysis of our ongoing business operations because they exclude items that may not be reflective of, or are unrelated to, XPO and its business segments' core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses. Other companies may calculate these non-GAAP financial measures differently, and therefore our measures may not be comparable to similarly titled measures of other companies. Items excluded from such non-GAAP financial measures are significant and necessary components of the operations of our business, and, therefore, such measures should only be used as supplemental measures of our operating performance.

Adjusted EBITDA, adjusted net income attributable to common shareholders and adjusted EPS include adjustments for transaction, integration and restructuring costs. Transaction, integration and restructuring adjustments are generally incremental costs that result from actual or planned acquisitions or divestitures (i.e., transaction costs, integration costs, consulting fees and internal salaries to the extent that individuals are assigned full-time to integration and transformation activities), as well as restructuring costs, such as severance, related to business optimization activities. Rebranding adjustments primarily relate to the rebranding of the XPO Logistics name on our truck fleet and buildings. Management uses these non-GAAP financial measures in making financial, operating and planning decisions and evaluating XPO's and each business segment's ongoing performance.

We believe that free cash flow is an important measure of our ability to repay maturing debt or fund other uses of capital that we believe will enhance stockholder value. We believe that EBITDA and adjusted EBITDA improve comparability from period to period by removing the impact of our capital structure (interest and financing expenses), asset base (depreciation and amortization), tax impacts and other adjustments as set out in the attached tables that management has determined are not reflective of normalized operating activities. We believe that adjusted net income attributable to common shareholders and adjusted EPS improve the comparability of our operating results from period to period by removing the impact of certain costs and gains that management has determined are not reflective of our core operating activities. We believe that net revenue improves the comparability of our operating results from period to period by removing the cost of transportation and services, in particular the cost of fuel, incurred in the reporting period as set out in the attached tables. We believe that adjusted operating income for our North American less-than-truckload business improves the comparability of our operating results from period to period by (i) removing the impact of certain transaction, integration, restructuring and rebranding costs and amortization expenses and, (ii) including the impact of pension income incurred in the reporting period as set out in the attached tables. We believe that organic revenue is an important measure because it excludes the impact of the following items: foreign currency exchange rate fluctuations and fuel surcharges.

With respect to our 2018 financial target of adjusted EBITDA and our 2017-2018 cumulative target for free cash flow, each of which is a non-GAAP measure, a reconciliation of the non-GAAP measure to the corresponding GAAP measure is not available without unreasonable effort due to the variability and complexity of the reconciling items described below that we exclude from the non-GAAP target measure. The variability of these items may have a significant impact on our future GAAP financial results and, as a result, we are unable to prepare the forward-looking balance sheet, statement of income and statement of cash flow, prepared in accordance with GAAP that would be required to produce such a reconciliation.

Forward-looking Statements

This document includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including our financial targets for our consolidated adjusted EBITDA and free cash flow, our expected future growth prospects and our exploration of acquisition opportunities. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. In some cases, forward-looking statements can be identified by the use of forward-looking terms such as "anticipate," "estimate," "believe," "continue," "could," "intend," "may," "plan," "potential," "predict," "should," "will," "expect," "objective," "projection," "forecast," "goal," "guidance," "outlook," "effort," "target," "trajectory" or the negative of these terms or other comparable terms. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements are based on certain assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances.

These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Factors that might cause or contribute to a material difference include the risks discussed in our filings with the SEC and the following: economic conditions generally; competition and pricing pressures; our ability to align our investments in capital assets, including equipment, service centers and warehouses, to our customers' demands; our ability to successfully integrate and realize anticipated synergies, cost savings and profit improvement opportunities with respect to acquired companies; our ability to develop and implement suitable information technology systems and prevent failures in or breaches of such systems; our substantial indebtedness; our ability to raise debt and equity capital; our ability to maintain positive relationships with our network of third-party transportation providers; our ability to attract and retain qualified drivers; litigation, including litigation related to alleged misclassification of independent contractors; labor matters, including our ability to manage our subcontractors, and risks associated with labor disputes at our customers and efforts by labor organizations to organize our employees; risks associated with our self-insured claims; risks associated with defined benefit plans for our current and former employees; fluctuations in currency exchange rates; fluctuations in fixed and floating interest rates; our ability to execute our growth strategy through acquisitions; fuel price and fuel surcharge changes; issues related to our intellectual property rights; governmental regulation, including trade compliance laws; and governmental or political actions, including the United Kingdom's likely exit from the European Union. All forward-looking statements set forth in this document are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to or effects on us or our business or operations. Forward-looking statements set forth in this document speak only as of the date hereof, and we do not undertake any obligation to update forward-looking statements to reflect subsequent events or circumstances, changes in expectations or the occurrence of unanticipated events, except to the extent required by law.