XPO Logistics Announces Fourth Quarter and Full Year 2019 Results

- Grows EPS by 50% and adjusted EPS by 56% for the fourth quarter

- Grows net income by 18% and adjusted EBITDA by 14% for the fourth quarter

- Provides guidance for 7% to 10% growth in adjusted EBITDA for full year 2020

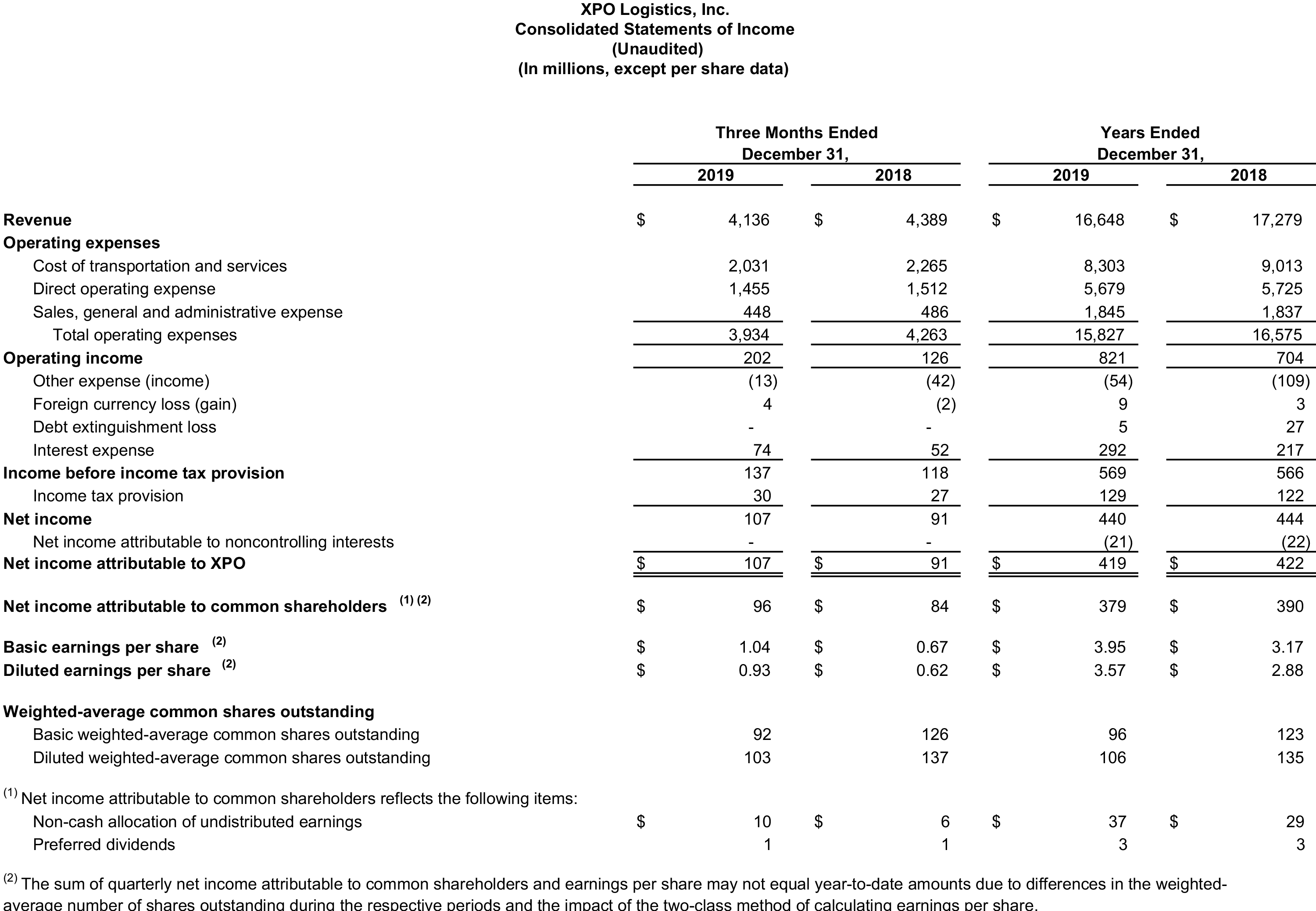

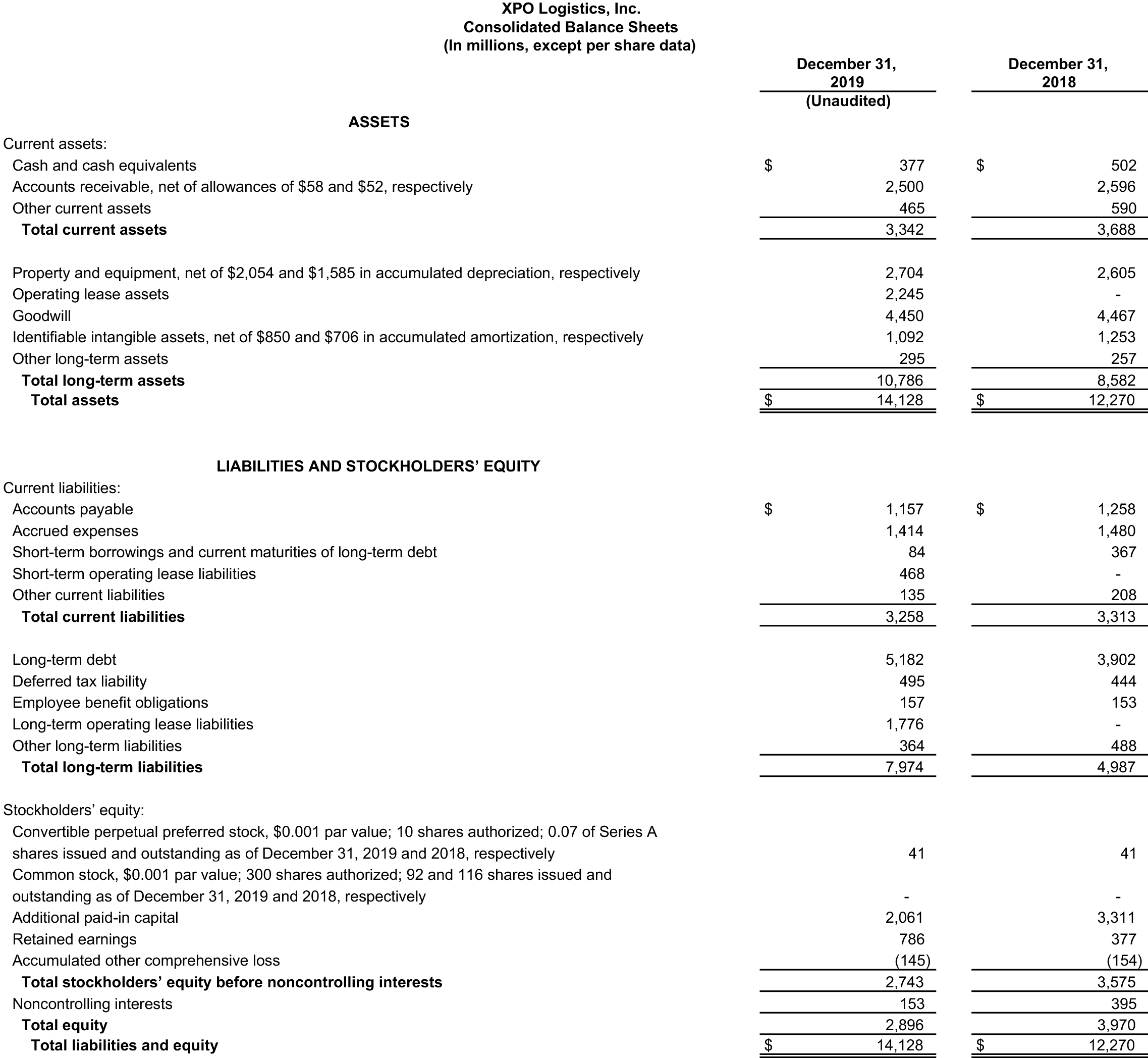

XPO Logistics, Inc. (NYSE: XPO) today announced financial results for the fourth quarter and full year 2019. Revenue was $4.14 billion for the quarter, compared with $4.39 billion for the same period in 2018. Net income attributable to common shareholders was $96 million for the quarter, compared with $84 million for the same period in 2018. Operating income was $202 million for the quarter, compared with $126 million for the same period in 2018. Diluted earnings per share was $0.93 for the quarter, compared with $0.62 for the same period in 2018.

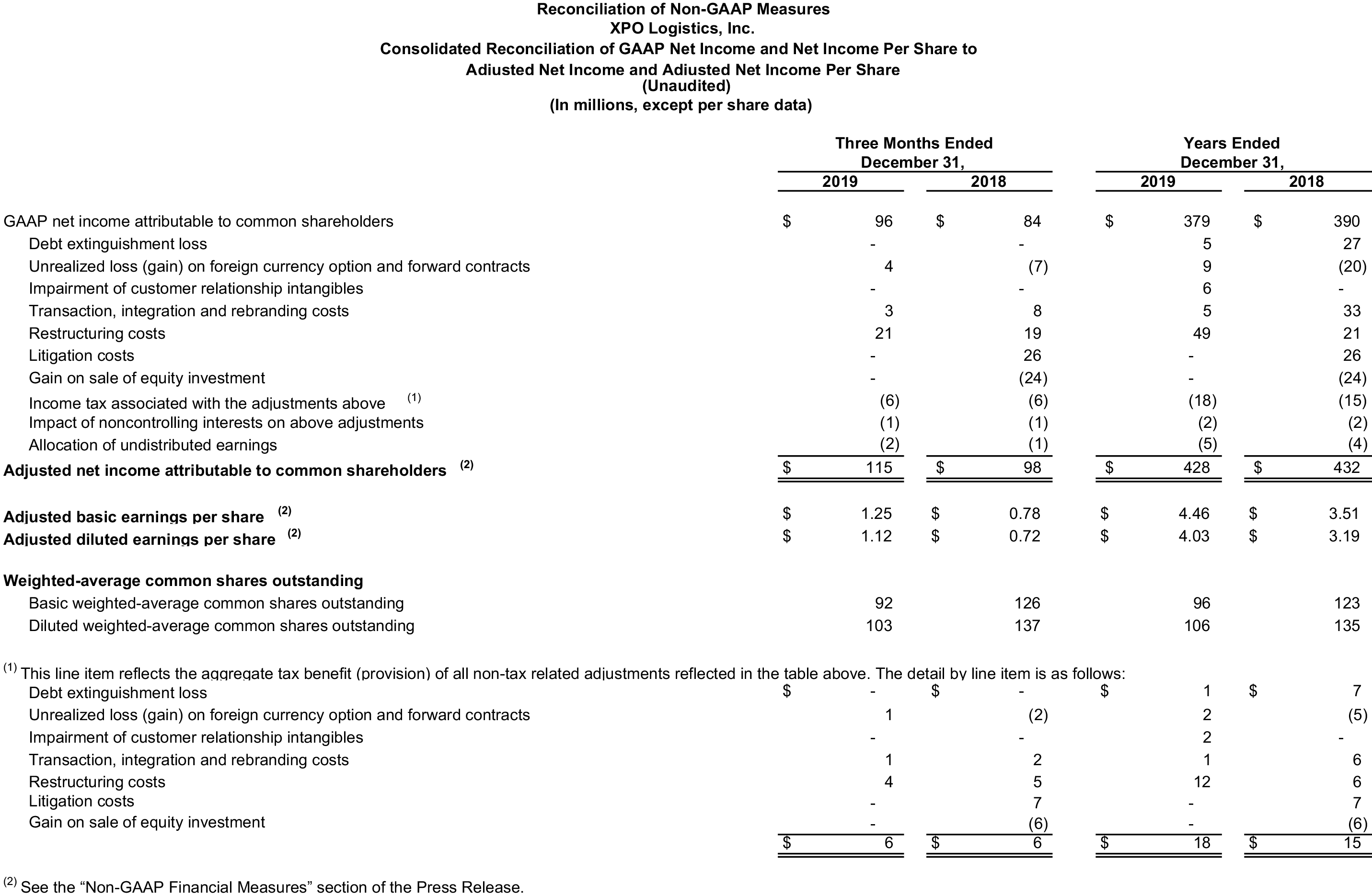

Adjusted net income attributable to common shareholders, a non-GAAP financial measure, was $115 million for the fourth quarter 2019, compared with $98 million for the same period in 2018. Adjusted diluted earnings per share, a non-GAAP financial measure, was $1.12 for the quarter, compared with $0.72 for the same period in 2018.

Adjusted net income attributable to common shareholders and adjusted diluted earnings per share for the fourth quarter 2019 exclude: $21 million, or $17 million after-tax, of restructuring costs, primarily severance; $4 million, or $3 million after-tax, of non-cash unrealized losses on foreign currency contracts; and $3 million, or $2 million after-tax, of transaction and integration costs.

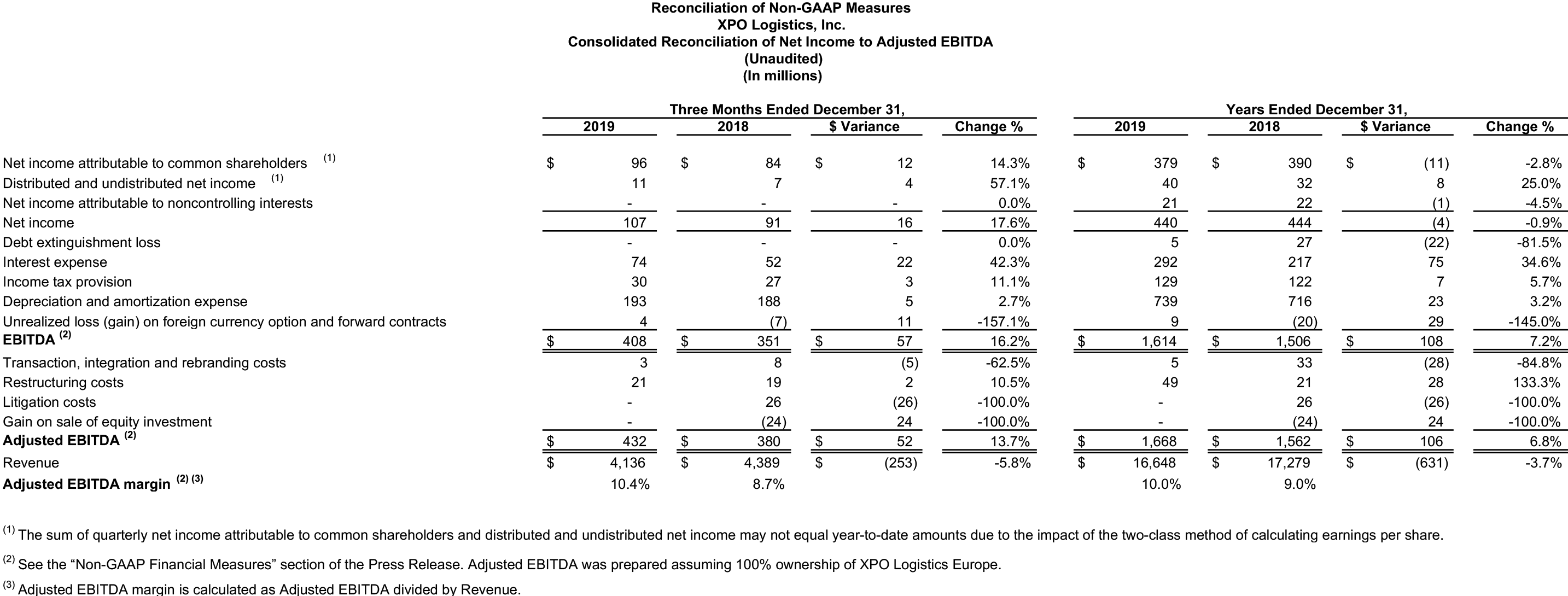

Adjusted earnings before interest, taxes, depreciation and amortization ("adjusted EBITDA"), a non-GAAP financial measure, increased to $432 million for the fourth quarter 2019, compared with $380 million for the same period in 2018. Adjusted EBITDA for the fourth quarter 2019 excludes $21 million of restructuring costs, primarily severance; and $3 million of transaction and integration costs.

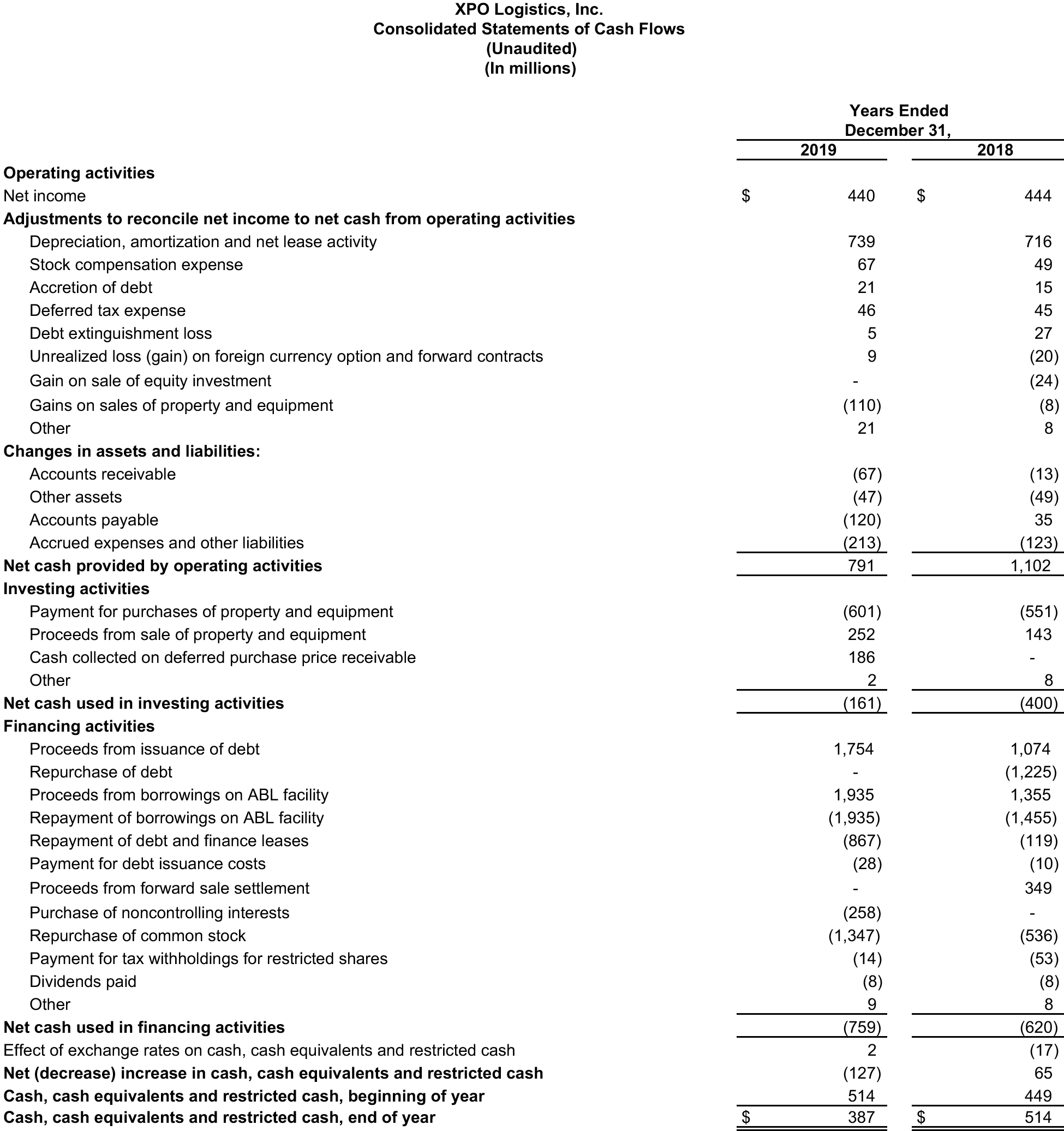

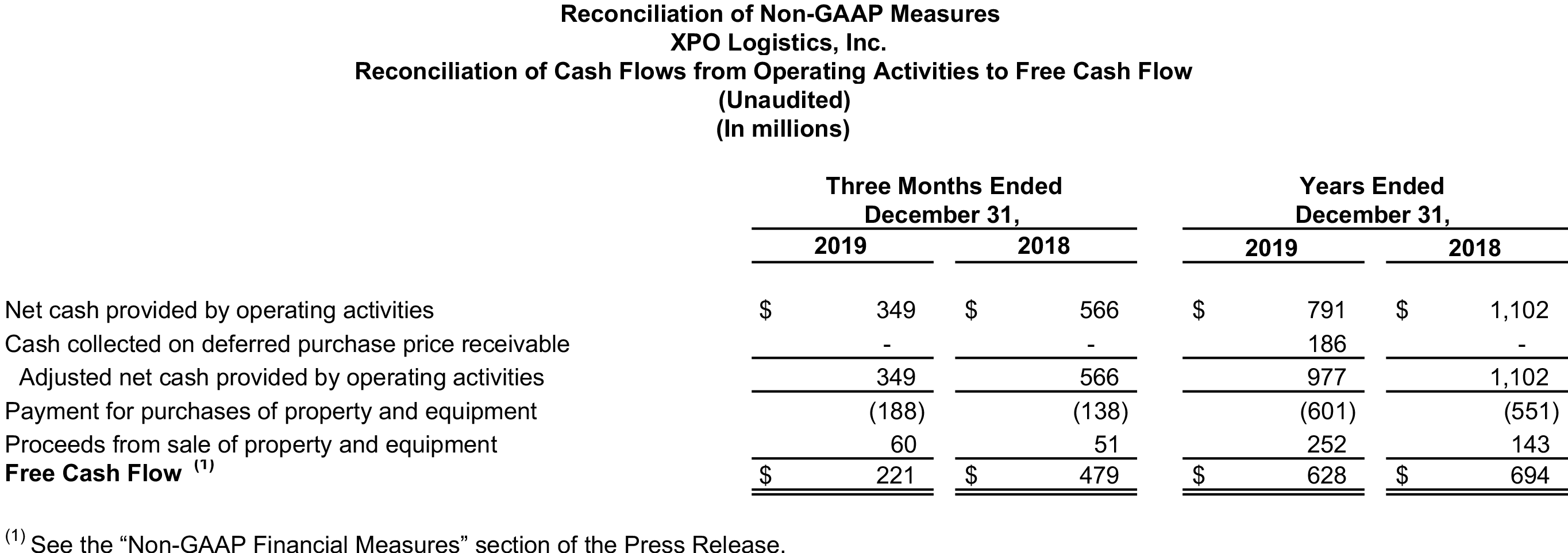

For the fourth quarter 2019, the company generated $349 million of cash flow from operations and $221 million of free cash flow, a non-GAAP financial measure. For the full year 2019, the company generated cash flow from operations of $791 million and free cash flow of $628 million, including an incremental benefit of approximately $110 million from trade receivables programs. Reconciliations of non-GAAP financial measures used in this release are provided in the attached financial tables.

2020 Financial Targets

The company issued the following full year 2020 targets, which do not reflect any potential impact to the company’s future financial performance from its exploration of strategic alternatives:

- Organic revenue growth of 3% to 5% year-over-year;

- Adjusted EBITDA in the range of $1.785 billion to $1.835 billion, an increase of 7% to 10% year-over-year;

- Free cash flow in the range of $600 million to $700 million;

- Net capital expenditures in the range of $475 million to $525 million;

- Depreciation and amortization in the range of $700 million to $750 million;

- Effective tax rate in the range of 24% to 27%; and

- Cash taxes in the range of $155 million to $180 million.

The company’s 2020 targets for free cash flow and cash taxes assume cash interest expense of $285 million to $305 million. The company’s 2020 target for free cash flow includes an incremental benefit to free cash flow of $50 million to $70 million from trade receivables programs.

Review of Strategic Alternatives

On January 15, 2020, the company announced that its board of directors has authorized a review of strategic alternatives, including the possible sale or spin-off of one or more business units. The company has not determined which, if any, business units will be sold or spun off. However, the company does not intend to sell or spin off its North American less-than-truckload unit.

CEO Comments

Brad Jacobs, chairman and chief executive officer of XPO Logistics, said, “We delivered a good fourth quarter and a good year. I’m particularly pleased that we grew fourth quarter EPS by 50% year-over-year, and adjusted EPS by 56%. We also increased net income by 18% and adjusted EBITDA by 14% in the quarter.

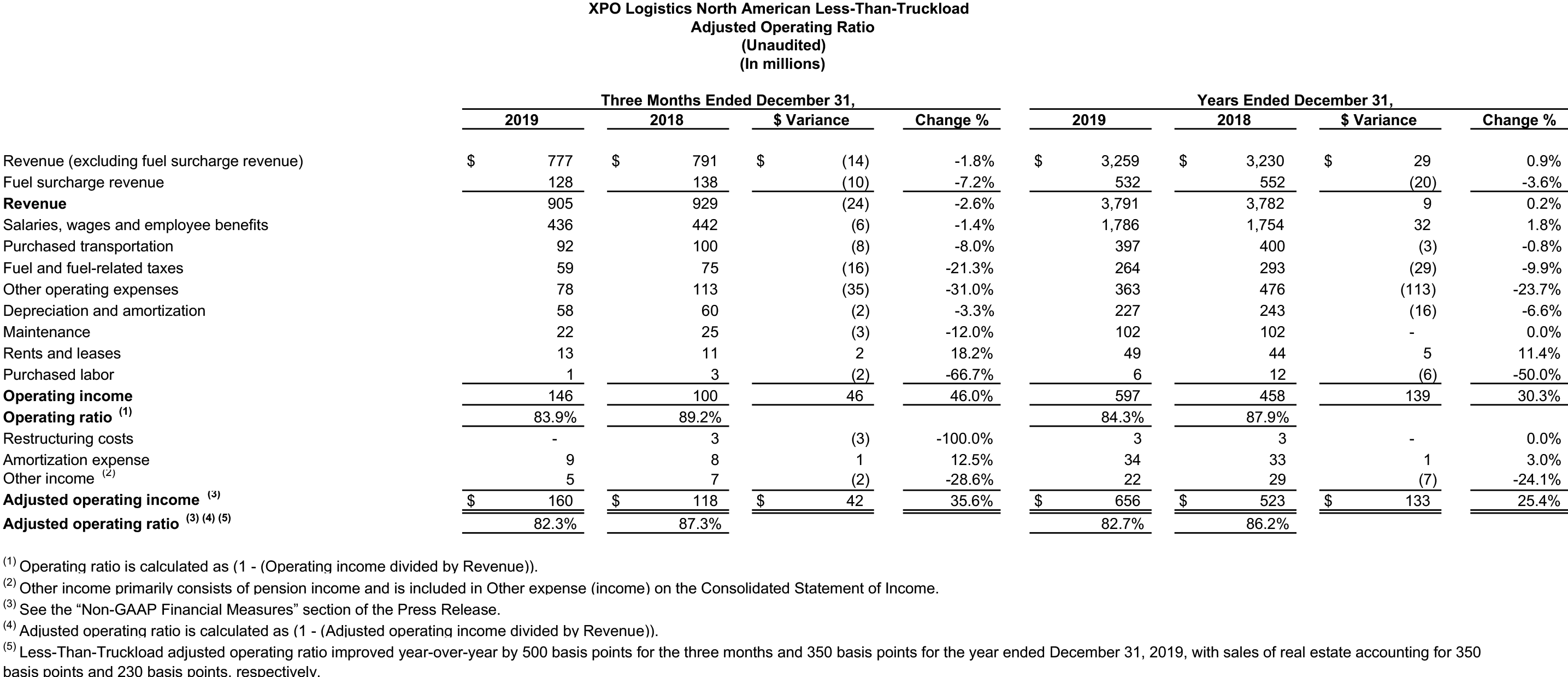

“In our less-than-truckload unit, where we have several new technologies in place, the operating ratio was 83.9%, and the adjusted operating ratio was a fourth quarter record at 82.3%. In truck brokerage, we increased volume year-over-year with lower headcount, propelled by our XPO Connect digital platform. Our technology also helped our logistics segment generate a double-digit adjusted EBITDA margin in the quarter for the first time since 2015.”

Jacobs continued, “In 2020, we’ll continue to focus on maximizing shareholder value, while remaining intensely committed to the satisfaction of our customers and employees.”

Fourth Quarter 2019 Results by Segment

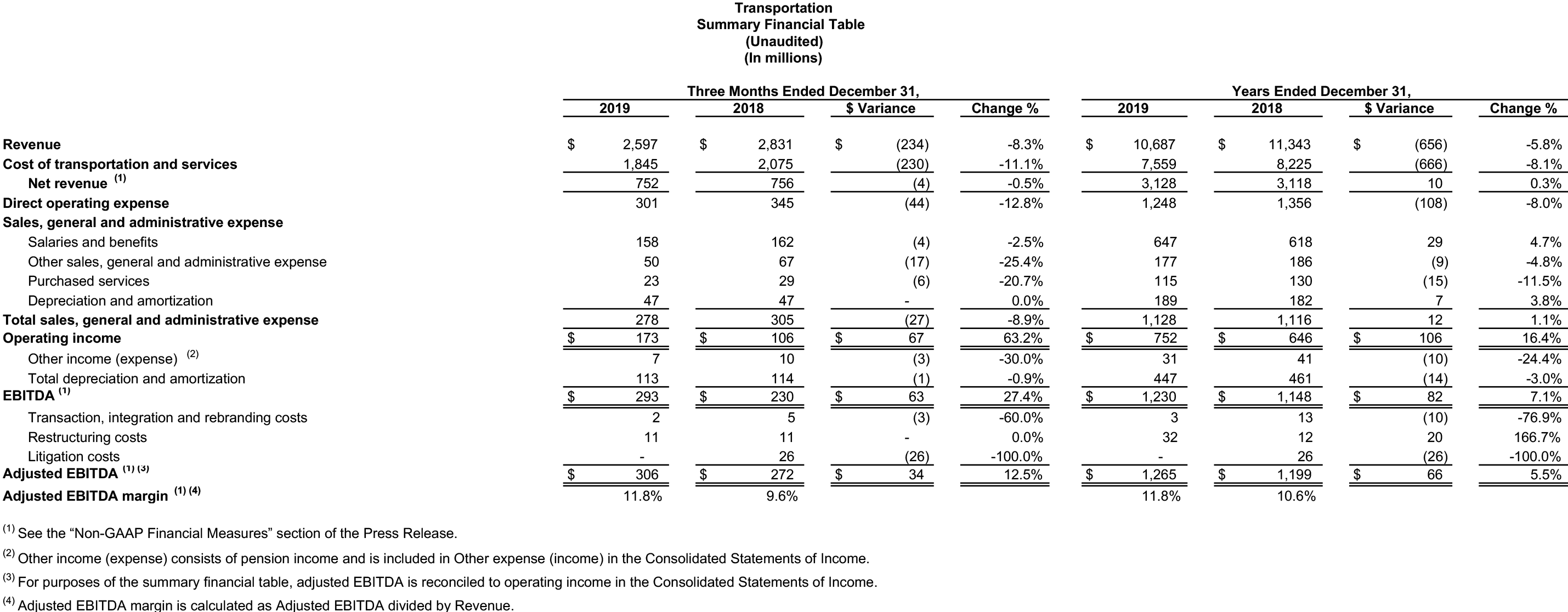

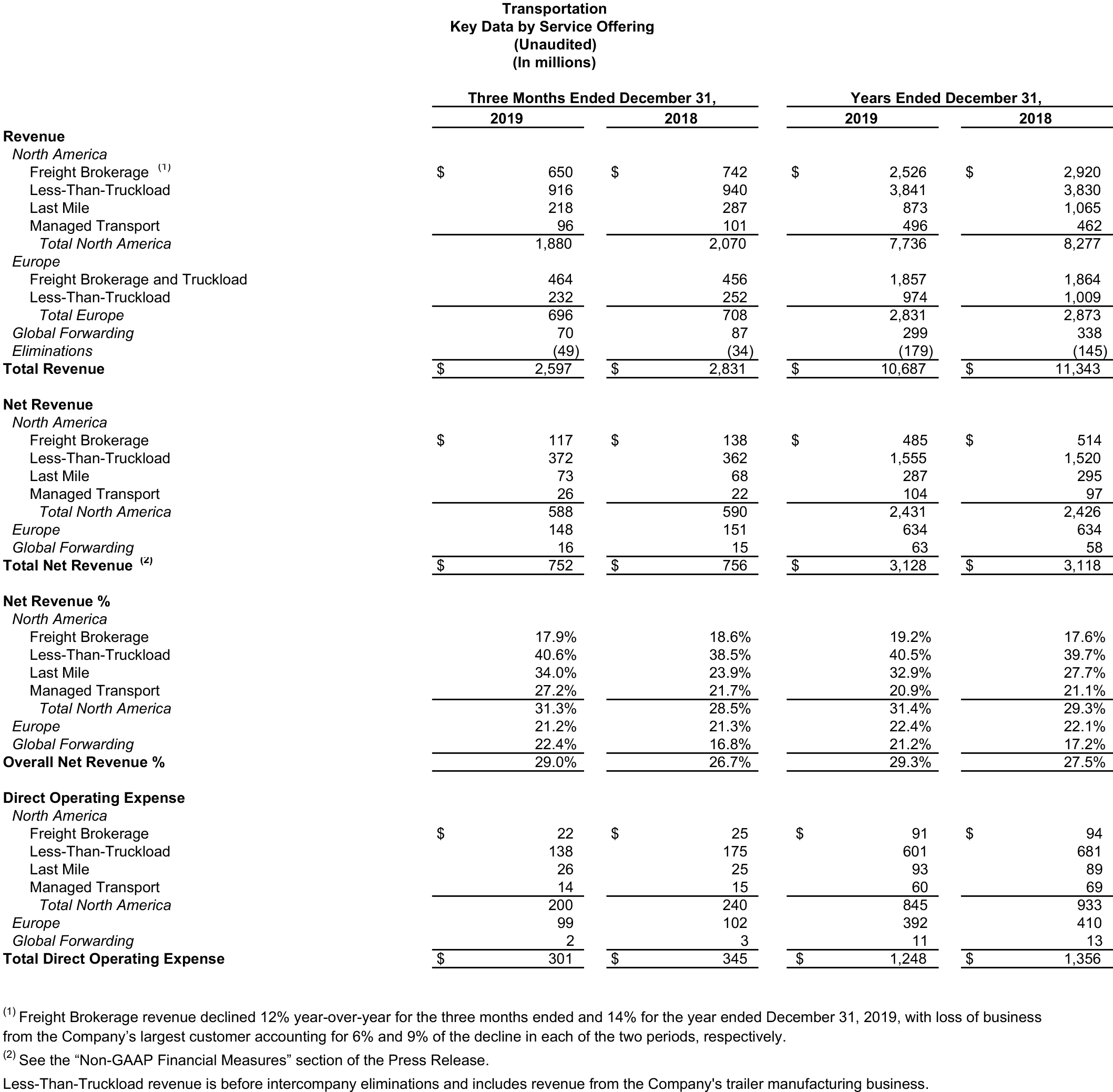

- Transportation: The company's transportation segment generated revenue of $2.60 billion for the fourth quarter 2019, compared with $2.83 billion for the same period in 2018. The reduction in segment revenue primarily reflects a decrease in freight brokerage and direct postal injection revenue from the company’s largest customer, lower rates in truck brokerage and unfavorable foreign currency exchange, partially offset by revenue growth in last mile and higher volumes in truck brokerage.

Operating income for the transportation segment was $173 million for the fourth quarter 2019, compared with $106 million for the same period in 2018. Adjusted EBITDA for the segment was $306 million for the quarter, compared with $272 million for the same period in 2018.

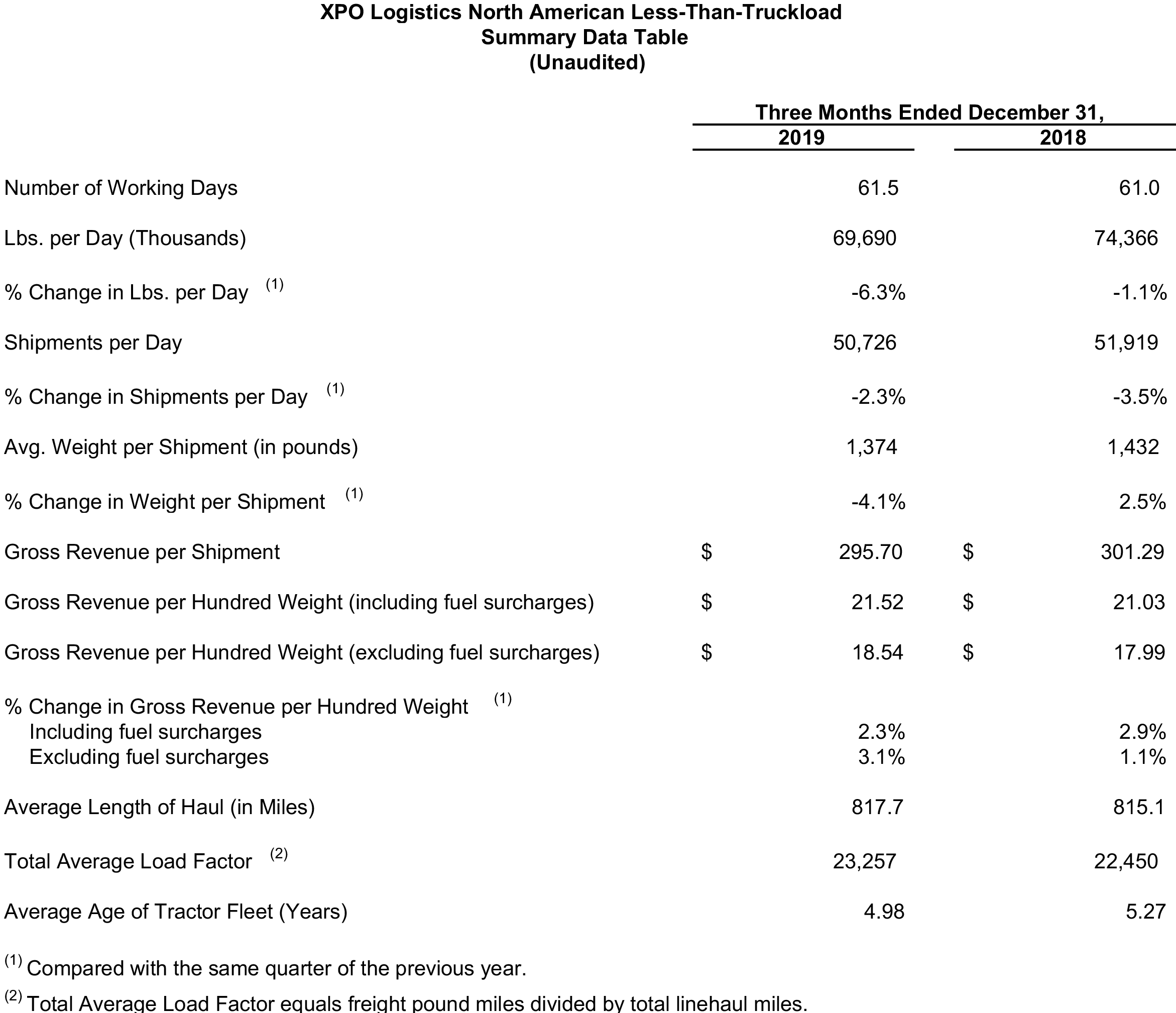

In North American less-than-truckload (LTL), yield excluding fuel improved by 3.1% year-over-year for the fourth quarter 2019. The fourth quarter operating ratio for LTL was 83.9%. Adjusted operating ratio, a non-GAAP financial measure, was a fourth quarter record at 82.3%, an improvement of 500 basis points year-over-year. Excluding the gains from sales of real estate, LTL adjusted operating ratio improved by 150 basis points.

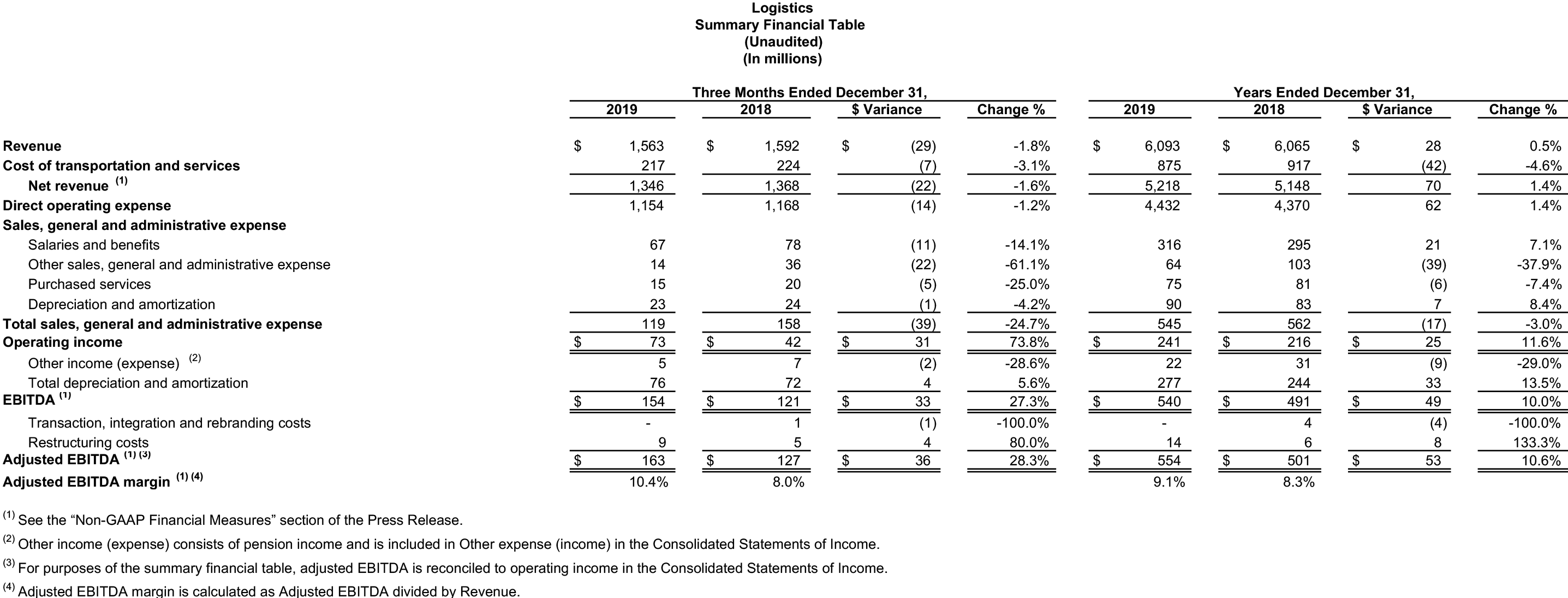

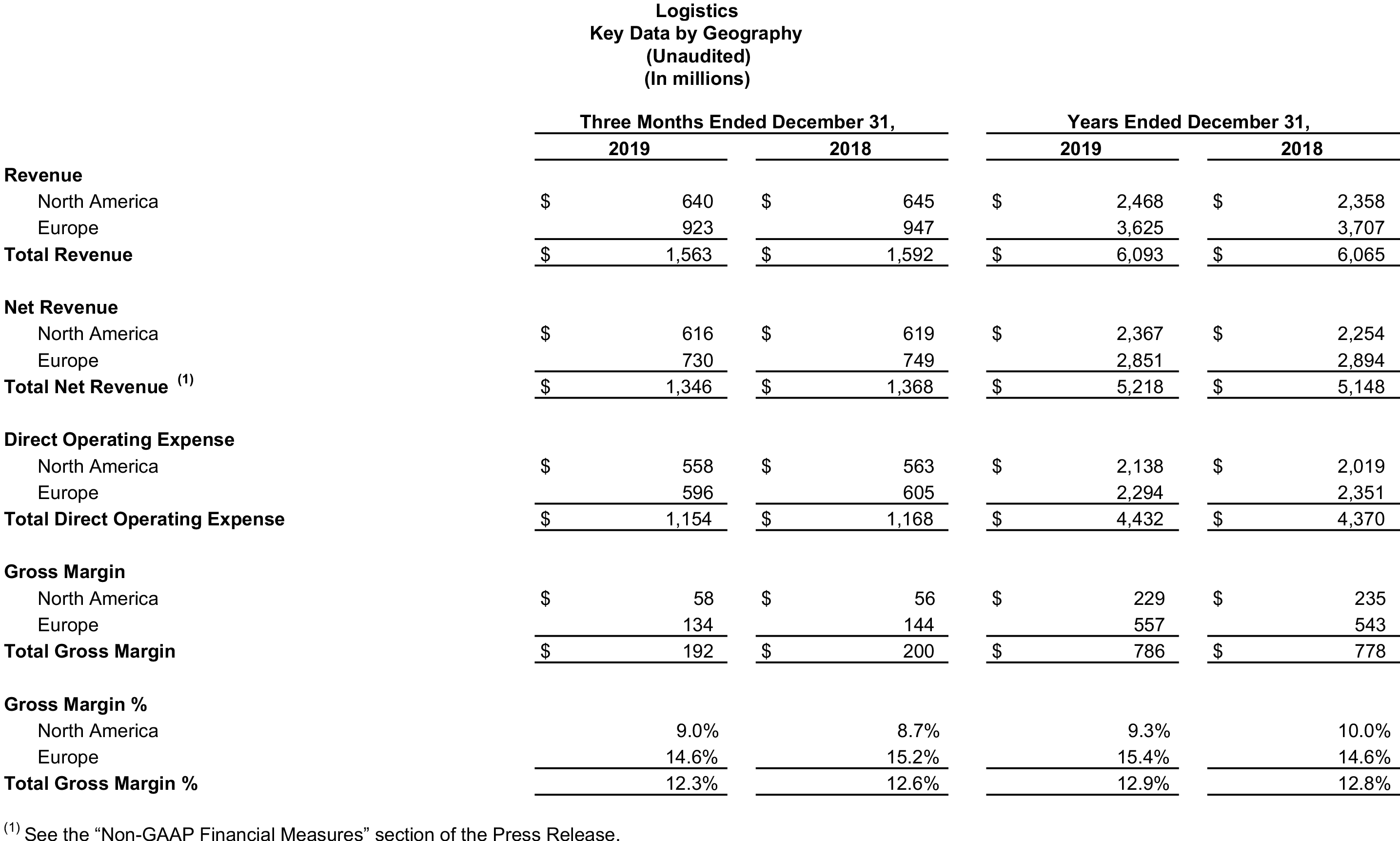

- Logistics: Fourth quarter revenue for the logistics segment was $1.56 billion, flat with $1.59 billion for the same period in 2018. A reduction in business from the company’s largest customer was offset by revenue growth in consumer packaged goods, aerospace, and food and beverage verticals in North America, and in e-commerce and chemicals in Europe.

Logistics segment operating income increased to $73 million for the fourth quarter 2019, compared with $42 million for the same period in 2018. Adjusted EBITDA for the segment was $163 million for the quarter, compared with $127 million for the same period in 2018. The improvement in adjusted EBITDA primarily reflects strong cost discipline, including gains in workforce productivity, increasing traction of the company’s technology initiatives, and pricing optimization.

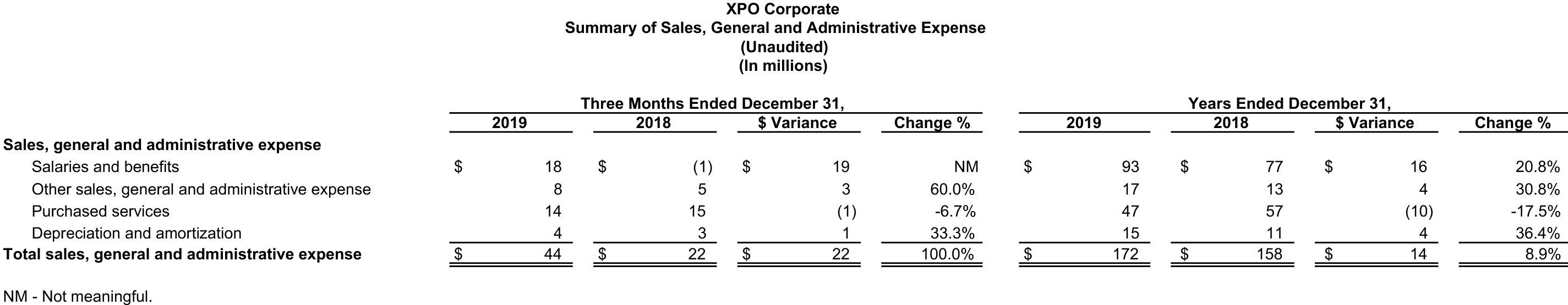

- Corporate: Corporate SG&A expense was $44 million for the fourth quarter 2019, compared with $22 million for the same period in 2018. The increase in corporate expense primarily reflects an increase in share-based compensation expense, including the impact of the increase in the share price of XPO stock.

Full Year 2019 Financial Results

For the full year 2019, the company reported total revenue of $16.65 billion, compared with $17.28 billion for 2018. Net income attributable to common shareholders was $379 million for 2019, compared with $390 million for 2018. Operating income was $821 million for 2019, compared with $704 million for 2018. Earnings per diluted share was $3.57 for 2019, compared with $2.88 for 2018. The increase in diluted EPS primarily reflects an increase in 2019 operating income, compared with 2018 and accretion from the company’s share repurchase activity. From December 14, 2018 through December 31, 2019, the company repurchased 35.2 million shares of XPO common stock at an average price of $53.42 per share.

Adjusted net income attributable to common shareholders was $428 million for 2019, compared with $432 million for 2018. Adjusted earnings per diluted share was $4.03 for 2019, compared with $3.19 for 2018. Adjusted net income attributable to common shareholders and adjusted earnings per diluted share for the full year 2019 exclude: $49 million, or $37 million after-tax, of restructuring costs, primarily severance; $9 million, or $7 million after-tax, of non-cash unrealized losses on foreign currency contracts; a non-cash charge of $6 million, or $4 million after-tax, related to the impairment of customer relationship intangibles; $5 million, or $4 million after-tax, of debt extinguishment costs; and $5 million, or $4 million after-tax, of transaction and integration costs.

Adjusted EBITDA for the full year 2019 increased to $1.67 billion, compared with $1.56 billion for 2018. Adjusted EBITDA for 2019 excludes: $49 million of restructuring costs, primarily severance; and $5 million of transaction and integration costs.

Appoints David Wyshner as Chief Financial Officer

On February 10, 2020, the company announced the appointment of David Wyshner as chief financial officer, effective March 2, 2020. Wyshner’s 28-year career includes 13 years as CFO of multi-billion-dollar public companies that completed major asset sales, spin-offs and acquisitions during his tenure. Prior to joining XPO, he served as CFO of Wyndham Hotels & Resorts, Inc. Sarah Glickman, who assumed the role of acting chief financial officer on August 15, 2018, will serve in a new role as senior vice president, corporate finance and transformation.

Conference Call

The company will hold a conference call on Tuesday, February 11, 2020, at 8:30 a.m. Eastern Time. Participants can call toll-free (from US/Canada) 1-877-269-7756; international callers dial +1-201-689-7817. A live webcast of the conference will be available on the investor relations area of the company’s website, xpo.com/investors. The conference will be archived until March 11, 2020. To access the replay by phone, call toll-free (from US/Canada) 1-877-660-6853; international callers dial +1-201-612-7415. Use participant passcode 13697897.

About XPO Logistics

XPO Logistics, Inc. (NYSE: XPO) is a top ten global logistics provider of cutting-edge supply chain solutions to the most successful companies in the world. The company operates as a highly integrated network of people, technology and physical assets in 30 countries, with 1,504 locations and approximately 100,000 employees. XPO uses its network to help more than 50,000 customers manage their goods most efficiently throughout their supply chains. XPO's corporate headquarters are in Greenwich, Conn., USA, and its European headquarters are in Lyon, France. xpo.com

Non-GAAP Financial Measures

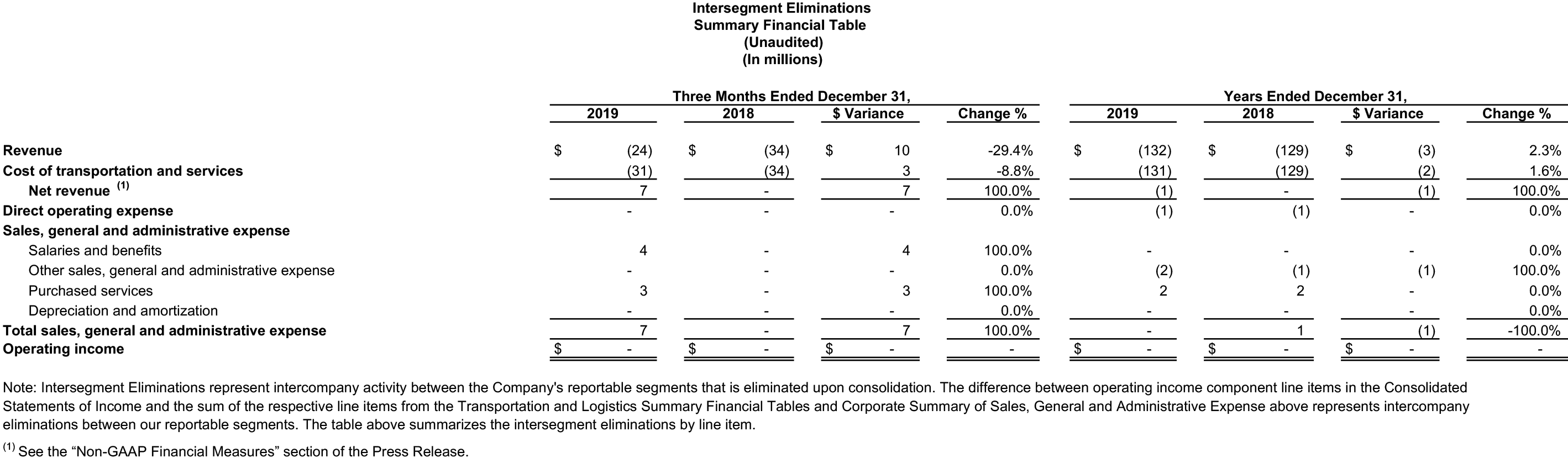

As required by the rules of the Securities and Exchange Commission ("SEC"), we provide reconciliations of the non-GAAP financial measures contained in this press release to the most directly comparable measure under GAAP, which are set forth in the financial tables attached to this release.

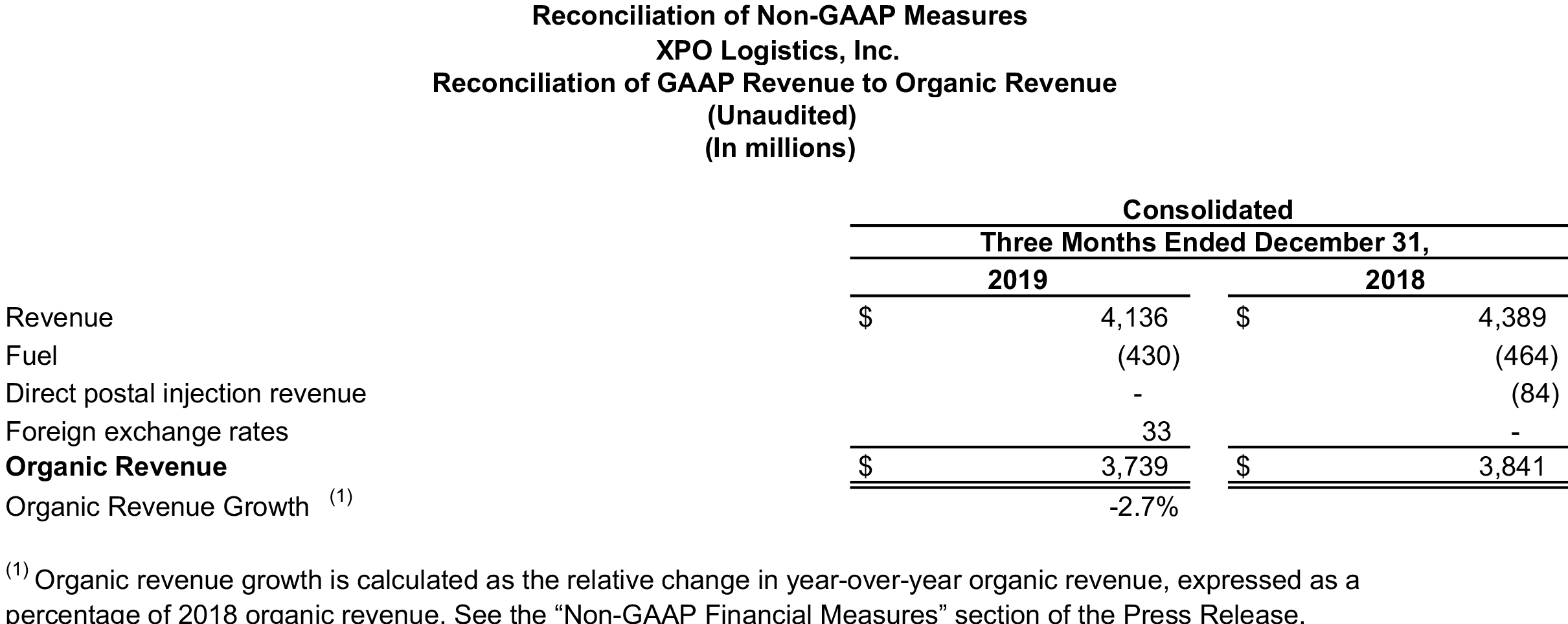

XPO’s non-GAAP financial measures for the three and twelve months ended December 31, 2019 used in this release include: earnings before interest, taxes, depreciation and amortization ("EBITDA"), adjusted EBITDA and adjusted EBITDA margin on a consolidated basis and for our transportation and logistics segments; free cash flow; adjusted net income attributable to common shareholders and adjusted earnings per share (basic and diluted) ("adjusted EPS"); net revenue for our transportation and logistics segments and intersegment eliminations; adjusted operating income and adjusted operating ratio for our North American less-than-truckload business; and organic revenue and organic revenue growth on a consolidated basis.

We believe that the above adjusted financial measures facilitate analysis of our ongoing business operations because they exclude items that may not be reflective of, or are unrelated to, XPO and its business segments' core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses. Other companies may calculate these non-GAAP financial measures differently, and therefore our measures may not be comparable to similarly titled measures of other companies. These non-GAAP financial measures should only be used as supplemental measures of our operating performance.

Adjusted EBITDA, adjusted net income attributable to common shareholders and adjusted EPS include adjustments for transaction, integration and rebranding costs, restructuring costs, litigation costs for independent contractor matters and the gain on sale of an equity investment. Transaction and integration adjustments are generally incremental costs that result from an actual or planned acquisition and include transaction costs, acquisition and integration consulting fees, internal salaries and wages (to the extent the individuals are assigned full-time to integration and transformation activities) and certain costs related to integrating and converging IT systems. Rebranding adjustments primarily relate to the rebranding of the XPO Logistics name on our truck fleet and buildings. Restructuring costs primarily relate to severance costs associated with business optimization initiatives. Litigation costs refer to settlement and related costs associated with independent contractor claims in our last mile business. The gain on sale of an equity investment relates to the sale of a non-strategic equity ownership interest in a private company. Management uses these non-GAAP financial measures in making financial, operating and planning decisions and evaluating XPO's and each business segment's ongoing performance.

We believe that free cash flow is an important measure of our ability to repay maturing debt or fund other uses of capital that we believe will enhance stockholder value. We calculate free cash flow as adjusted net cash provided by operating activities, less payment for purchases of property and equipment plus proceeds from sale of property and equipment, with adjusted net cash

provided by operating activities defined as net cash provided by operating activities plus cash collected on deferred purchase price receivables. We believe that EBITDA, adjusted EBITDA and adjusted EBITDA margin improve comparability from period to period by removing the impact of our capital structure (interest and financing expenses), asset base (depreciation and amortization), tax impacts and other adjustments as set out in the attached tables that management has determined are not reflective of core operating activities and thereby assist investors with assessing trends in our underlying businesses. We believe that adjusted net income attributable to common shareholders and adjusted EPS improve the comparability of our operating results from period to period by removing the impact of certain costs and gains that management has determined are not reflective of our core operating activities. We believe that net revenue improves the comparability of our operating results from period to period by removing the cost of transportation and services, in particular the cost of fuel, incurred in the reporting period as set out in the attached tables. We believe that adjusted operating income and adjusted operating ratio for our North American less-than-truckload business improve the comparability of our operating results from period to period by (i) removing the impact of certain restructuring costs and amortization expenses and (ii) including the impact of pension income incurred in the reporting period as set out in the attached tables. We believe that organic revenue is an important measure because it excludes the following items: foreign currency exchange rate fluctuations, fuel surcharges and revenue associated with our direct postal injection service in last mile.

With respect to our 2020 financial targets for adjusted EBITDA, free cash flow and organic revenue growth, each of which is a non-GAAP measure, a reconciliation of the non-GAAP measure to the corresponding GAAP measure is not available without unreasonable effort due to the variability and complexity of the reconciling items described below that we exclude from the non-GAAP target measure. The variability of these items may have a significant impact on our future GAAP financial results and, as a result, we are unable to prepare the forward-looking balance sheet, statement of income and statement of cash flow, prepared in accordance with GAAP that would be required to produce such a reconciliation.

Forward-looking Statements

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including our 2020 financial targets for our organic revenue growth, adjusted EBITDA, free cash flow, net capital expenditures, depreciation and amortization, effective tax rate, cash taxes, cash interest expense and the free cash flow benefit from our trade receivables programs. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. In some cases, forward-looking statements can be identified by the use of forward-looking terms such as "anticipate," "estimate," "believe," "continue," "could," "intend," "may," "plan," "potential," "predict," "should," "will," "expect," "objective," "projection," "forecast," "goal," "guidance," "outlook," "effort," "target," "trajectory" or the negative of these terms or other comparable terms. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements are based on certain assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances.

These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Factors that might cause or contribute to a material difference include the risks discussed in our filings with the SEC and the following: economic conditions generally; competition and pricing pressures; our ability to align our investments in capital assets, including equipment, service centers and warehouses, to our customers' demands; risks and uncertainties as to the timing, benefits and costs of our exploration of strategic alternatives, including whether any transactions will be completed; the impact of any sale or spin-off of one or more business units on our remaining businesses; our ability to successfully integrate and realize anticipated synergies, cost savings and profit improvement opportunities with respect to acquired companies; our ability to develop and implement suitable information technology systems and prevent failures in or breaches of such systems; our substantial indebtedness; our ability to raise debt and equity capital; our ability to implement our cost and revenue initiatives; our ability to maintain positive relationships with our network of third-party transportation providers; our ability to attract and retain qualified drivers; litigation, including litigation related to alleged misclassification of independent contractors and securities class actions; labor matters, including our ability to manage our subcontractors, and risks associated with labor disputes at our customers and efforts by labor organizations to organize our employees; risks associated with our self-insured claims; risks associated with defined benefit plans for our current and former employees; fluctuations in currency exchange rates; fluctuations in fixed and floating interest rates; fuel price and fuel surcharge changes; issues related to our intellectual property rights; governmental regulation, including trade compliance laws, as well as changes in international trade policies and tax regimes; and governmental or political actions, including the United Kingdom's exit from the European Union. All forward-looking statements set forth in this release are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to or effects on us or our business or operations. Forward-looking statements set forth in this release speak only as of the date hereof, and we do not undertake any obligation to update forward-looking statements to reflect subsequent events or circumstances, changes in expectations or the occurrence of unanticipated events, except to the extent required by law.