XPO Logistics Announces Plan to Create Two Standalone, Publicly Traded Industry Leaders in Less-Than-Truckload and Tech-Enabled Brokered Transportation

Spin-off of brokered transportation services to XPO shareholders would transform the remaining business into a pure-play less-than-truckload company

Divestitures of XPO’s European business and North American intermodal operation would simplify the company’s transportation service offering

XPO Logistics, Inc. (NYSE: XPO) today announced that its board of directors, after a thorough examination of strategic alternatives, has approved a plan that the board believes is the optimal path to unlock value for XPO stakeholders. XPO intends to separate its tech-enabled brokered transportation services from its less-than-truckload (LTL) business in North America; and intends to divest its European business and North American intermodal operation.

The planned spin-off transaction is intended to be tax-free to XPO shareholders and would create two focused, publicly traded companies at the top of their industries:

- The spin-off would be a leading platform for tech-enabled truck brokerage services in North America, with a long track record of industry-best revenue and margin growth, a highly efficient digital freight marketplace and access to vast truckload capacity, with complementary, asset-light offerings for last mile logistics, managed transportation and global forwarding. The corporate headquarters are expected to be in Charlotte, North Carolina.

- Upon completion of the spin-off, XPO’s North American LTL segment would be a pure-play LTL industry leader — the third largest provider of domestic and cross-border LTL freight shipping, with a competitively advantaged network of transportation assets managed by proprietary technology. The standalone business would have a singular focus on enhancing the growth and profitability of its national network for the benefit of its stakeholders. The corporate headquarters are expected to be in Greenwich, Connecticut.

The company plans to divest its European business through either a sale or a listing on a European stock exchange. In North America, the company is currently under an exclusivity agreement in connection with a potential sale of its intermodal business, which provides rail brokerage and drayage services.

Brad Jacobs, chairman and chief executive officer of XPO Logistics, said, “Our two core businesses of North American less-than-truckload and tech-enabled truck brokerage are industry-leading platforms in their own right, each with a distinct operating model and a high return on invested capital. We believe that by separating these businesses through a spin-off, we can significantly enhance value creation for our customers, employees and shareholders, as we did with our successful spin-off of GXO last year.”

The company expects to complete the planned spin-off in the fourth quarter of 2022, subject to various conditions, including the effectiveness of a Form 10 registration statement, receipt of a tax opinion from counsel, the refinancing of XPO’s debt on terms satisfactory to the XPO board of directors, and final approval by the XPO board of directors, among other requirements. There can be no assurance that the planned spin-off or divestiture transactions will occur or, if one or more do occur, of the terms or timing.

Additionally, XPO reiterated its first quarter and full year 2022 guidance issued February 8, 2022.

Compelling Strategic and Financial Rationale for the Separation

The XPO board of directors believes that each of the two transportation powerhouses created by the planned spin-off and the divestitures would be strongly positioned to unlock significant value:

- Each company will benefit from an undiluted focus on strategic priorities, customer requirements and stakeholder interests, with its own management team and culture, and greater flexibility to tailor strategic decision-making.

- Both companies are expected to generate a high return on invested capital and robust free cash flow based on the historical performance of the core businesses they encompass, and both will have greater flexibility in allocating capital.

- Each company will have an investor base aligned with a clear-cut value proposition and be valued separately by the investment community, benefiting each company in executing its growth strategy.

- The aggregate trading price of the stocks of the two standalone companies is expected to be higher than the price that XPO’s stock would trade at if the two businesses remained combined, allowing each company to use its stock to pursue strategic objectives, including acquisitions, and to significantly increase the long-term attractiveness of its equity compensation programs, with less dilution to existing stockholders.

- Each company will have a robust balance sheet with low net debt leverage and strong financial characteristics on day one of the spin-off, and will pursue an investment-grade credit rating.

- Each company will be able to deepen its differentiation as a customer-centric innovator by focusing technology resources on enhancing proprietary software developed for its specific services and end-markets.

- Both companies will be better positioned to attract and retain world-class talent by offering meaningful equity-based compensation that correlates more closely to performance and the interests of their respective stockholders.

XPO’s views regarding the spin-off’s potential impact on aggregate equity value are based, among other things, on a study of the valuation multiples assigned to its publicly traded peers that have specialized business models. XPO believes that the separation of its North American LTL business from its asset-light transportation services will unlock significant equity value in both standalone companies beyond what is currently reflected in the existing conglomerate, for the benefit of all stakeholders.

Less-Than-Truckload Business Profile

Post-spin-off, the remaining company will be the third largest North American provider of less-than-truckload transportation services, with significant competitive advantages, including its position as one of the few national LTL networks in the United States, 130 commercial truck driver training schools and a company-owned trailer manufacturing facility in Arkansas. A team of approximately 21,000 employees serve 25,000 accounts, including innumerable long-tenured customer relationships across diverse verticals.

As of year-end 2021, XPO’s North American LTL business segment had an integrated network of 291 terminals, approximately 12,000 professional drivers, and equipment assets of approximately 7,900 tractors and 25,800 trailers.

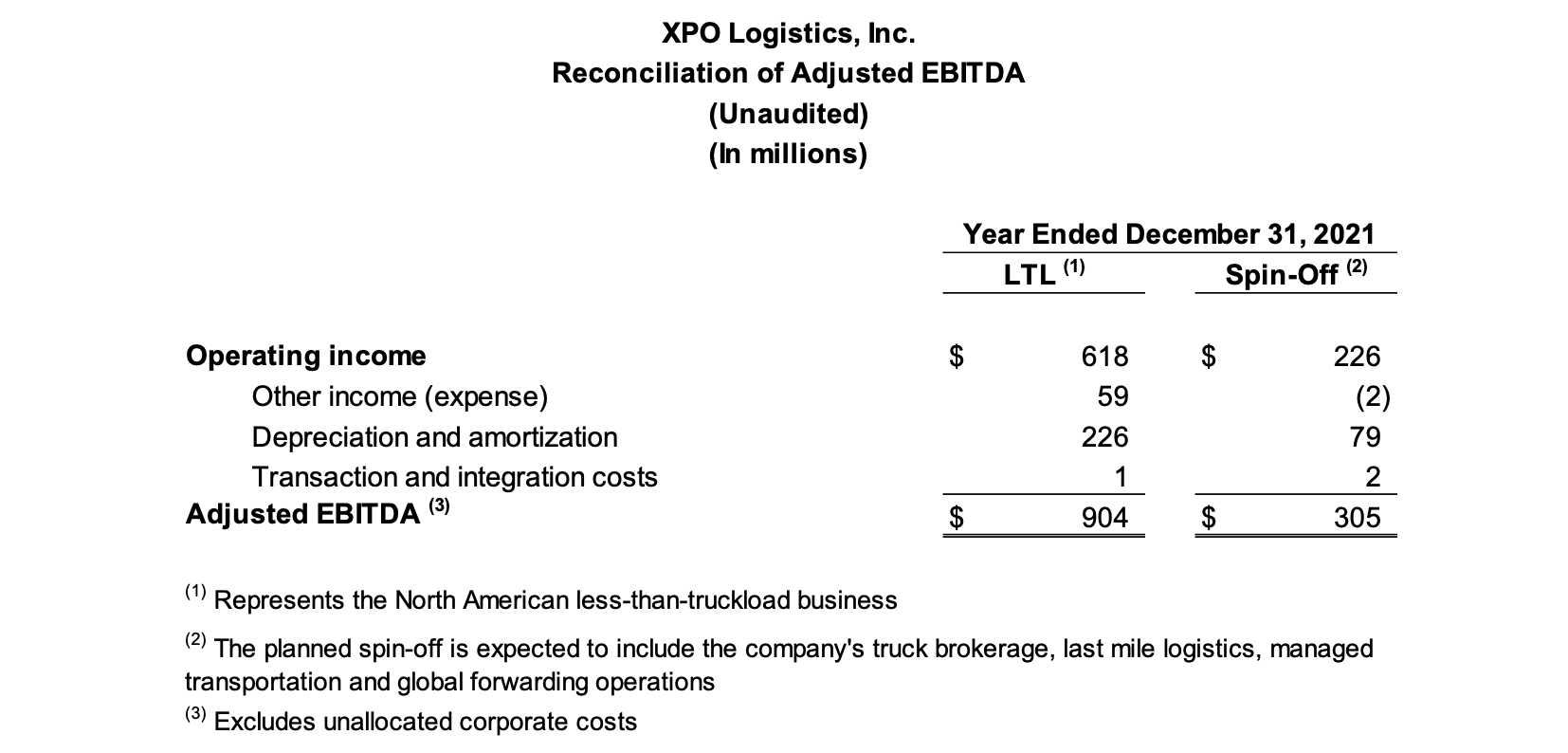

For the full year 2021, the business generated $4.1 billion of revenue, $618 million of operating income and $904 million of adjusted EBITDA, as well as the second best adjusted operating ratio in the LTL industry.

Spin-Off Business Profile

Post-spin-off, the new company will be a best-in-class, tech-enabled truck brokerage platform with a history of outsized revenue and margin growth, including a revenue CAGR three times faster than the industry growth rate from 2013 to 2021. The spin-off will inherit XPO’s first-mover advantage with brokerage automation, giving its customers access to massive truckload capacity through its XPO Connect® digital freight marketplace: 80,000 carriers representing approximately one million trucks. The company’s offering will include complementary asset-light services for last mile logistics, managed transportation and global forwarding.

As of year-end 2021, the proposed spin-off operations included a total of 172 locations and approximately 5,500 employees, with approximately 10,000 customers.

For the full year 2021, the proposed spin-off operations generated a total of $4.8 billion of revenue, $226 million of operating income and $305 million of adjusted EBITDA.

Divestiture Profiles

XPO’s European transportation business provides truckload, less-than-truckload, managed transportation, last mile logistics and global forwarding services, with 207 locations in 14 countries and approximately 13,700 employees as of year-end 2021. The company is the No. 1 truck broker and the No. 1 LTL provider in France and Iberia (Spain and Portugal), and the No. 3 truck broker in the UK, where it also has the largest single-owner LTL network. These four countries accounted for approximately 90% of the $3.1 billion of revenue generated by XPO’s European business for the full year 2021.

XPO’s intermodal operation is a leading provider of drayage and rail brokerage services in North America. As of year-end 2021, the business unit had 44 locations, including 36 drayage terminals, and approximately 425 employees. For the full year 2021, the intermodal business generated $1.2 billion of revenue.

Advisors

To assist with the planned spin-off, XPO has retained, BofA Securities, Goldman Sachs & Co. LLC and Morgan Stanley & Co. LLC as its financial advisors; and Paul, Weiss, Rifkind, Wharton & Garrison LLP and Wachtell, Lipton, Rosen & Katz as its legal advisors.

To assist with the planned sale or public listing of its European business, XPO has retained Rothschild & Co as its financial advisor; and Freshfields Bruckhaus Deringer LLP and Wachtell, Lipton, Rosen & Katz as its legal advisors.

About XPO Logistics

XPO Logistics, Inc. (NYSE: XPO) is a leading provider of freight transportation services, primarily truck brokerage and less-than-truckload (LTL). XPO uses its proprietary technology, including the cutting-edge XPO Connect® automated freight marketplace, to move goods efficiently through supply chains. The company’s global network serves 50,000 shippers with 771 locations and approximately 42,000 employees, and is headquartered in Greenwich, Conn., USA. Visit xpo.com and europe.xpo.com for more information, and connect with XPO on Facebook, Twitter, LinkedIn, Instagram and YouTube.

Non-GAAP Financial Measures

As required by the rules of the Securities and Exchange Commission ("SEC"), we provide reconciliations of the non-GAAP financial measures contained in this press release to the most directly comparable measure under GAAP, which are set forth in the financial table attached to this press release.

This press release contains the following non-GAAP financial measures for the year ended December 31, 2021: adjusted earnings before interest, taxes, depreciation and amortization (“adjusted EBITDA”) for our North American less-than-truckload business; and adjusted EBITDA for the proposed spin-off operations.

We believe that the above adjusted financial measures facilitate analysis of our ongoing business operations because they exclude items that may not be reflective of, or are unrelated to, XPO and its business segments’ core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses. Other companies may calculate these non-GAAP financial measures differently, and therefore our measures may not be comparable to similarly titled measures of other companies. These non-GAAP financial measures should only be used as supplemental measures of our operating performance.

Adjusted EBITDA includes adjustments for transaction and integration costs as set forth in the attached table. Transaction and integration adjustments are generally incremental costs that result from an actual or planned acquisition, divestiture or spin-off and may include transaction costs, consulting fees, retention awards, and internal salaries and wages (to the extent the individuals are assigned full-time to integration and transformation activities) and certain costs related to integrating and converging IT systems. Management uses these non-GAAP financial measures in making financial, operating and planning decisions and evaluating XPO’s and each business segment’s ongoing performance.

We believe that adjusted EBITDA improves comparability from period to period by removing the impact of our capital structure (interest and financing expenses), asset base (depreciation and amortization), tax impacts and other adjustments as set out in the attached tables that management has determined are not reflective of core operating activities and thereby assist investors with assessing trends in our underlying businesses.

Forward-looking Statements

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements relating to the planned spin-off and divestitures, the expected timing of the transactions and the anticipated benefits of the transactions. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. In some cases, forward-looking statements can be identified by the use of forward-looking terms such as “anticipate,” “estimate,” “believe,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “should,” “will,” “expect,” “objective,” “projection,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target,” “trajectory” or the negative of these terms or other comparable terms. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements are based on certain assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances.

These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Factors that might cause or contribute to a material difference include our ability to effect the spin-off and meet the related conditions noted above, our ability to complete the divestitures of our European freight transportation business and intermodal business, the expected timing of the completion of the transactions and the terms of the transactions, our ability to realize the expected benefits of the transactions, our ability to retain and attract key personnel for the separate businesses, the risks discussed in our filings with the SEC and the following: economic conditions generally; the severity, magnitude, duration and aftereffects of the COVID-19 pandemic, including supply chain disruptions due to plant and port shutdowns and transportation delays, the global shortage of certain components such as semiconductor chips, strains on production or extraction of raw materials, cost inflation and labor and equipment shortages, which may lower levels of service, including the timeliness, productivity and quality of service, and government responses to these factors; our ability to align our investments in capital assets, including equipment, service centers and warehouses, to our customers’ demands; our ability to implement our cost and revenue initiatives; the effectiveness of our action plan, and other management actions, to improve our North American LTL business; our ability to benefit from a sale, spin-off or other divestiture of one or more business units, and the impact of anticipated material compensation and other expenses, including expenses related to the acceleration of equity awards, to be incurred in connection with a substantial disposition; our ability to successfully integrate and realize anticipated synergies, cost savings and profit improvement opportunities with respect to acquired companies; goodwill impairment, including in connection with a business unit sale, spin-off or other divestiture; matters related to our intellectual property rights; fluctuations in currency exchange rates; fuel price and fuel surcharge changes; natural disasters, terrorist attacks, wars or similar incidents; risks and uncertainties regarding the expected benefits of the spin-off of our logistics segment or a future spin-off of a business unit; the impact of the spin-off of our logistics segment or a future spin-off of a business unit on the size and business diversity of our company; the ability of the spin-off of our logistics segment or a future spin-off of a business unit to qualify for tax-free treatment for U.S. federal income tax purposes; our ability to develop and implement suitable information technology systems and prevent failures in or breaches of such systems; our indebtedness; our ability to raise debt and equity capital; fluctuations in fixed and floating interest rates; our ability to maintain positive relationships with our network of third-party transportation providers; our ability to attract and retain qualified drivers; labor matters, including our ability to manage our subcontractors, and risks associated with labor disputes at our customers and efforts by labor organizations to organize our employees and independent contractors; litigation, including litigation related to alleged misclassification of independent contractors and securities class actions; risks associated with our self-insured claims; risks associated with defined benefit plans for our current and former employees; the impact of potential sales of common stock by our chairman; governmental regulation, including trade compliance laws, as well as changes in international trade policies and tax regimes; governmental or political actions, including the United Kingdom’s exit from the European Union; and competition and pricing pressures.

All forward-looking statements set forth in this release are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to or effects on us or our business or operations. Forward-looking statements set forth in this release speak only as of the date hereof, and we do not undertake any obligation to update forward-looking statements to reflect subsequent events or circumstances, changes in expectations or the occurrence of unanticipated events, except to the extent required by law.

Where required by law, no binding decision will be made with respect to the divestiture of the European business other than in compliance with applicable employee information and consultation requirements.