XPO Announces Fourth Quarter and Full Year 2022 Results

Reports fourth quarter growth in North American LTL year-over-year, including 26% increase in operating income and 20% increase in adjusted EBITDA

Achieves fourth quarter tonnage growth year-over-year in North American LTL

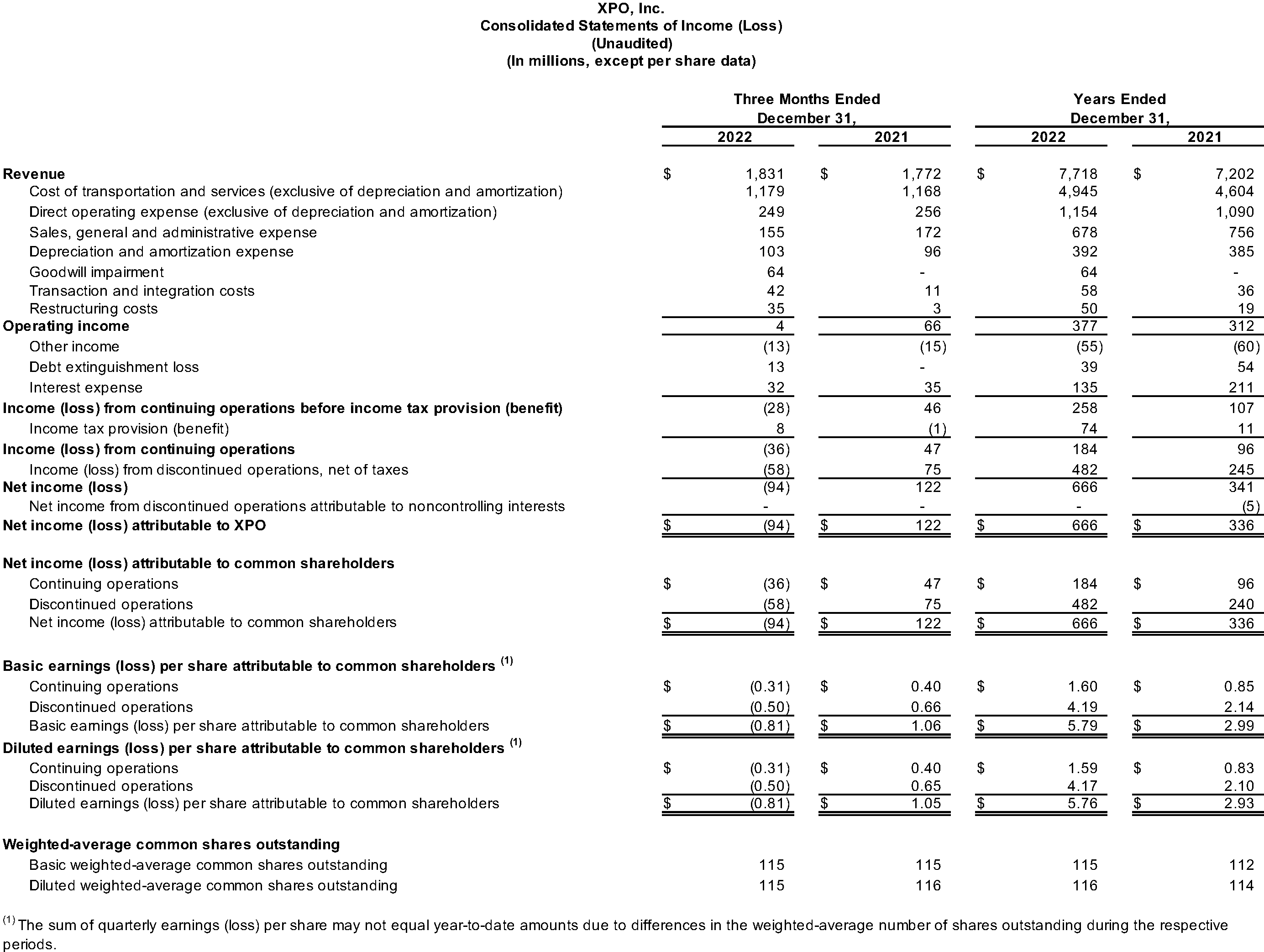

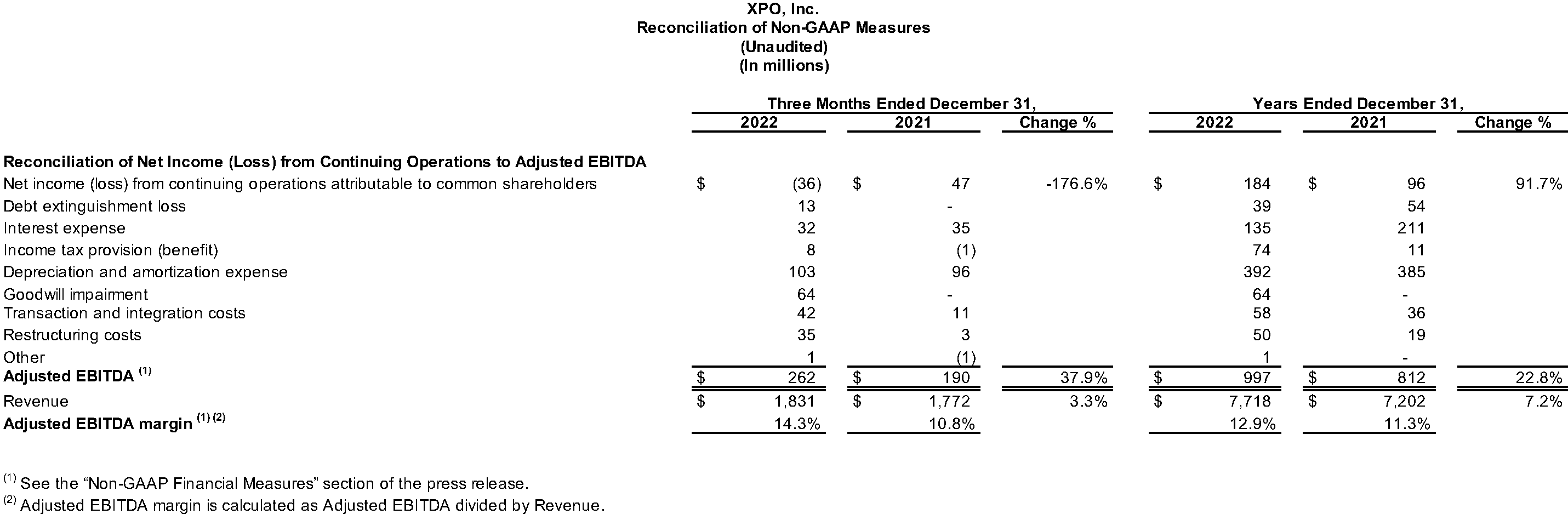

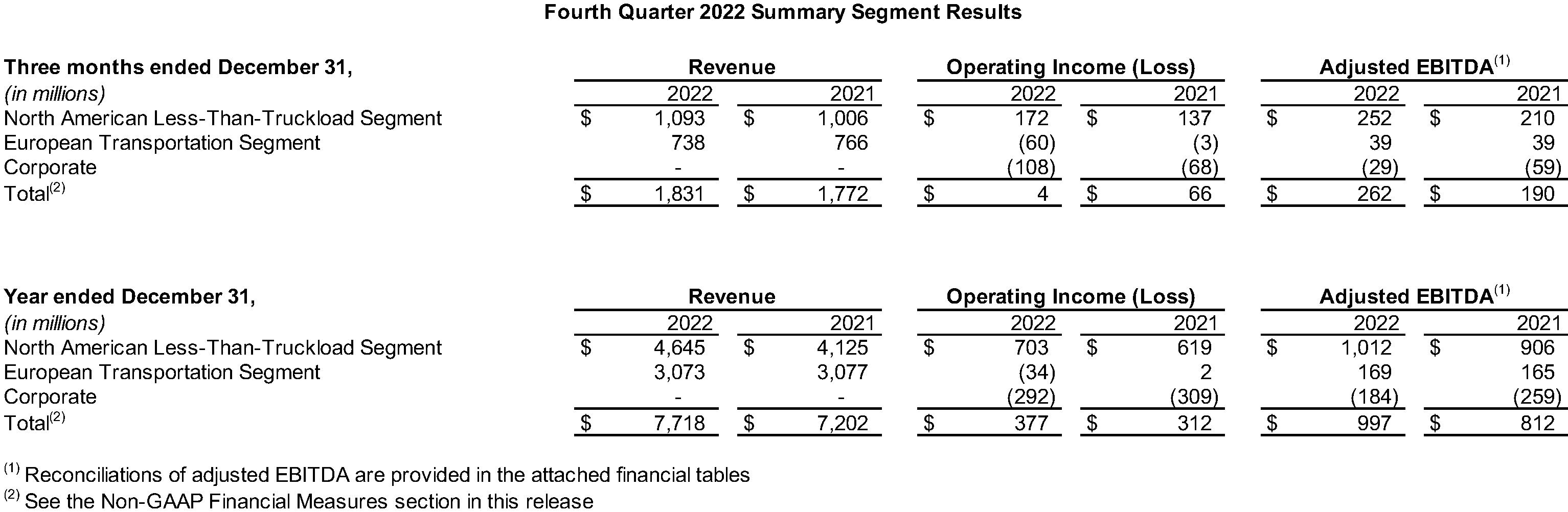

XPO (NYSE: XPO) today announced its financial results for the fourth quarter 2022. Revenue was $1.83 billion for the quarter, compared with $1.77 billion for the same period in 2021.

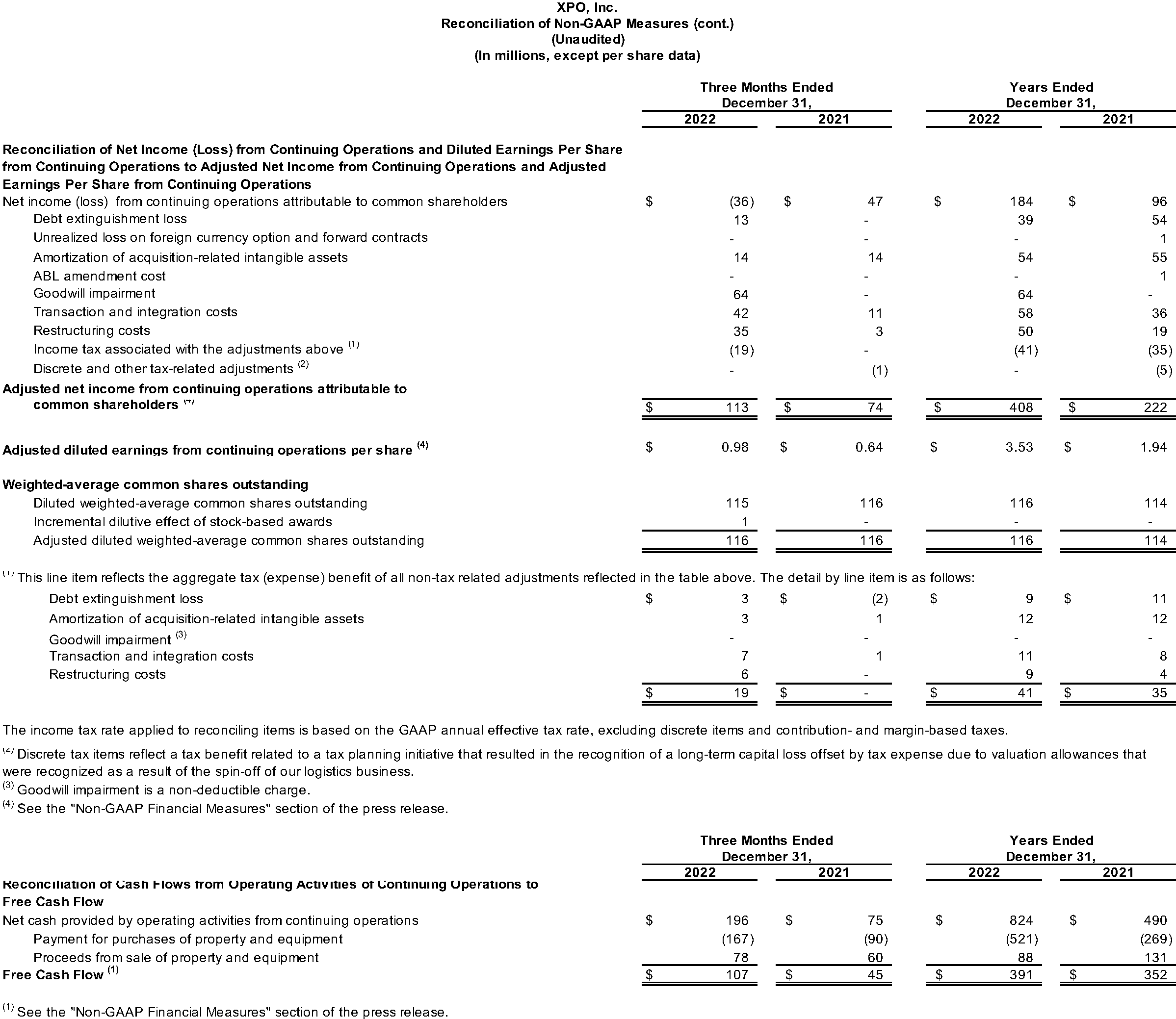

The company reported a net loss from continuing operations attributable to common shareholders of $36 million for the fourth quarter 2022, or a diluted loss from continuing operations per share of $0.31, compared with net income from continuing operations attributable to common shareholders of $47 million, or diluted earnings from continuing operations per share of $0.40, for the same period in 2021. The fourth quarter 2022 net loss includes three impacts primarily related to the RXO spin-off completed in November: i) a $64 million non-cash goodwill impairment charge related to European Transportation, which became a new segment of XPO, requiring goodwill to be evaluated on a disaggregated basis; ii) $42 million of transaction and integration costs; and iii) $35 million of restructuring charges.

Adjusted net income from continuing operations attributable to common shareholders, a non-GAAP financial measure, increased to $113 million for the fourth quarter, compared with $74 million for the same period in 2021. Adjusted diluted earnings from continuing operations per share (“adjusted EPS”), a non-GAAP financial measure, was $0.98 for the fourth quarter, compared with $0.64 for the same period in 2021.

Adjusted earnings before interest, taxes, depreciation and amortization (“adjusted EBITDA”), a non-GAAP financial measure, increased to $262 million for the fourth quarter, compared with $190 million for the same period in 2021.

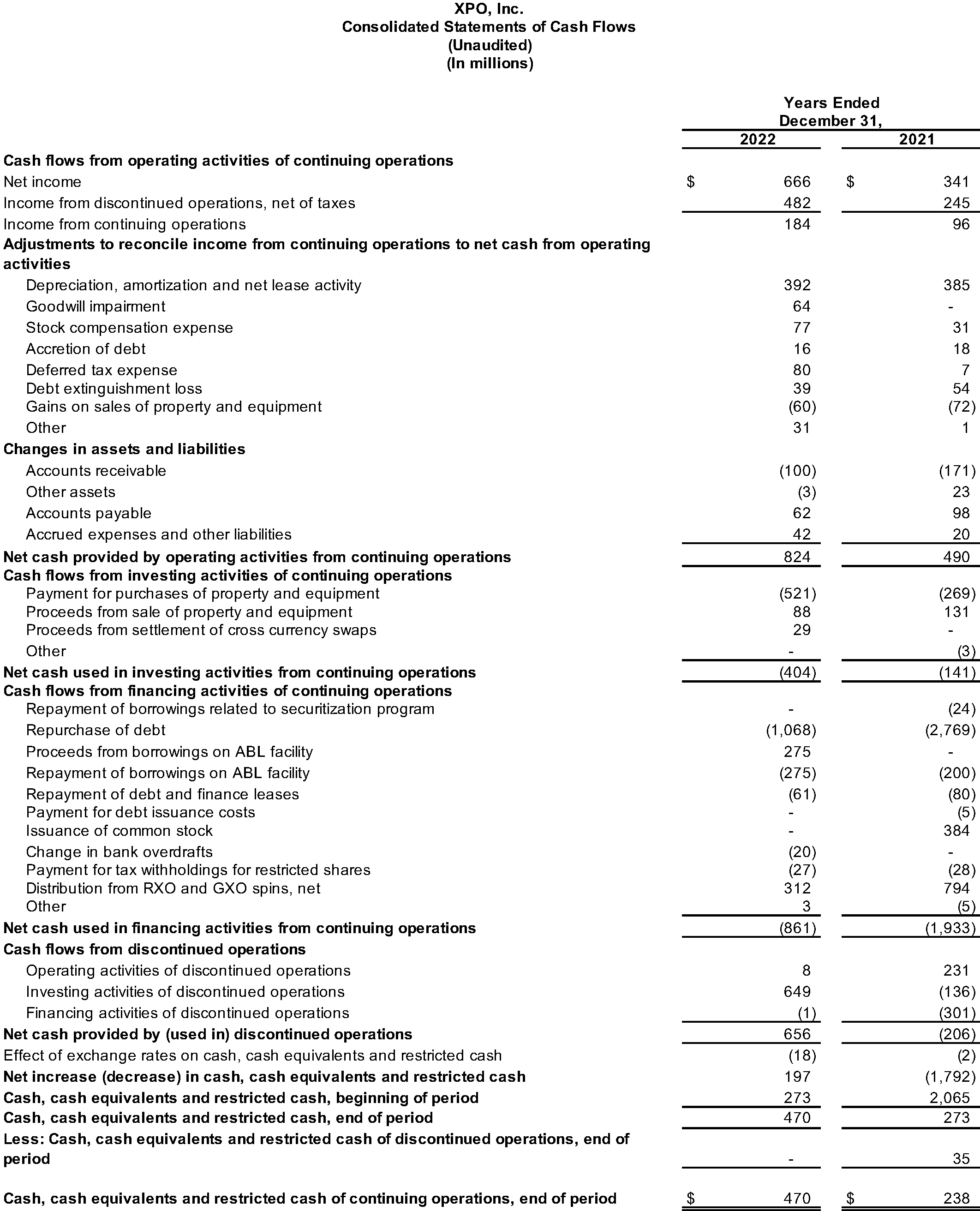

For the fourth quarter 2022, the company generated $196 million of cash flow from operating activities and $107 million of free cash flow, a non-GAAP financial measure.

Reconciliations of non-GAAP financial measures used in this release are provided in the attached financial tables.

CEO Comments

Mario Harik, chief executive officer of XPO, said, “In the fourth quarter, we reported solid revenue growth and strong year-over-year increases in adjusted EBITDA, adjusted EPS and free cash flow. Our North American LTL business achieved a 26% increase in operating income and a 20% increase in adjusted EBITDA. We’re pleased that we delivered over $1 billion of LTL adjusted EBITDA for our shareholders in 2022, exceeding our target.

“Our growth plan for LTL is to invest in capacity ahead of demand and earn market share by providing best-in-class service. In the fourth quarter, we grew tonnage and shipment count year-over-year at a time when the industry saw these metrics decline. Yield came in at the low end of our outlook, reflecting a strategic change in channel mix that we believe will be a tailwind for both volume and yield as freight demand improves. In January, our tonnage was up year-over-year and trended better than typical seasonality.”

Harik continued, “We’re excited by the strong trajectory we’ve created, and the tangible ways we're strengthening our positioning. In LTL, our employee satisfaction was up sharply to the highest rating in more than a decade. In Europe, the business is continuing to perform above expectations. We’re confident that we’ll achieve our long-term LTL outlook and deliver superior shareholder value."

Results by Business Segment

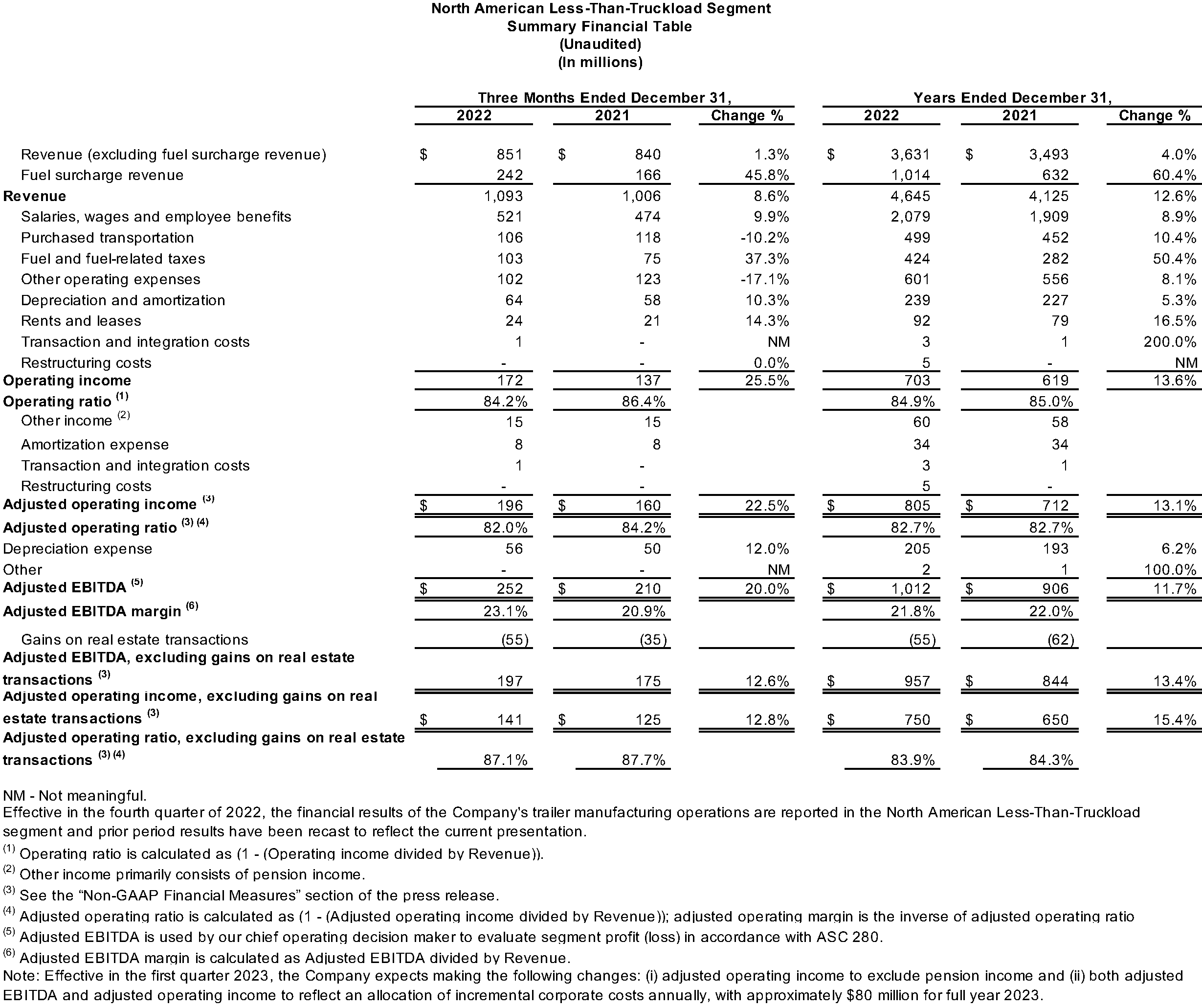

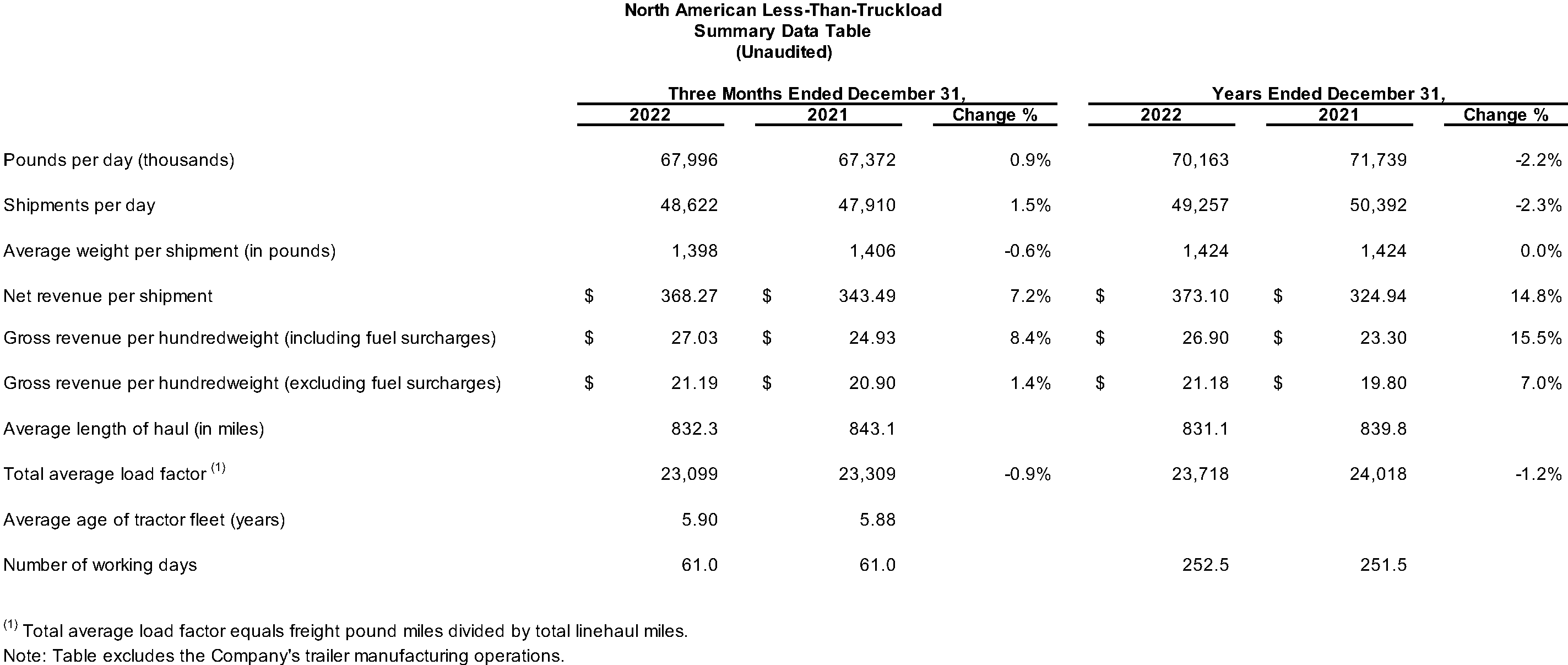

- North American Less-Than-Truckload (LTL): The segment generated revenue of $1.09 billion for the fourth quarter 2022, compared with $1.01 billion for the same period in 2021. Yield, excluding fuel, increased by 1.4% year-over-year, reflecting a strategic change in channel mix; and tonnage increased by 0.9%, driven by a 1.5% increase in shipment count.

Operating income for the segment was $172 million for the fourth quarter 2022, compared with $137 million for the same period in 2021. Adjusted EBITDA for the fourth quarter 2022 was $252 million, compared with $210 million for the same period in 2021. Adjusted EBITDA reflects a $55 million gain on the sale of real estate in the fourth quarter 2022, compared with a $35 million gain for the same period in 2021. Excluding real estate sales in both periods, LTL adjusted EBITDA grew year-over-year by 13%.

The fourth quarter 2022 operating ratio for North American LTL was 84.2%. Excluding real estate sales, the adjusted operating ratio improved by 60 basis points to 87.1%.

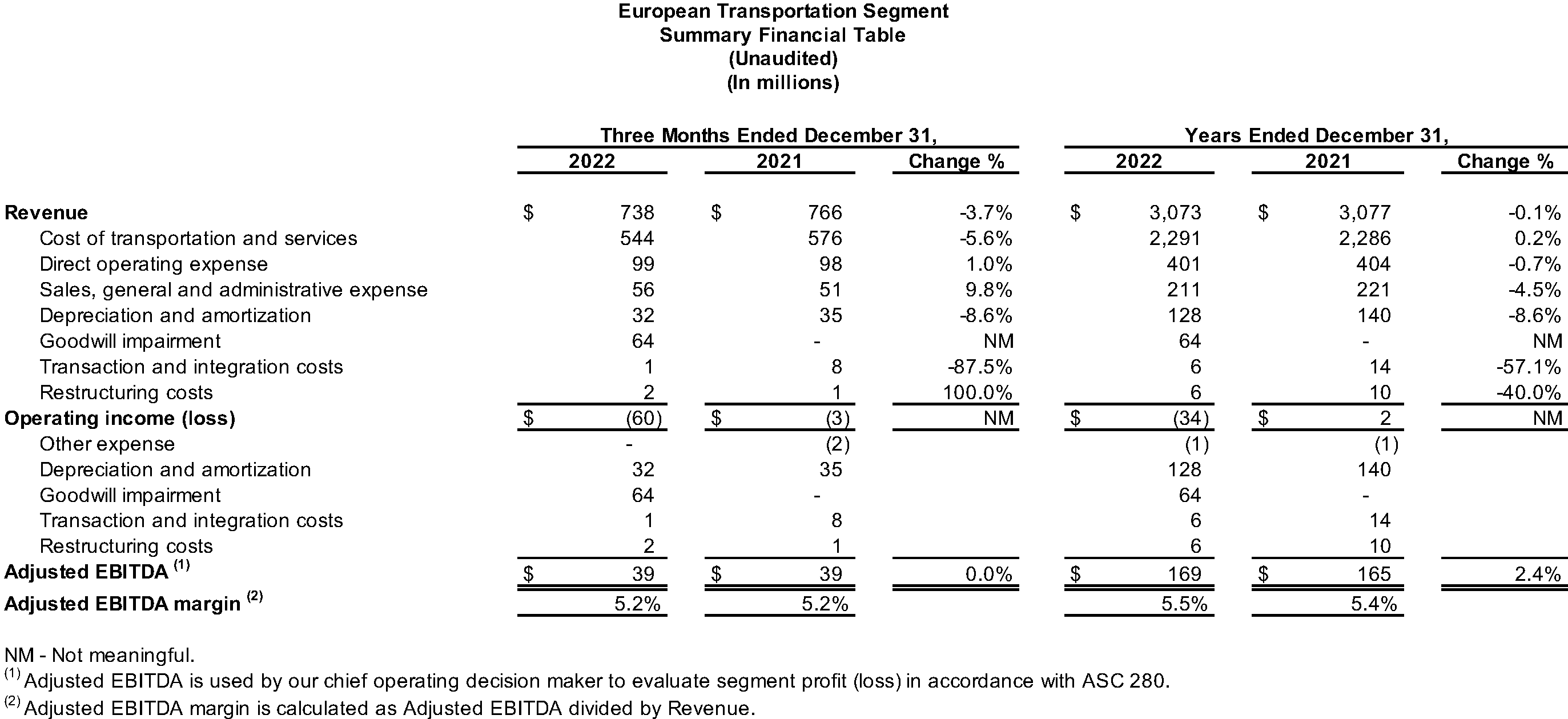

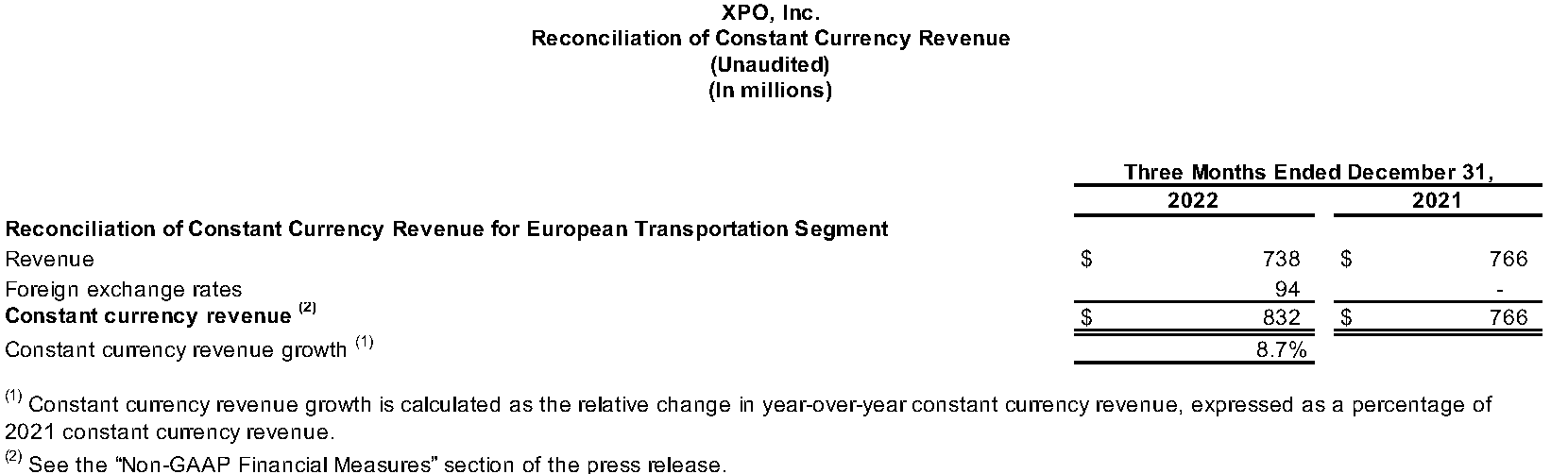

- European Transportation: Revenue for the segment was $738 million for the fourth quarter 2022, compared with $766 million for the same period in 2021. The year-over-year decrease in revenue was due to unfavorable foreign currency exchange. In constant currency, revenue in the quarter increased year-over-year by 9%.

Fourth quarter 2022 operating loss for the segment was $60 million, compared with an operating loss of $3 million for the same period in 2021. Adjusted EBITDA was $39 million for the fourth quarters in both 2022 and 2021. The fourth quarter operating loss includes a $64 million non-cash goodwill impairment charge related to a change in the company’s segment structure following the RXO spin-off. Prior to the spin-off, the European transportation business was a single reporting unit and goodwill was evaluated for impairment at that level. Following the spin-off, the European transportation business is comprised of four reporting units and impairment testing is required to be performed on a disaggregated basis for each of the new reporting units.

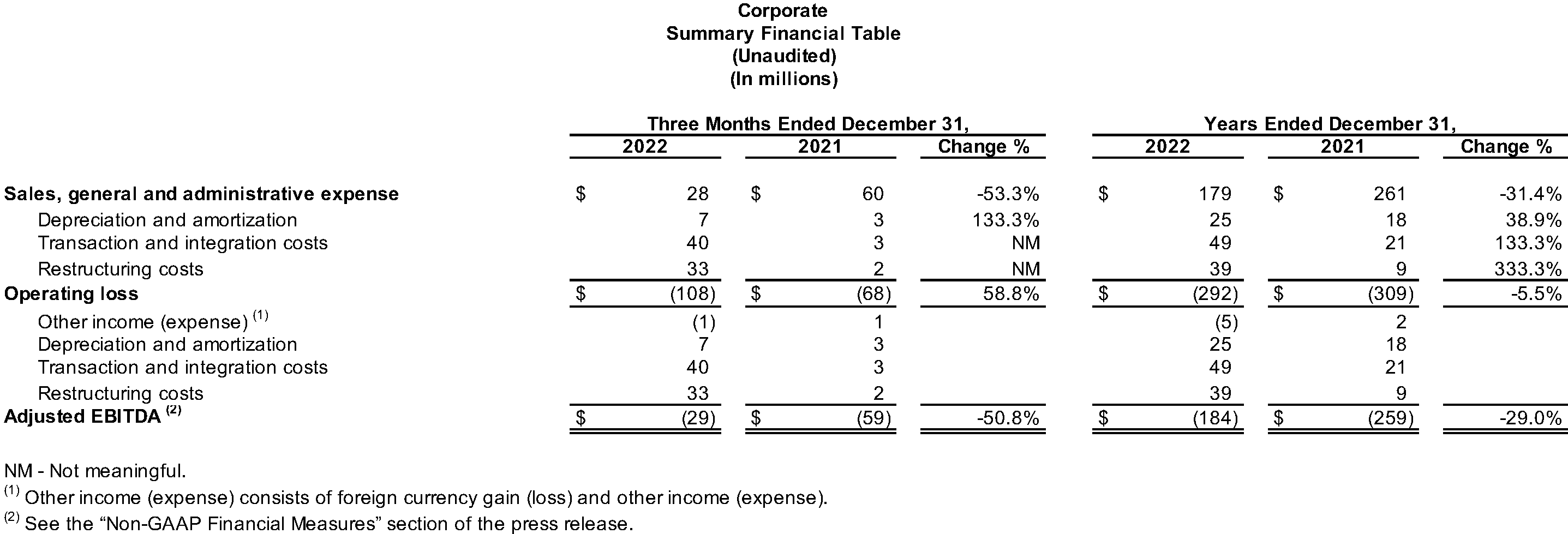

- Corporate: Corporate expense was $108 million for the fourth quarter 2022, compared with $68 million for the same period in 2021. Corporate adjusted EBITDA was an expense of $29 million for the fourth quarter 2022, compared with an expense of $59 million for the same period in 2021. The decrease in corporate adjusted EBITDA expense was due primarily to a $32 million reduction in SG&A expense as the company continued to rationalize overhead following the RXO spin-off.

Full Year 2022 Financial Results

For the full year 2022, the company reported total revenue of $7.7 billion, compared with $7.2 billion for 2021. Net income from continuing operations attributable to common shareholders was $184 million for 2022, compared with $96 million for 2021. Operating income was $377 million for 2022, compared with $312 million for 2021. Diluted earnings from continuing operations per share was $1.59 for 2022, compared with $0.83 for 2021.

Adjusted EBITDA for 2022 was $997 million, compared with $812 million for 2021. Adjusted net income from continuing operations attributable to common shareholders for the full year 2022 was $408 million, compared with $222 million for 2021. Adjusted EPS was $3.53 for 2022, compared with $1.94 for 2021.

Liquidity

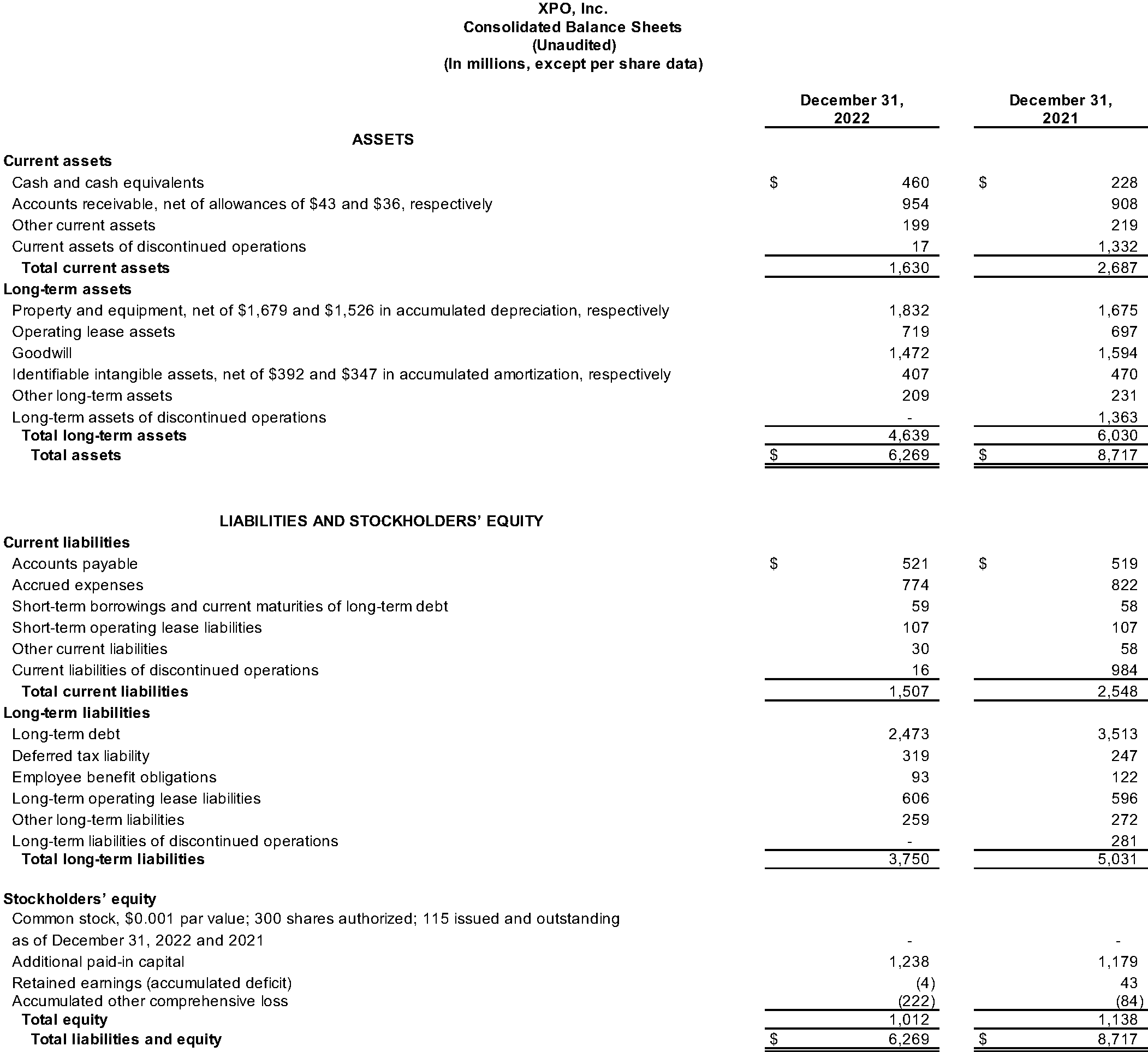

As of December 31, 2022, the company had $930 million of total liquidity, including $460 million of cash and cash equivalents and approximately $470 million of borrowing capacity. On February 6, 2023, the company extended the maturity of its ABL facility by two years to April 2026.

Conference Call

The company will hold a conference call on Thursday, February 9, 2023, at 8:30 a.m. Eastern Time. Participants can call toll-free (from US/Canada) 1-877-269-7756; international callers dial +1-201-689-7817. A live webcast of the conference will be available on the investor relations area of the company’s website, xpo.com/investors. The conference will be archived until March 9, 2023. To access the replay by phone, call toll-free (from US/Canada) 1-877-660-6853; international callers dial +1-201-612-7415. Use participant passcode 13735446.

About XPO

XPO (NYSE: XPO) is one of the largest providers of asset-based less-than-truckload (LTL) transportation in North America, with proprietary technology that moves goods efficiently through its network. Together with its business in Europe, XPO serves approximately 48,000 customers with 554 locations and 38,000 employees. The company is headquartered in Greenwich, Conn., USA. Visit xpo.com for more information, and connect with XPO on Facebook, Twitter, LinkedIn, Instagram and YouTube.

Non-GAAP Financial Measures

As required by the rules of the Securities and Exchange Commission (“SEC”), we provide reconciliations of the non-GAAP financial measures contained in this press release to the most directly comparable measure under GAAP, which are set forth in the financial tables attached to this press release.

XPO’s non-GAAP financial measures in this press release include: adjusted earnings before interest, taxes, depreciation and amortization (“adjusted EBITDA”) on a consolidated basis and for corporate and intersegment eliminations; adjusted EBITDA margin on a consolidated basis; adjusted net income from continuing operations attributable to common shareholders and adjusted diluted earnings from continuing operations per share (“adjusted EPS”); free cash flows; adjusted operating income (including and excluding gains on real estate transactions) for our North American less-than-truckload segment; adjusted operating ratio (including and excluding gains on real estate transactions) for our North American less-than-truckload segment; adjusted EBITDA excluding gains on real estate transactions for our North American less-than-truckload segment; and constant currency revenue growth for our European Transportation segment.

We believe that the above adjusted financial measures facilitate analysis of our ongoing business operations because they exclude items that may not be reflective of, or are unrelated to, XPO and its business segments’ core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses. Other companies may calculate these non-GAAP financial measures differently, and therefore our measures may not be comparable to similarly titled measures of other companies. These non-GAAP financial measures should only be used as supplemental measures of our operating performance.

Adjusted EBITDA, adjusted EBITDA margin, adjusted net income from continuing operations attributable to common shareholders and adjusted EPS include adjustments for transaction and integration costs, as well as restructuring costs and other adjustments as set forth in the attached tables. Transaction and integration adjustments are generally incremental costs that result from an actual or planned acquisition, divestiture or spin-off and may include transaction costs, consulting fees, stock-based compensation, retention awards, and internal salaries and wages (to the extent the individuals are assigned full-time to integration and transformation activities) and certain costs related to integrating and converging IT systems. Restructuring costs primarily relate to severance costs associated with business optimization initiatives. Management uses these non-GAAP financial measures in making financial, operating and planning decisions and evaluating XPO’s and each business segment’s ongoing performance.

We believe that free cash flow is an important measure of our ability to repay maturing debt or fund other uses of capital that we believe will enhance stockholder value. We calculate free cash flow as net cash provided by operating activities from continuing operations, less payment for purchases of property and equipment plus proceeds from sale of property and equipment. We believe that adjusted EBITDA and adjusted EBITDA margin improve comparability from period to period by removing the impact of our capital structure (interest and financing expenses), asset base (depreciation and amortization), goodwill impairment charge, tax impacts and other adjustments as set out in the attached tables that management has determined are not reflective of core operating activities and thereby assist investors with assessing trends in our underlying businesses. We believe that adjusted net income from continuing operations attributable to common shareholders and adjusted EPS improve the comparability of our operating results from period to period by removing the impact of certain costs and gains that management has determined are not reflective of our core operating activities, including amortization of acquisition-related intangible assets, transaction and integration costs, restructuring costs and other adjustments as set out in the attached tables. We believe that adjusted operating income and adjusted operating ratio improve the comparability of our operating results from period to period by (i) removing the impact of certain transaction and integration costs and restructuring costs, as well as amortization expenses and (ii) including the impact of pension income incurred in the reporting period as set out in the attached tables. We believe that constant currency revenue growth improves the comparability of our revenue from period to period by adding foreign exchange rates to our reported revenue.

Forward-looking Statements

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. In some cases, forward-looking statements can be identified by the use of forward-looking terms such as “anticipate,” “estimate,” “believe,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “should,” “will,” “expect,” “objective,” “projection,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target,” “trajectory” or the negative of these terms or other comparable terms. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements are based on certain assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances.

These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Factors that might cause or contribute to a material difference include our ability to achieve the expected benefits of the spin-off of RXO, the risks discussed in our filings with the SEC, and the following: economic conditions generally; the severity, magnitude, duration and aftereffects of the COVID-19 pandemic, including supply chain disruptions due to plant and port shutdowns and transportation delays, the global shortage of certain components such as semiconductor chips, strains on production or extraction of raw materials, cost inflation and labor and equipment shortages, which may lower levels of service, including the timeliness, productivity and quality of service, and government responses to these factors; our ability to align our investments in capital assets, including equipment, service centers, and warehouses and other network facilities, to our customers’ demands; our ability to implement our cost and revenue initiatives; the effectiveness of our action plan, and other management actions, to improve our North American LTL business; our ability to benefit from a sale or other divestiture of one or more business units; our ability to successfully integrate and realize anticipated synergies, cost savings and profit improvement opportunities with respect to acquired companies; goodwill impairment, including in connection with a business unit sale or other divestiture; matters related to our intellectual property rights; fluctuations in currency exchange rates; fuel price and fuel surcharge changes; natural disasters, terrorist attacks, wars or similar incidents, including the conflict between Russia and Ukraine and increased tensions between Taiwan and China; the impact of the prior spin-offs of GXO and RXO on the size and business diversity of our company; the ability of the spin-off of a business unit to qualify for tax-free treatment for U.S. federal income tax purposes; our ability to develop and implement suitable information technology systems and prevent failures in or breaches of such systems; our indebtedness; our ability to raise debt and equity capital; fluctuations in fixed and floating interest rates; our ability to maintain positive relationships with our network of third-party transportation providers; our ability to attract and retain qualified drivers; labor matters; litigation; risks associated with our self-insured claims; risks associated with defined benefit plans for our current and former employees; the impact of potential sales of common stock by our chairman; governmental regulation, including trade compliance laws, as well as changes in international trade policies, sanctions and tax regimes; governmental or political actions, including the United Kingdom’s exit from the European Union; and competition and pricing pressures.

All forward-looking statements set forth in this release are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to or effects on us or our business or operations. Forward-looking statements set forth in this release speak only as of the date hereof, and we do not undertake any obligation to update forward-looking statements to reflect subsequent events or circumstances, changes in expectations or the occurrence of unanticipated events, except to the extent required by law.