XPO Logistics Announces First Quarter 2019 Results

- Closes $1.1 billion of new business, up 15% year-over-year, and grows sales pipeline to a record $4.1 billion

- Improves LTL yield by 3% year-over-year, excluding fuel, compared with 1.1% improvement the prior quarter

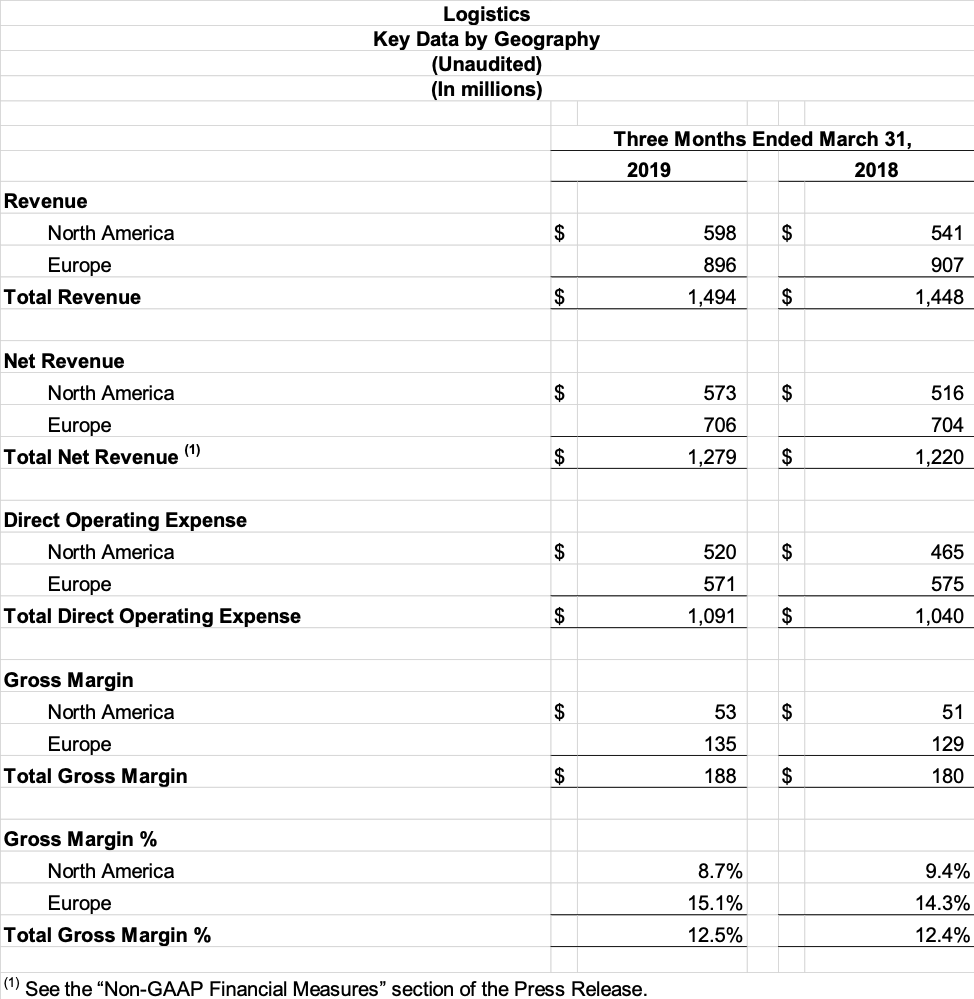

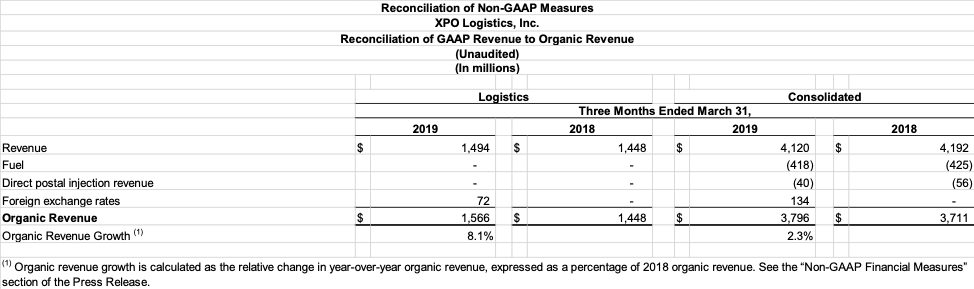

- Achieves logistics segment revenue growth of 3.2%; organic revenue growth of 8.1%

- Reaffirms 2019 targets for adjusted EBITDA and free cash flow

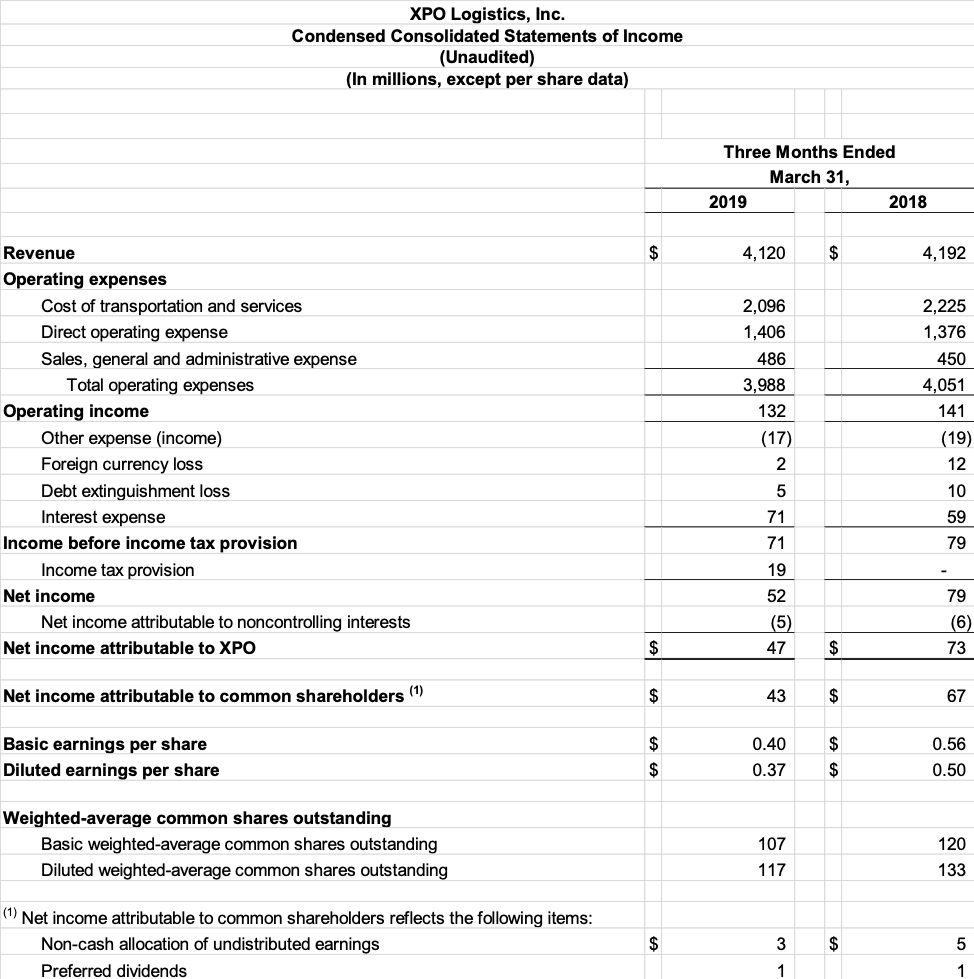

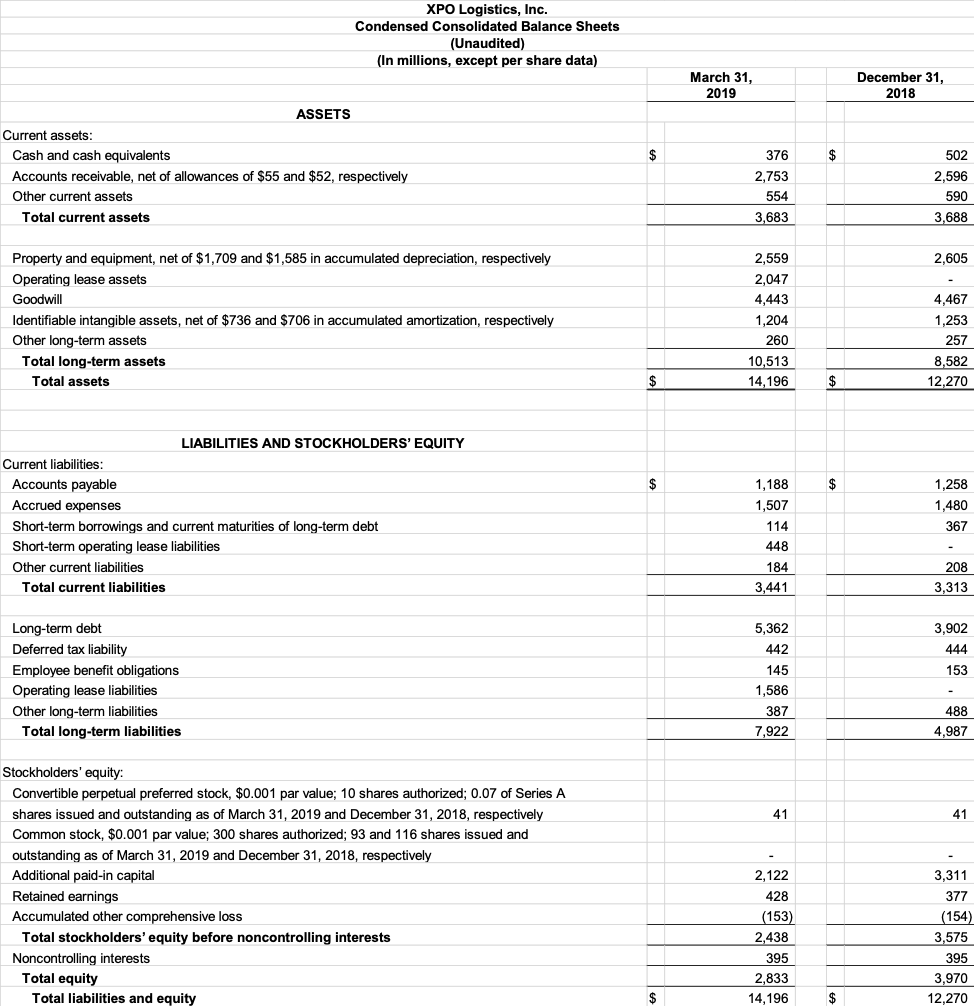

XPO Logistics, Inc. (NYSE: XPO) today announced financial results for the first quarter 2019. First quarter revenue was $4.12 billion, compared with $4.19 billion for the same period in 2018. Net income attributable to common shareholders was $43 million for the quarter, compared with $67 million for the same period in 2018. Diluted earnings per share was $0.37 for the quarter, compared with $0.50 for the same period in 2018. First quarter 2019 financial results were adversely impacted by: a reduction in business from the company’s largest customer; foreign currency exchange; higher interest expense year-over-year, partially offset by share repurchase activity; and a higher effective tax rate of 27% in 2019, compared with 0% in 2018.

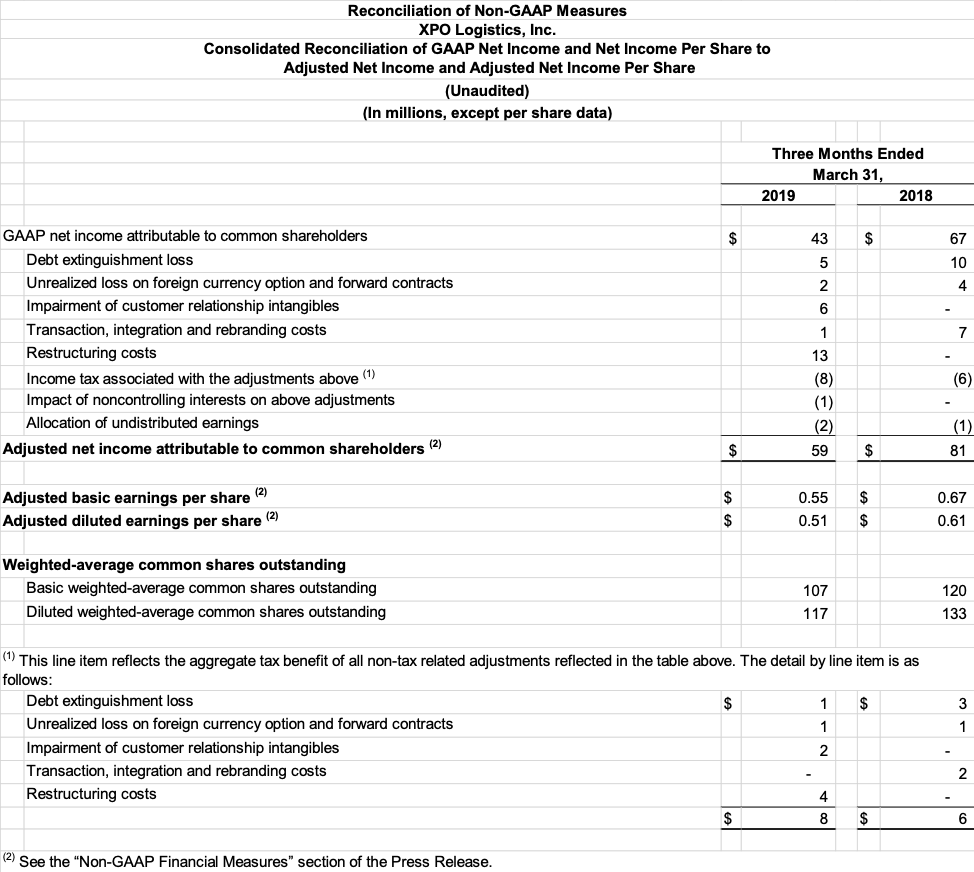

Adjusted net income attributable to common shareholders, a non-GAAP financial measure, was $59 million for the first quarter 2019, compared with $81 million for the same period in 2018. Adjusted diluted earnings per share, a non-GAAP financial measure, was $0.51 for the first quarter 2019, compared with $0.61 for the same period in 2018. Adjusted diluted EPS for 2019 reflects a higher tax rate in the first quarter 2019, compared with the same period in 2018.

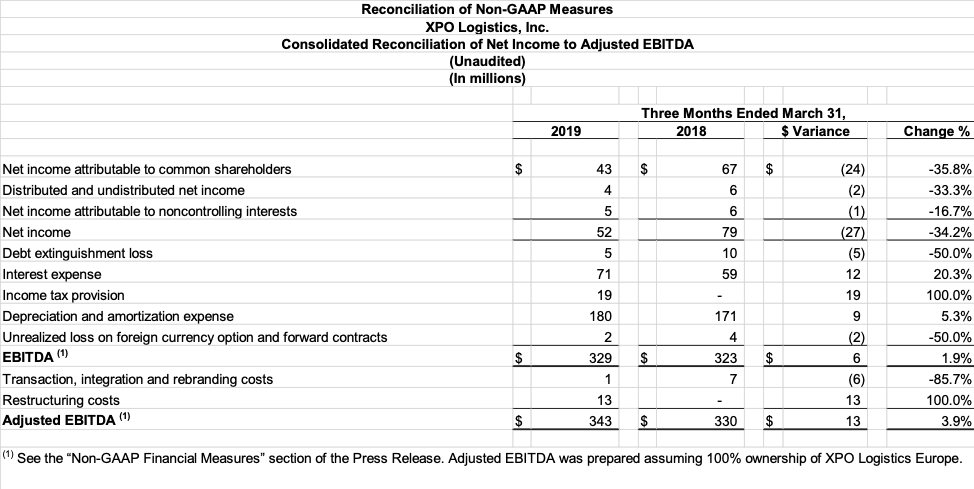

Adjusted net income attributable to common shareholders and adjusted diluted earnings per share for the first quarter 2019 exclude: $13 million, or $9 million after-tax, of restructuring costs, primarily severance; a non-cash charge of $6 million, or $4 million after-tax, related to the impairment of customer relationship intangibles; and $5 million, or $4 million after-tax, of debt extinguishment costs; $2 million, or $1 million after-tax, of non-cash unrealized losses on foreign currency contracts; and $1 million, or $1 million after-tax, of transaction, integration and rebranding costs. Reconciliations of non-GAAP financial measures used in this release are provided in the attached financial tables.

Adjusted earnings before interest, taxes, depreciation and amortization ("adjusted EBITDA"), a non-GAAP financial measure, increased to $343 million for the first quarter 2019, compared with $330 million for the same period in 2018. Adjusted EBITDA for the first quarter 2019 excludes: $13 million of restructuring costs, primarily severance; and $1 million of transaction, integration and rebranding costs.

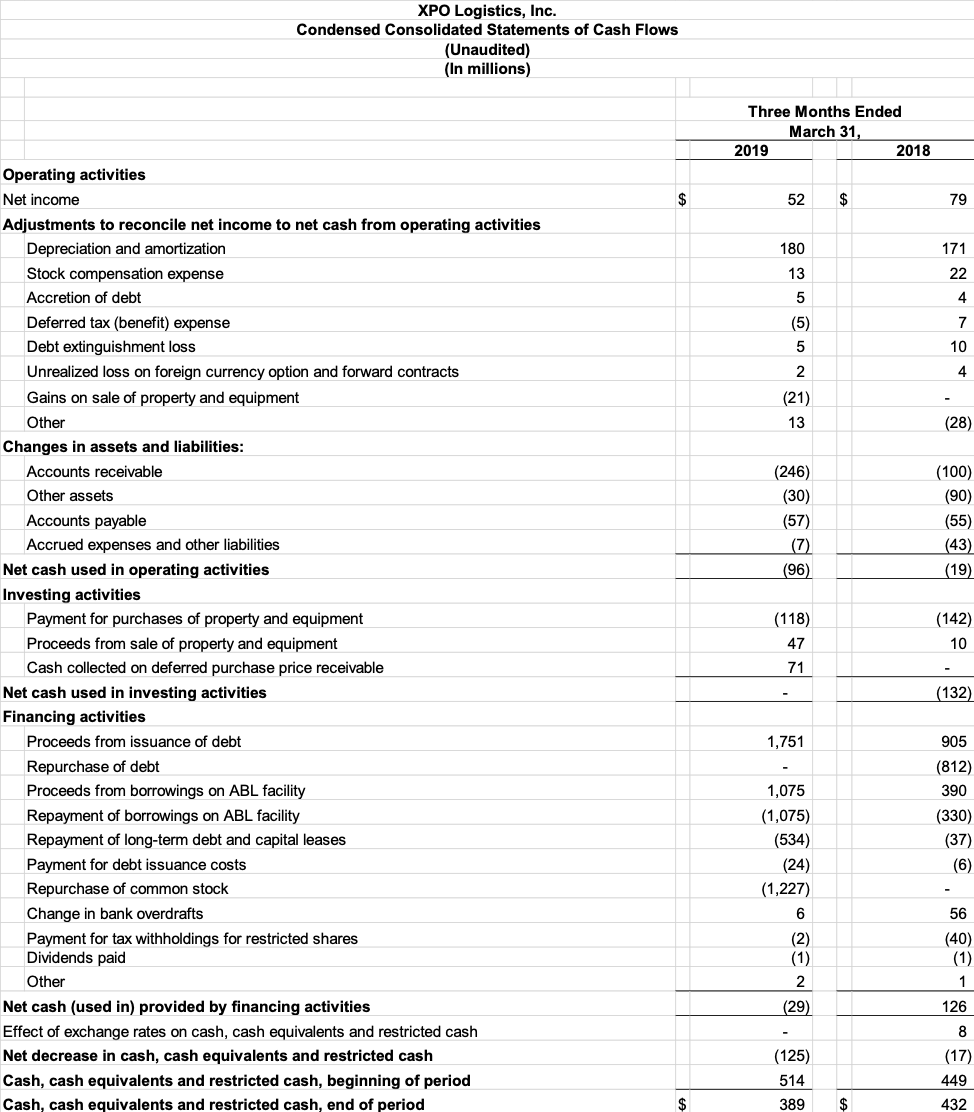

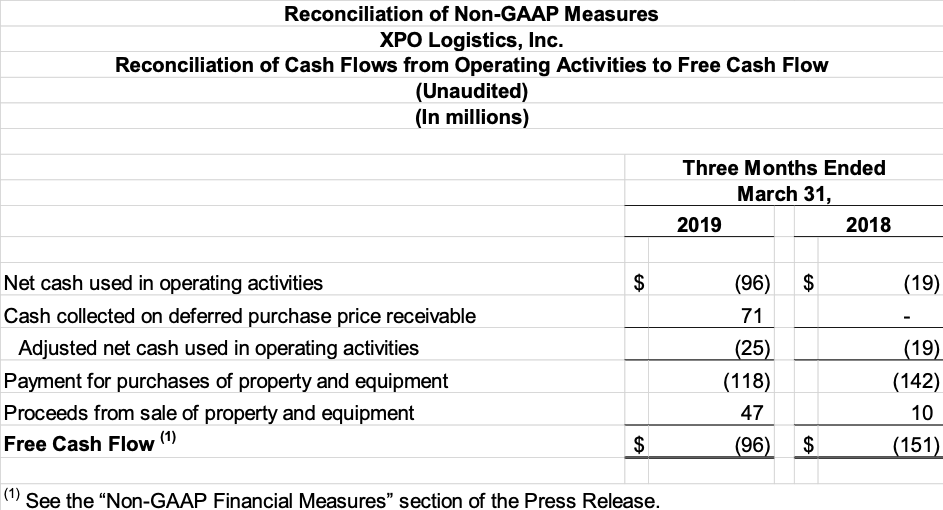

For the first three months of 2019, cash flow from operations was a cash usage of $96 million. Free cash flow, a non-GAAP financial measure, was a cash usage of $96 million. Free cash flow favorability was driven by lower net capex and lower bonus payments year-over-year.

Financial Targets

The company’s full-year 2019 targets are:

- Revenue growth of 3% to 5%, which corresponds to organic revenue growth of 5.5% to 7.5% year-over-year;

- Adjusted EBITDA in the range of $1.650 billion to $1.725 billion, an increase of 6% to 10% year-over-year;

- Free cash flow in the range of $525 million to $625 million;

- Net capital expenditures in the range of $400 million to $450 million;

- Depreciation and amortization in the range of $765 million to $785 million;

- Effective tax rate in the range of 26% to 29%; and

- Cash taxes in the range of $165 million to $190 million.

Effective first quarter 2019, the company excludes direct postal injection revenue from its calculation of organic revenue growth, and continues to exclude fuel and foreign currency exchange. The company ceased offering direct postal injection service in its last mile business in the first quarter 2019. The 5.5% to 7.5% target for full-year organic revenue growth equates to the 4% to 6% target issued in February 2019, adjusted for the exclusion of direct postal injection revenue.

The company’s 2019 targets for free cash flow and cash taxes assume cash interest expense of $275 million to $315 million. The company expects an incremental benefit to free cash flow of $125 million to $150 million from trade receivables programs in 2019.

$2.5 Billion Share Repurchase Program

From December 14, 2018, through April 30, 2019, the company repurchased 35.2 million shares of XPO common stock at a $53.42 average price per share, for a total cost of approximately $1.9 billion.

The company is not obligated to repurchase any specific number of shares, and can suspend or discontinue the program at any time.

CEO Comments

Bradley Jacobs, chairman and chief executive officer of XPO Logistics, said, “In the first quarter, we delivered on expectations and beat on adjusted EBITDA and free cash flow. We also closed a record $1.1 billion of new business, up 15% year-over-year. Our sales pipeline stands at more than $4 billion of active bids – a new high-water mark for us.

“In our logistics segment, we generated significant growth in our e-commerce, food and beverage, consumer packaged goods and aerospace verticals. We’re using our XPO Smart labor productivity tools in our logistics operations, including the 23 contract startups we implemented in the first quarter. In transportation, we increased freight brokerage net revenue by 9.5% year-over-year and grew our net revenue margin by 420 basis points. We’re automating key touchpoints in brokerage on our XPO Connect digital platform, with large upsides to customer service and productivity. We’ve rolled out XPO Connect in Europe, and last month we launched new capabilities for last mile on the platform.”

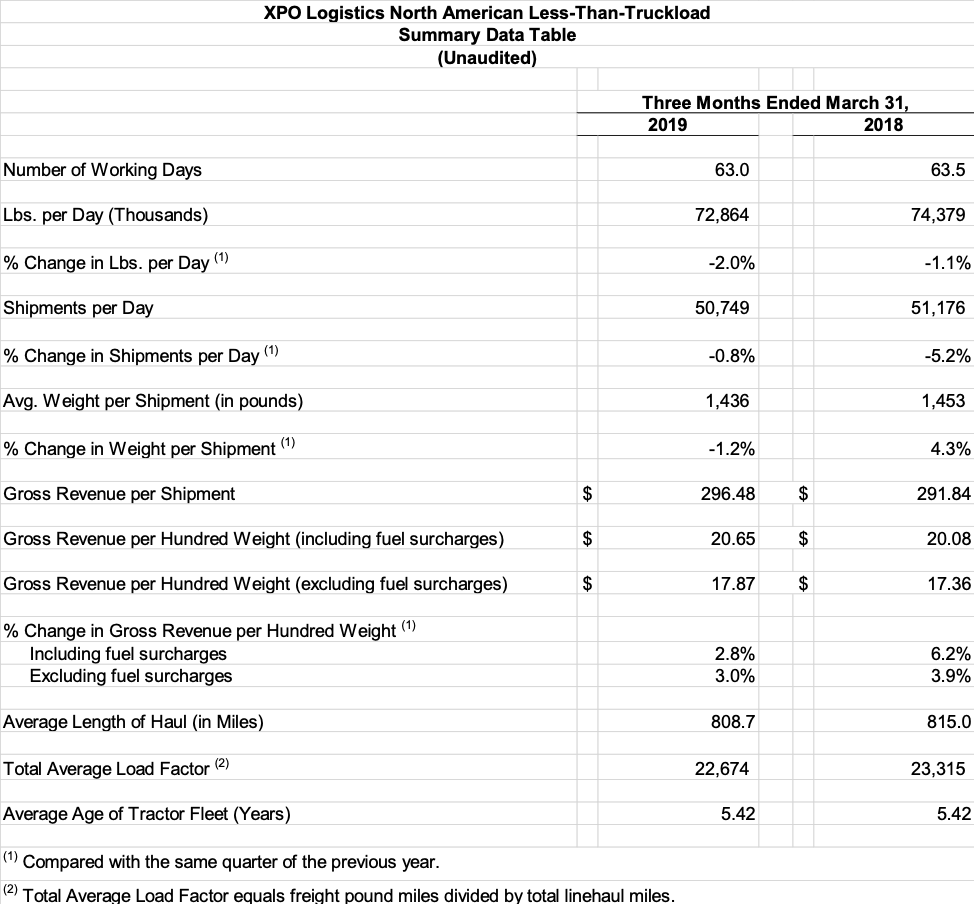

Jacobs continued, “In less-than-truckload, we accelerated our year-over-year yield improvement to 3% in the first quarter, from 1.1% in the fourth quarter of 2018, while delivering high levels of service for customers. Our LTL technology initiatives are resulting in significant improvements in on-time delivery and overall customer satisfaction ratings. We’re deploying dynamic route optimization, AI-based load-building and a new linehaul bypass model, and implementing our labor productivity tools in all 290 LTL service centers.”

First Quarter 2019 Results by Segment

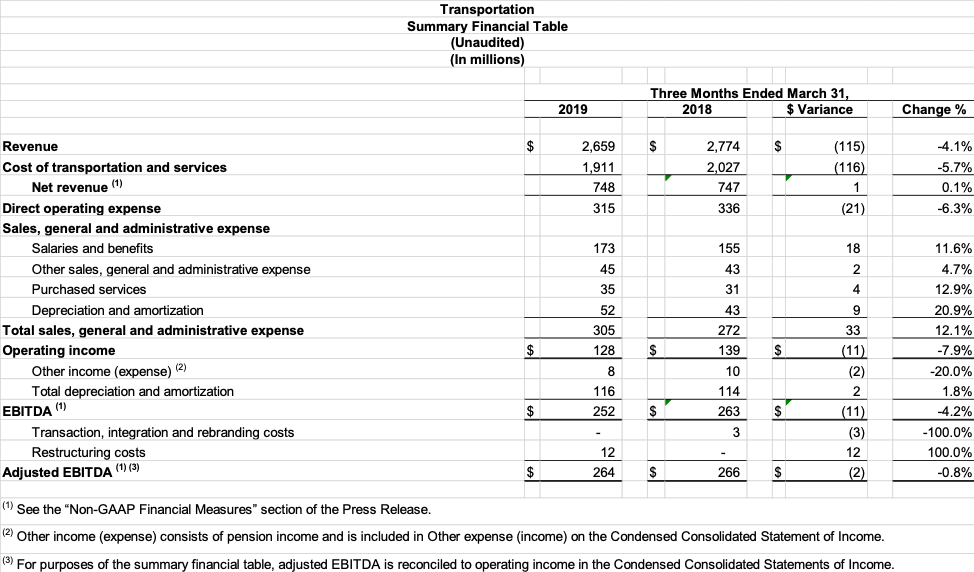

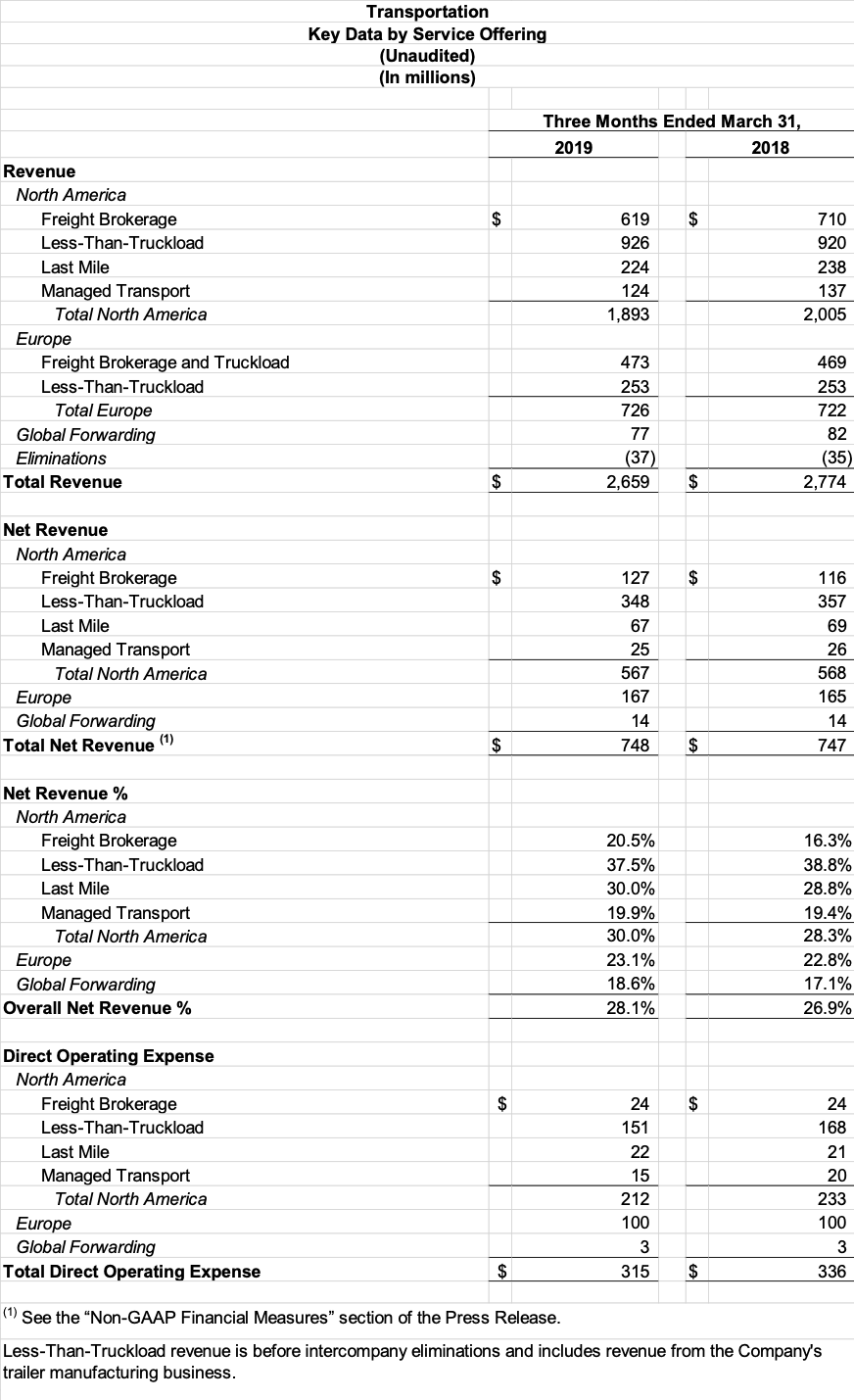

- Transportation: The company's transportation segment generated revenue of $2.66 billion for the quarter, compared with $2.77 billion for the same period in 2018. Segment revenue primarily reflects lowerfreight brokerage and last mile direct postal injection revenue from the company’s largest customer, as well as the adverse impact of foreign currency exchange, partially offset by growth in North American less-than-truckload (LTL) and European transport.

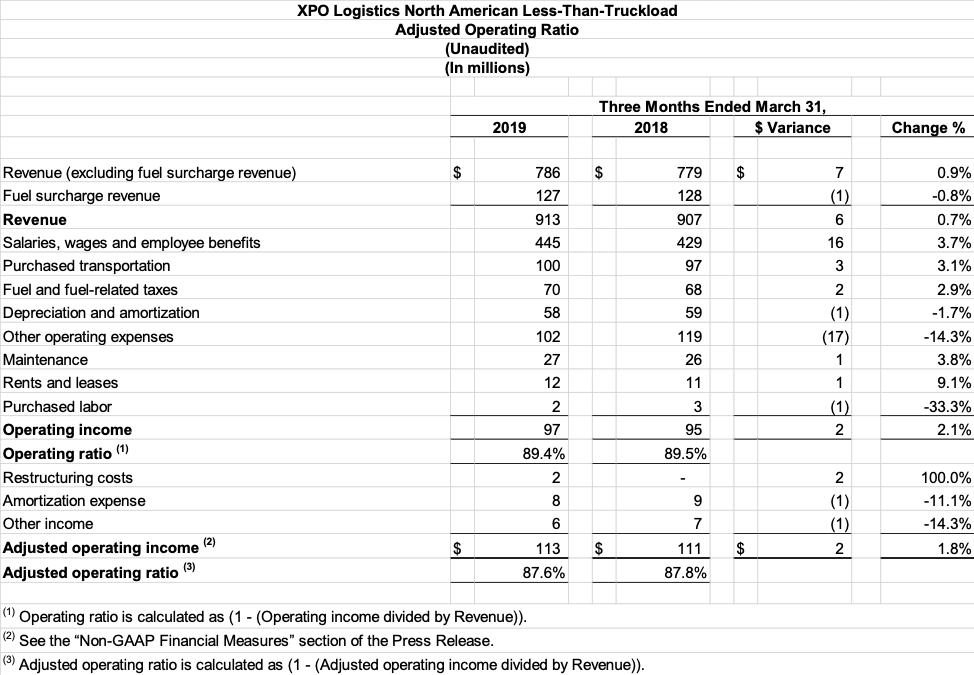

Operating income for the transportation segment was $128 million for the quarter, compared with $139 million for the same period in 2018. Adjusted EBITDA for the segment was $264 million, compared with $266 million for the same period in 2018. In North American LTL, yield improved by 3% year-over-year, excluding fuel, compared with 1.1% improvement in the prior quarter. The first quarter operating ratio for LTL was 89.4% and the adjusted operating ratio was 87.6%, the best first quarter adjusted operating ratio in 20 years. - Logistics: The company's logistics segment generated revenue of $1.49 billion for the quarter, a 3.2% increase from the same period in 2018. Organic revenue growth was 8.1%. Segment revenue was led by significant growth in the company’s e-commerce, food and beverage, consumer packaged goods and aerospace verticals, partially offset by the adverse impact of foreign currency exchange.

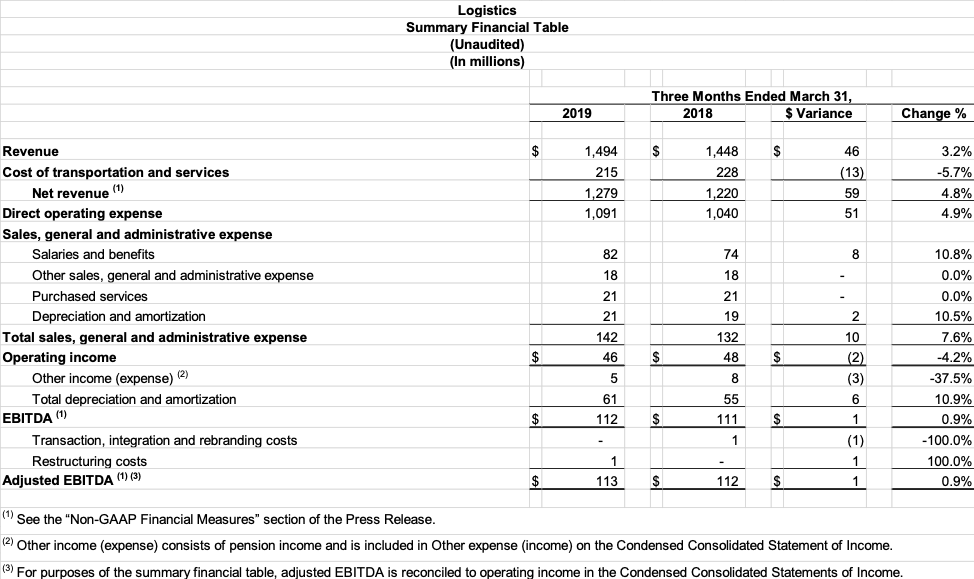

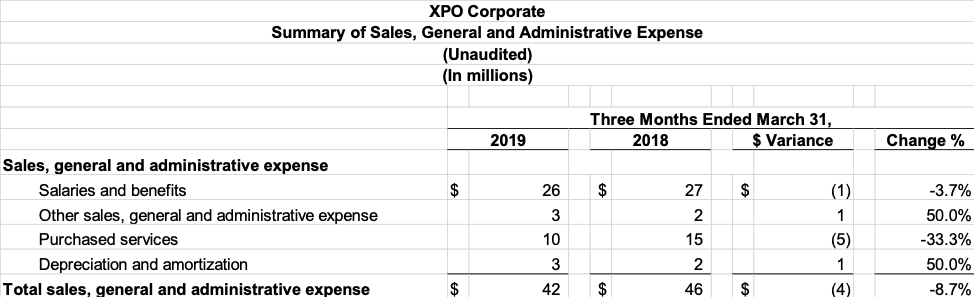

Operating income for the logistics segment was $46 million, compared with $48 million for the same period in 2018, primarily reflecting higher depreciation expense related to prior capital investments in new business wins. Adjusted EBITDA for the segment was $113 million, an increase of 0.9% from a year ago.The increase in adjusted EBITDA primarily reflects growth from existing customers and from startups in recent quarters. - Corporate: Corporate SG&A expense was $42 million for the quarter, compared with $46 million for the same period in 2018. The year-over-year change in corporate expense primarily reflects a decrease in purchased services, as well as lower share-based compensation expense.

New Sustainability Report

On April 22, 2019, the company released its inaugural Sustainability Report detailing initiatives related to safety, engagement, workplace inclusion, environmental protection and other key areas. XPO’s global 2018 Sustainability Report, and its 2018 Corporate Social Responsibility Report for operations in Europe, can be found at https://sustainability.xpo.com.

Conference Call

The company will hold a conference call on Thursday, May 2, 2019, at 8:30 a.m. Eastern Time. Participants can call toll-free (from US/Canada) 1-877-269-7756; international callers dial +1-201-689-7817. A live webcast of the conference will be available on the investor relations area of the company’s website, xpo.com/investors. The conference will be archived until June 2, 2019. To access the replay by phone, call toll-free (from US/Canada) 1-877-660-6853; international callers dial +1-201-612-7415. Use participant passcode 13689334.

Non-GAAP Financial Measures

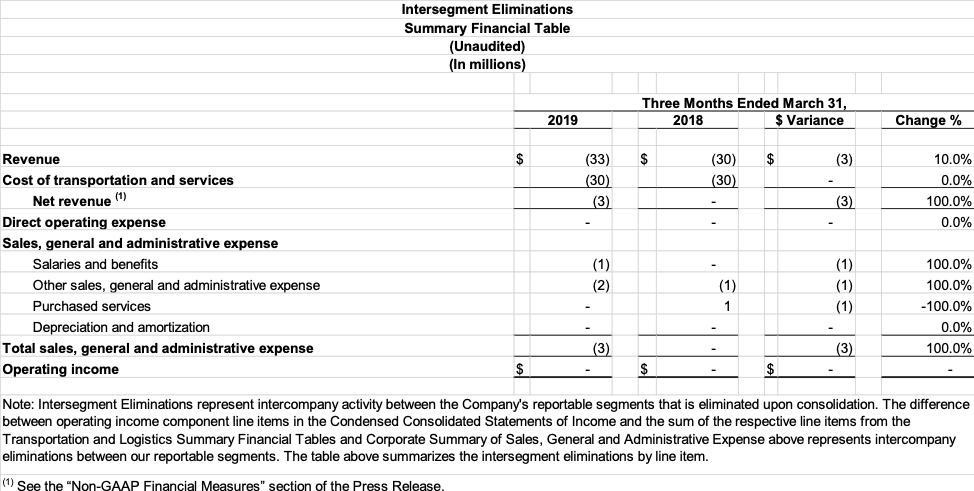

As required by the rules of the Securities and Exchange Commission ("SEC"), we provide reconciliations of the non-GAAP financial measures contained in this press release to the most directly comparable measure under GAAP, which are set forth in the financial tables attached to this release.

XPO’s non-GAAP financial measures for the quarter ended March 31, 2019 used in this release include: earnings before interest, taxes, depreciation and amortization ("EBITDA") and adjusted EBITDA on a consolidated basis and for our transportation and logistics segments; free cash flow; adjusted net income attributable to common shareholders and adjusted earnings per share (basic and diluted) ("adjusted EPS"); net revenue for our transportation and logistics segments and intersegment eliminations; adjusted operating income and adjusted operating ratio for our North American less-than-truckload business; and organic revenue and organic revenue growth on a consolidated basis and for our logistics business.

We believe that the above adjusted financial measures facilitate analysis of our ongoing business operations because they exclude items that may not be reflective of, or are unrelated to, XPO and its business segments' core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses. Other companies may calculate these non-GAAP financial measures differently, and therefore our measures may not be comparable to similarly titled measures of other companies. These non-GAAP financial measures should only be used as supplemental measures of our operating performance.

Adjusted EBITDA, adjusted net income attributable to common shareholders and adjusted EPS include adjustments for transaction, integration and rebranding costs as well as adjustments for restructuring costs. Transaction and integration adjustments are generally incremental costs that result from an actual or planned acquisition and include transaction costs, acquisition and integration consulting fees, internal salaries and wages (to the extent the individuals are assigned full-time to integration and transformation activities) and certain costs related to integrating and converging IT systems. Rebranding adjustments primarily relate to the rebranding of the XPO Logistics name on our truck fleet and buildings. Restructuring costs primarily relate to severance costs associated with business optimization initiatives. Management uses these non-GAAP financial measures in making financial, operating and planning decisions and evaluating XPO's and each business segment's ongoing performance.

We believe that free cash flow is an important measure of our ability to repay maturing debt or fund other uses of capital that we believe will enhance stockholder value. We calculate free cash flow as adjusted net cash used in operating activities, less payment for purchases of property and equipment plus proceeds from sale of property and equipment, with adjusted net cash used in operating activities defined as net cash used in operating activities plus cash collected on deferred purchase price receivables. We believe that EBITDA and adjusted EBITDA improve comparability from period to period by removing the impact of our capital structure (interest and financing expenses), asset base (depreciation and amortization), tax impacts and other adjustments as set out in the attached tables that management has determined are not reflective of core operating activities and thereby assist investors with assessing trends in our underlying businesses. We believe that adjusted net income attributable to common shareholders and adjusted EPS improve the comparability of our operating results from period to period by removing the impact of certain costs and gains that management has determined are not reflective of our core operating activities. We believe that net revenue improves the comparability of our operating results from period to period by removing the cost of transportation and services, in particular the cost of fuel, incurred in the reporting period as set out in the attached tables. We believe that adjusted operating income and adjusted operating ratio for our North American less-than-truckload business improve the comparability of our operating results from period to period by (i) removing the impact of certain transaction, integration, restructuring and rebranding costs and amortization expenses and, (ii) including the impact of pension income incurred in the reporting period as set out in the attached tables. We believe that organic revenue is an important measure because it excludes the impact of the following items: foreign currency exchange rate fluctuations, fuel surcharges and revenue associated with our direct postal injection service in last mile.

With respect to our 2019 financial targets for adjusted EBITDA, free cash flow and organic revenue growth, each of which is a non-GAAP measure, a reconciliation of the non-GAAP measure to the corresponding GAAP measure is not available without unreasonable effort due to the variability and complexity of the reconciling items described below that we exclude from the non-GAAP target measure. The variability of these items may have a significant impact on our future GAAP financial results and, as a result, we are unable to prepare the forward-looking balance sheet, statement of income and statement of cash flow, prepared in accordance with GAAP that would be required to produce such a reconciliation.

Forward-looking Statements

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including our 2019 financial targets for our consolidated revenue and organic revenue growth, adjusted EBITDA, free cash flow, net capital expenditures, depreciation and amortization, effective tax rate, cash taxes and the free cash flow benefit from our trade receivables programs. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. In some cases, forward-looking statements can be identified by the use of forward-looking terms such as "anticipate," "estimate," "believe," "continue," "could," "intend," "may," "plan," "potential," "predict," "should," "will," "expect," "objective," "projection," "forecast," "goal," "guidance," "outlook," "effort," "target," "trajectory" or the negative of these terms or other comparable terms. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements are based on certain assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances.

These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Factors that might cause or contribute to a material difference include the risks discussed in our filings with the SEC and the following: economic conditions generally; competition and pricing pressures; our ability to align our investments in capital assets, including equipment, service centers and warehouses, to our customers' demands; our ability to successfully integrate and realize anticipated synergies, cost savings and profit improvement opportunities with respect to acquired companies; our ability to develop and implement suitable information technology systems and prevent failures in or breaches of such systems; our substantial indebtedness; our ability to raise debt and equity capital; our ability to maintain positive relationships with our network of third-party transportation providers; our ability to attract and retain qualified drivers; litigation, including litigation related to alleged misclassification of independent contractors and securities class actions; labor matters, including our ability to manage our subcontractors, and risks associated with labor disputes at our customers and efforts by labor organizations to organize our employees; risks associated with our self-insured claims; risks associated with defined benefit plans for our current and former employees; fluctuations in currency exchange rates; fluctuations in fixed and floating interest rates; fuel price and fuel surcharge changes; issues related to our intellectual property rights; governmental regulation, including trade compliance laws; and governmental or political actions, including the United Kingdom's likely exit from the European Union. All forward-looking statements set forth in this release are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to or effects on us or our business or operations. Forward-looking statements set forth in this release speak only as of the date hereof, and we do not undertake any obligation to update forward-looking statements to reflect subsequent events or circumstances, changes in expectations or the occurrence of unanticipated events, except to the extent required by law.