XPO Reports First Quarter 2024 Results

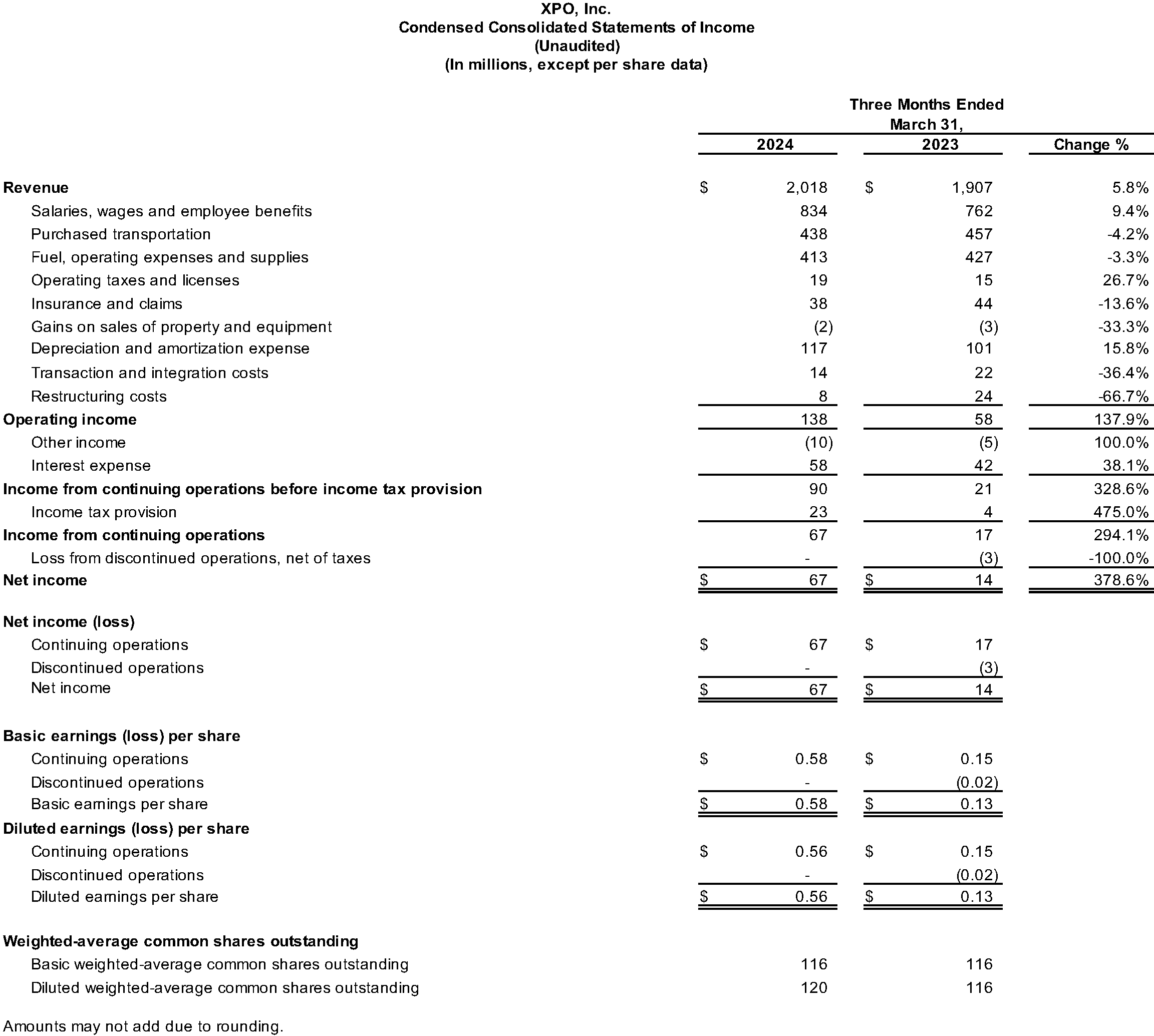

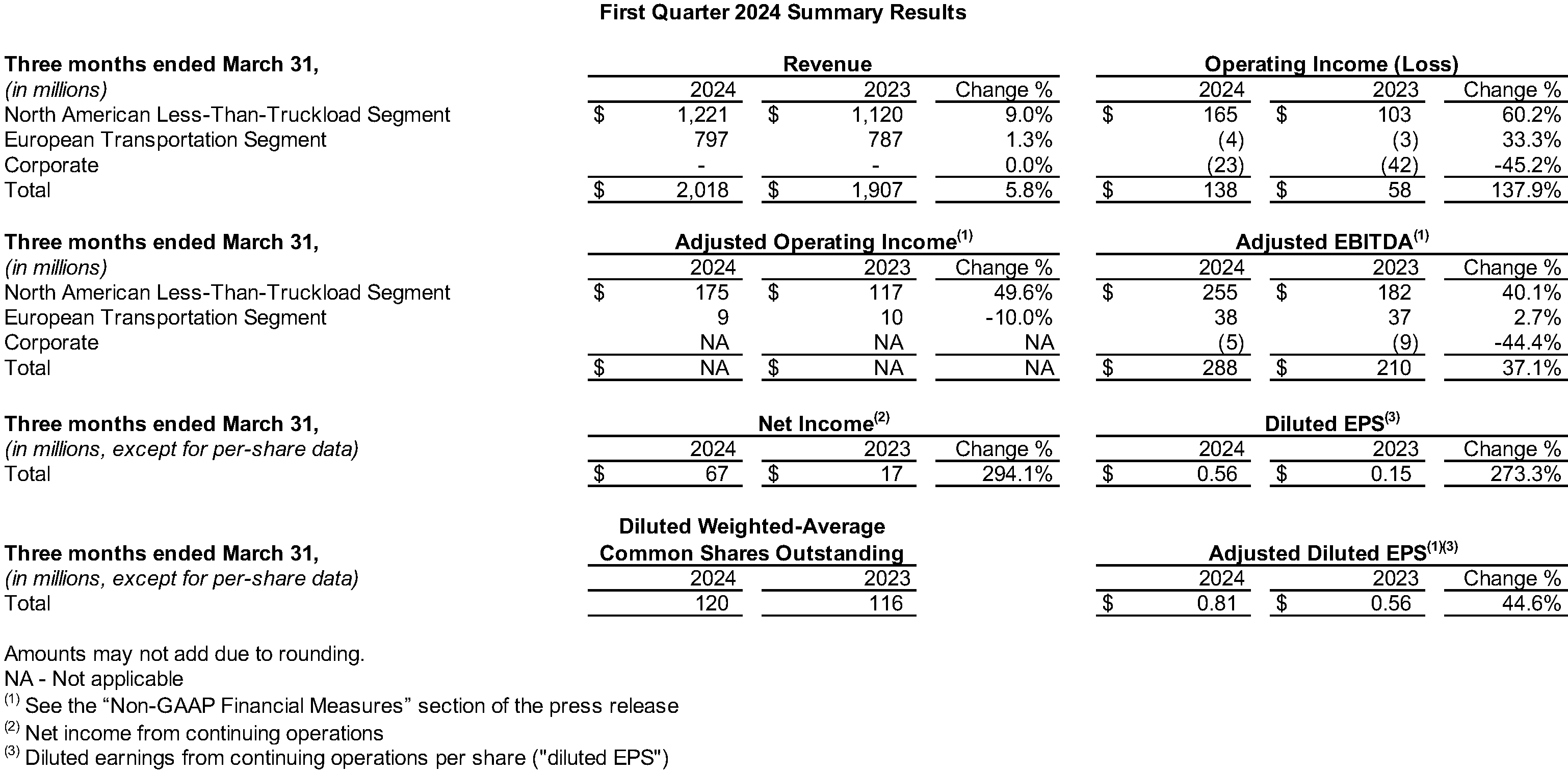

XPO (NYSE: XPO) today announced its financial results for the first quarter 2024. The company reported diluted earnings from continuing operations per share of $0.56, compared with $0.15 for the same period in 2023, and adjusted diluted earnings from continuing operations per share of $0.81, compared with $0.56 for the same period in 2023.

Mario Harik, chief executive officer of XPO, said, “Our strong first quarter financial results exceeded expectations, giving us a solid start to 2024. Companywide, year-over-year, we grew revenue by 6%, adjusted EBITDA by 37% and adjusted diluted EPS by 45%.

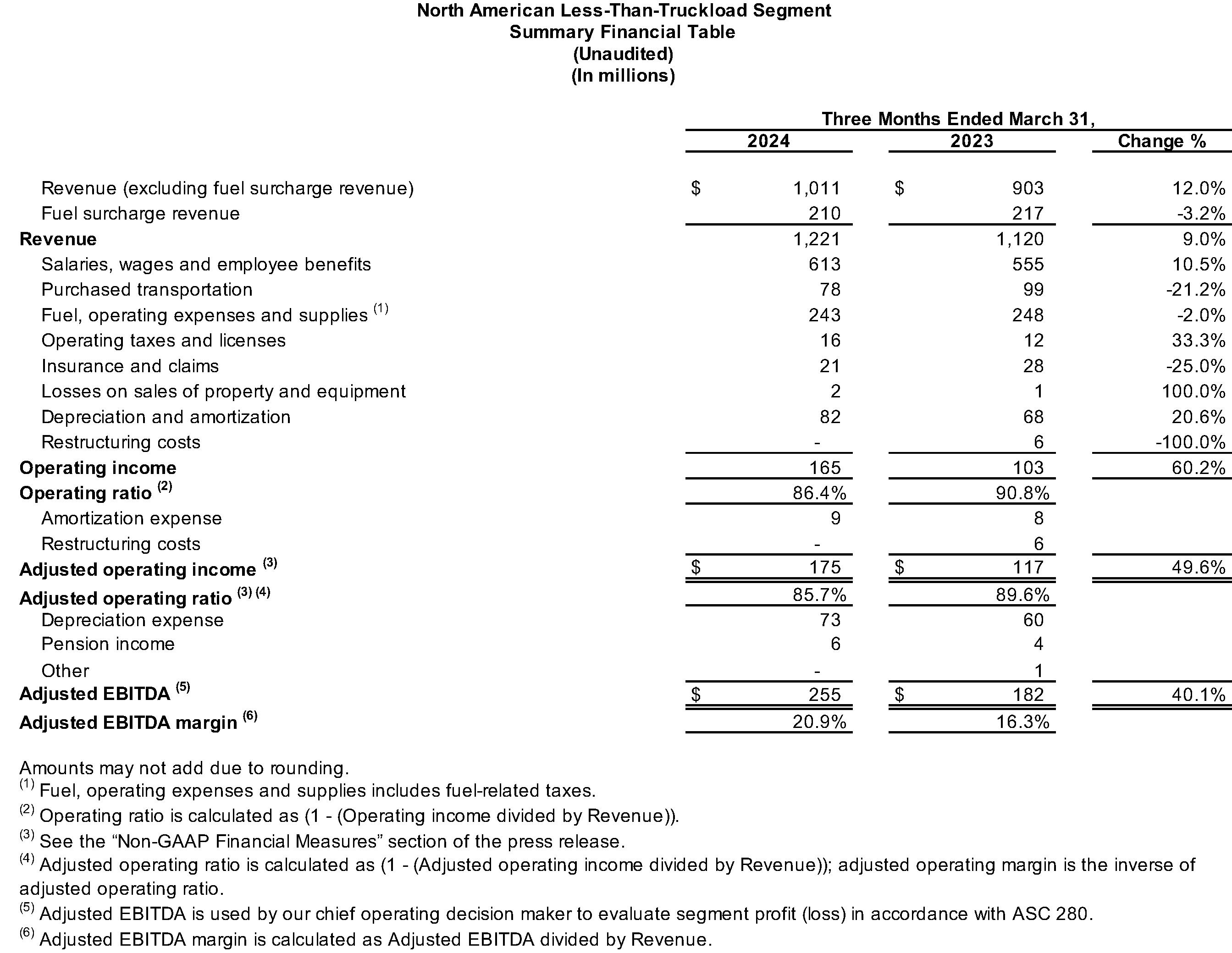

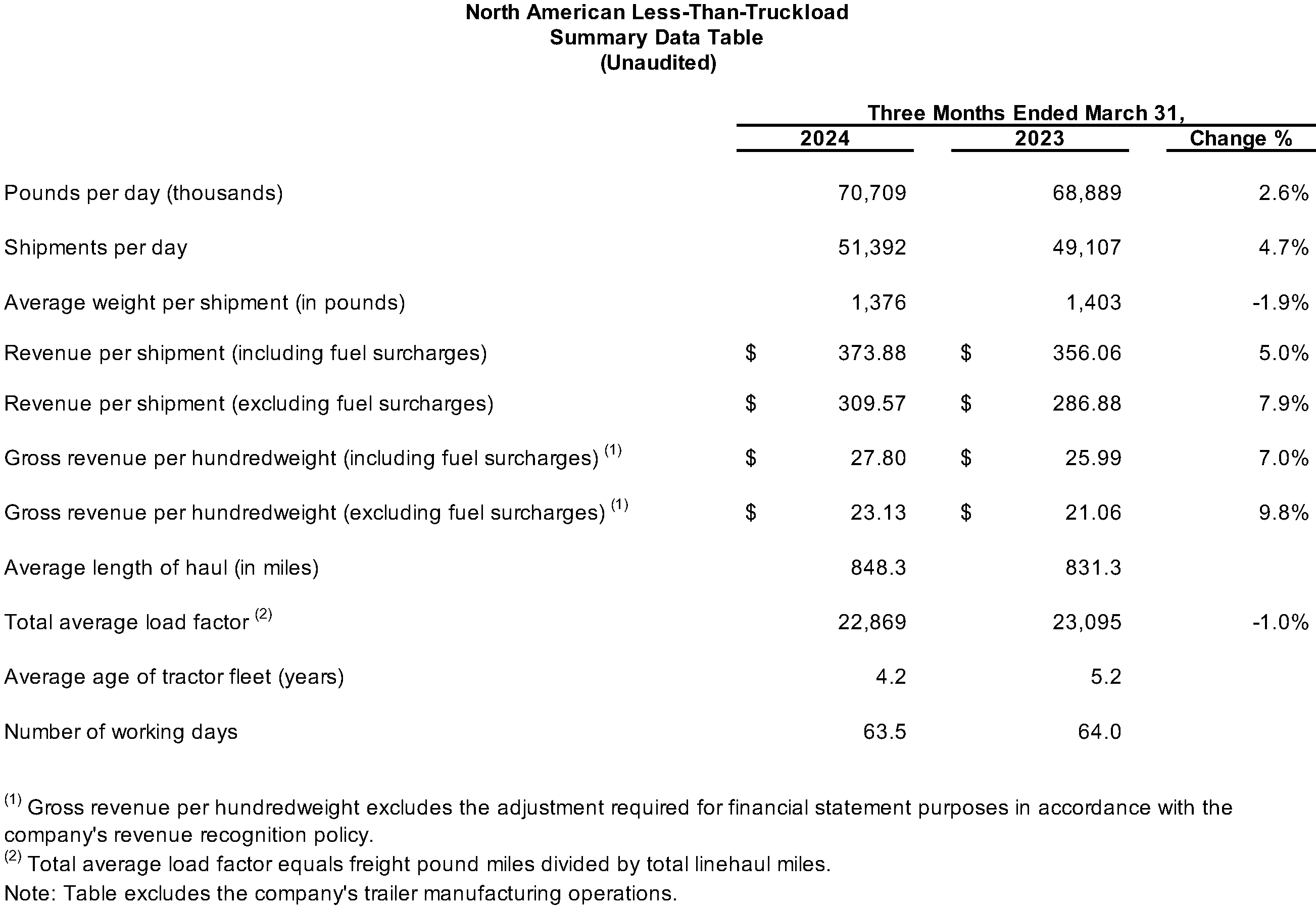

“In North American LTL, every key operating and financial metric reflected the team’s strong execution of our LTL 2.0 plan. We reported a 50% increase in adjusted operating income, with a 390-basis-point improvement in adjusted operating ratio to 85.7%. This was underpinned by yield growth, ex-fuel, of 9.8% and an acceleration in revenue per shipment. Our tonnage per day was 2.6% higher than in the first quarter a year ago, with 4.7% more shipments per day.

“We also delivered one of the best damage claims ratios in the industry at 0.3%, continuing our record performance. We’re determined to become the leading LTL service provider by giving our customers the best possible service experience every time we move their freight.”

Harik continued, “While we’ve made significant progress in executing our LTL 2.0 plan, we’re still in the early stages of unlocking our full potential.”

First Quarter Highlights

For the first quarter 2024, the company generated revenue of $2.02 billion, compared to $1.91 billion for the same period in 2023. The year-over-year increase in revenue was due primarily to higher yield and tonnage per day in the North American LTL segment, partially offset by lower fuel surcharge revenue.

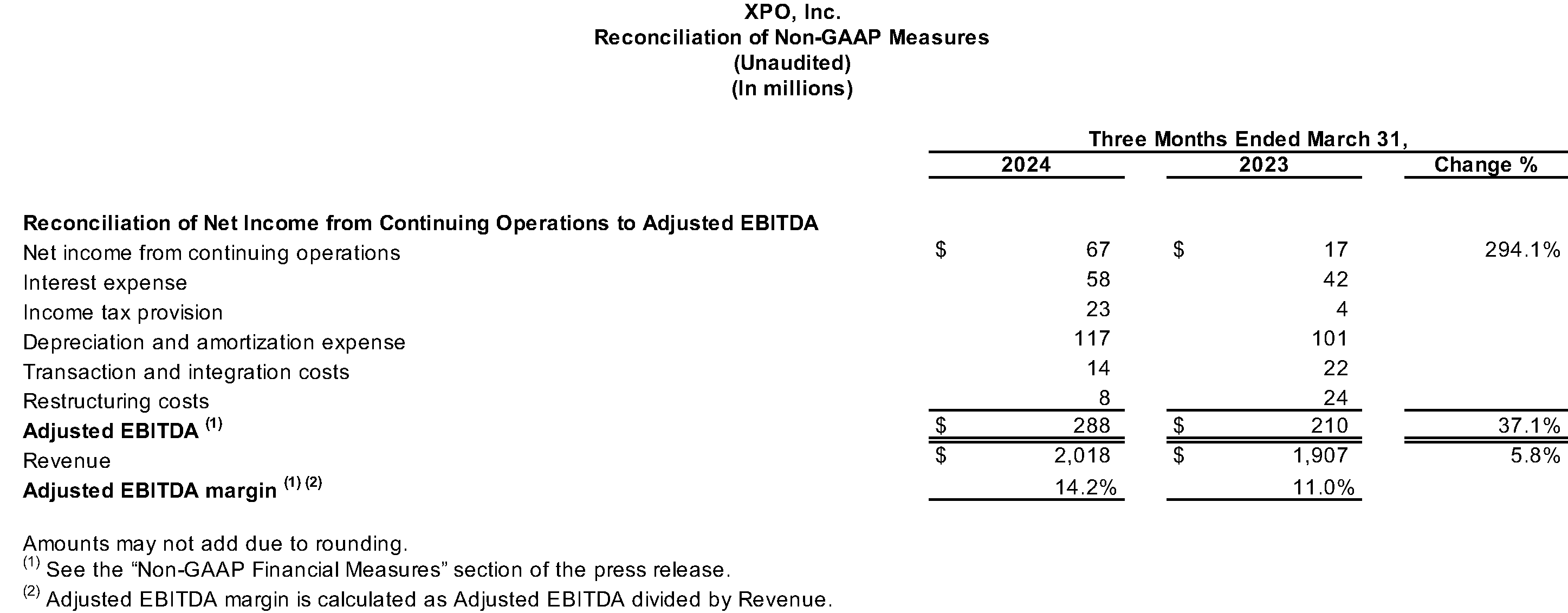

Operating income was $138 million for the first quarter, compared with $58 million for the same period in 2023. Net income from continuing operations was $67 million for the first quarter, compared to $17 million for the same period in 2023. Diluted earnings from continuing operations per share was $0.56 for the first quarter, compared with $0.15 for the same period in 2023.

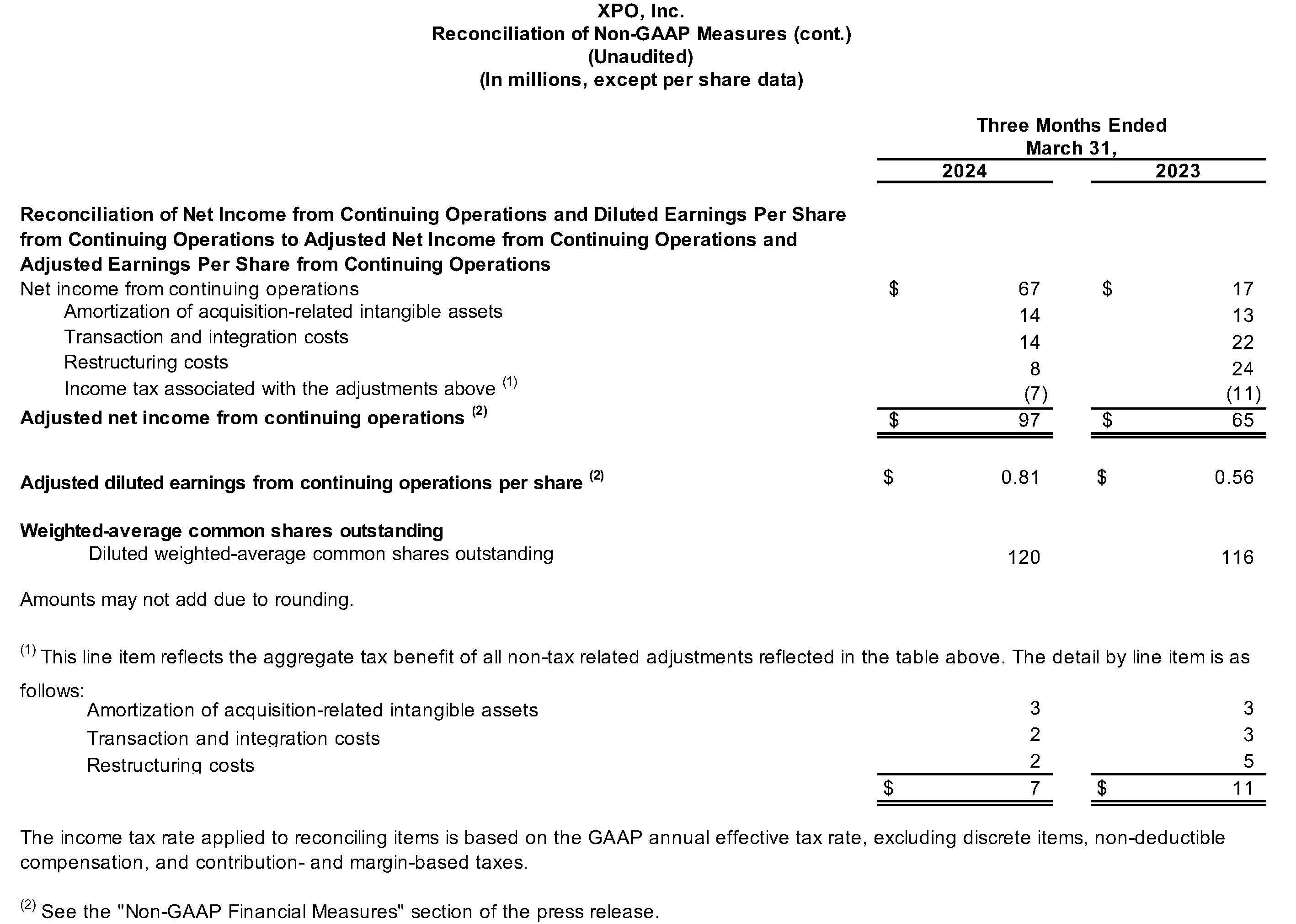

Adjusted net income from continuing operations, a non-GAAP financial measure, was $97 million for the first quarter, compared with $65 million for the same period in 2023. Adjusted diluted EPS, a non-GAAP financial measure, was $0.81 for the first quarter, compared with $0.56 for the same period in 2023.

Adjusted earnings before interest, taxes, depreciation and amortization (“adjusted EBITDA”), a non-GAAP financial measure, was $288 million for the first quarter, compared with $210 million for the same period in 2023.

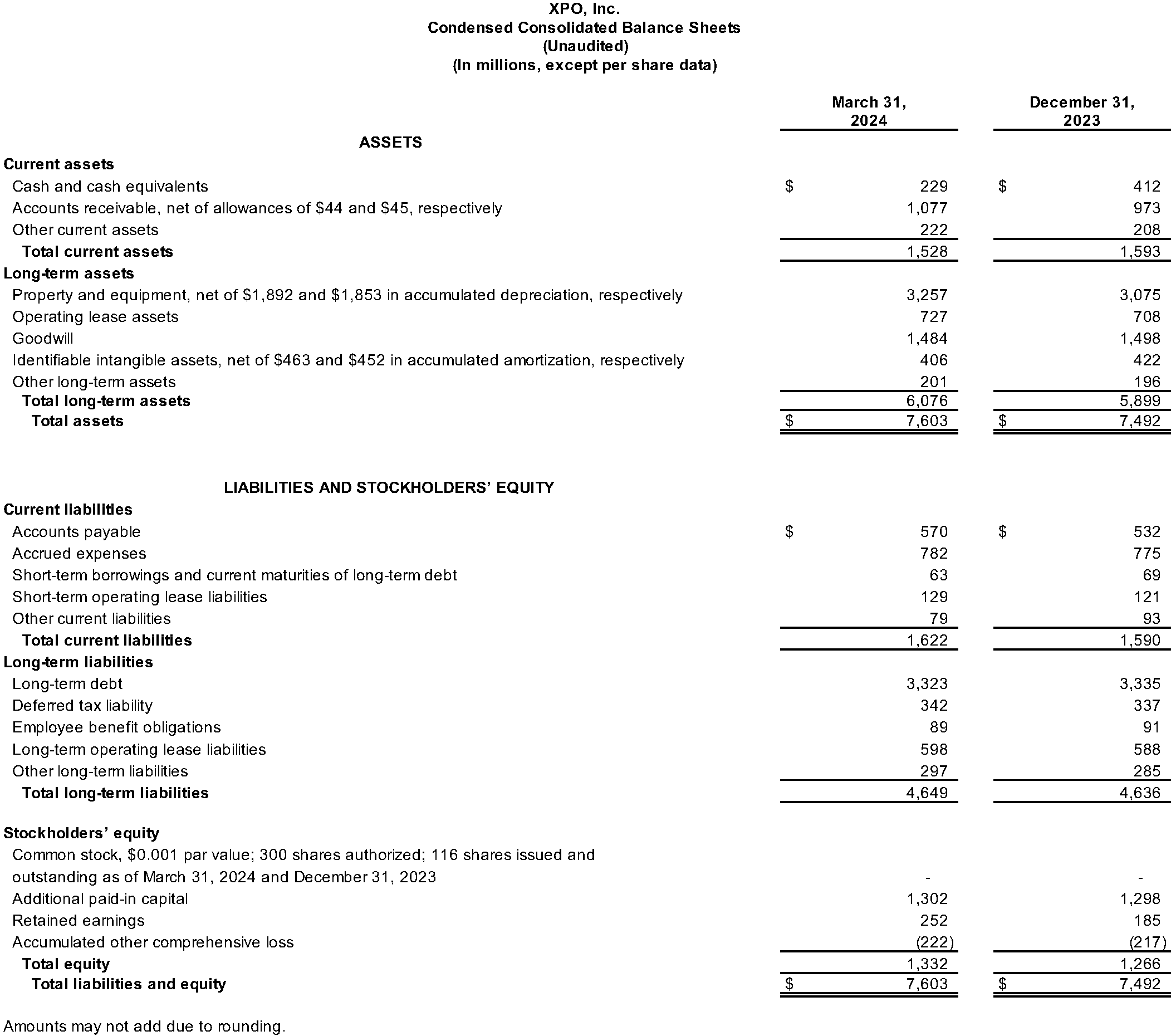

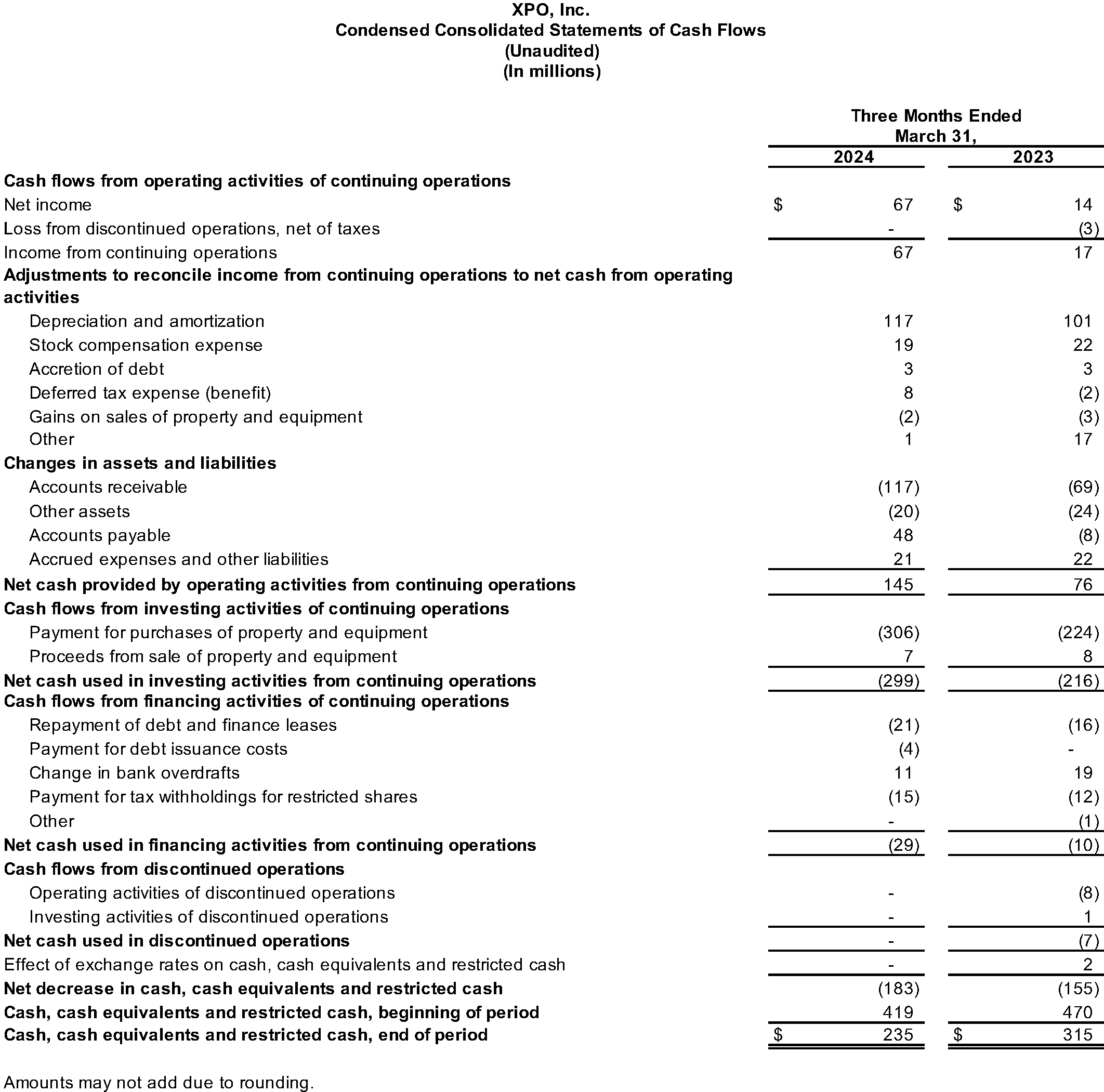

The company generated $145 million of cash flow from operating activities in the first quarter, and ended the quarter with $229 million of cash and cash equivalents on hand, after $299 million of net capital expenditures.

Results by Business Segment

- North American Less-Than-Truckload (LTL): The segment generated revenue of $1.22 billion for the first quarter 2024, compared with $1.12 billion for the same period in 2023. On a year-over-year basis, shipments per day increased 4.7%, tonnage per day increased 2.6%, and yield, excluding fuel, increased 9.8%. Including fuel, yield increased 7.0%.

Operating income was $165 million for the first quarter 2024, compared with $103 million for the same period in 2023. Adjusted operating income, a non-GAAP financial measure, was $175 million for the first quarter, compared with $117 million for the same period in 2023. Adjusted operating ratio, a non-GAAP financial measure, was 85.7%, reflecting a year-over-year improvement of 390 basis points.

Adjusted EBITDA for the first quarter 2024 was $255 million, compared with $182 million for the same period in 2023. The year-over-year increase in adjusted EBITDA was due primarily to higher yield, excluding fuel, and an increase in tonnage per day, partially offset by lower fuel surcharge revenue.

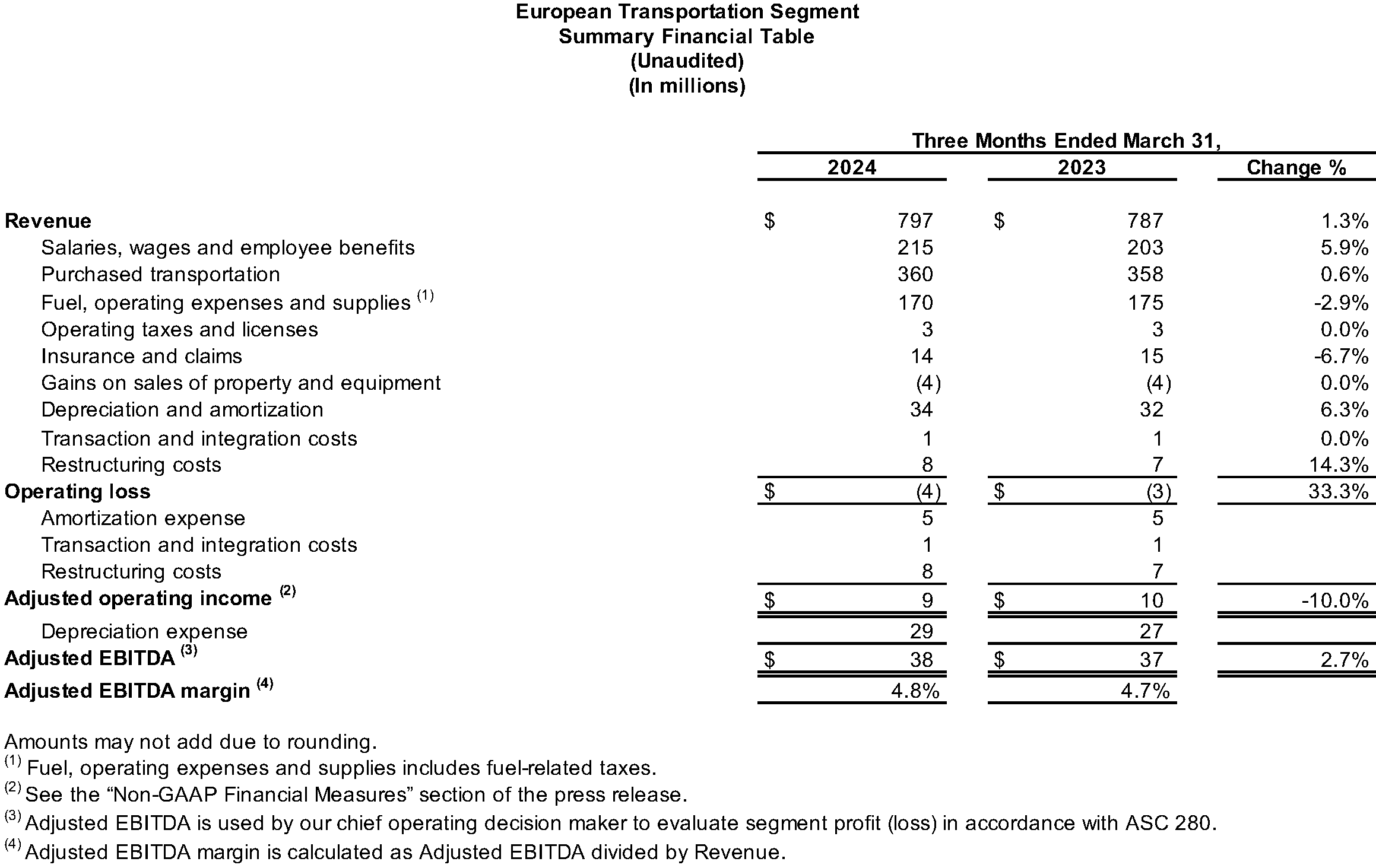

- European Transportation: The segment generated revenue of $797 million for the first quarter 2024, compared with $787 million for the same period in 2023. Operating income was a loss of $4 million for the first quarter, compared with a loss of $3 million for the same period in 2023.

Adjusted EBITDA was $38 million for the first quarter, compared with $37 million for the same period in 2023.

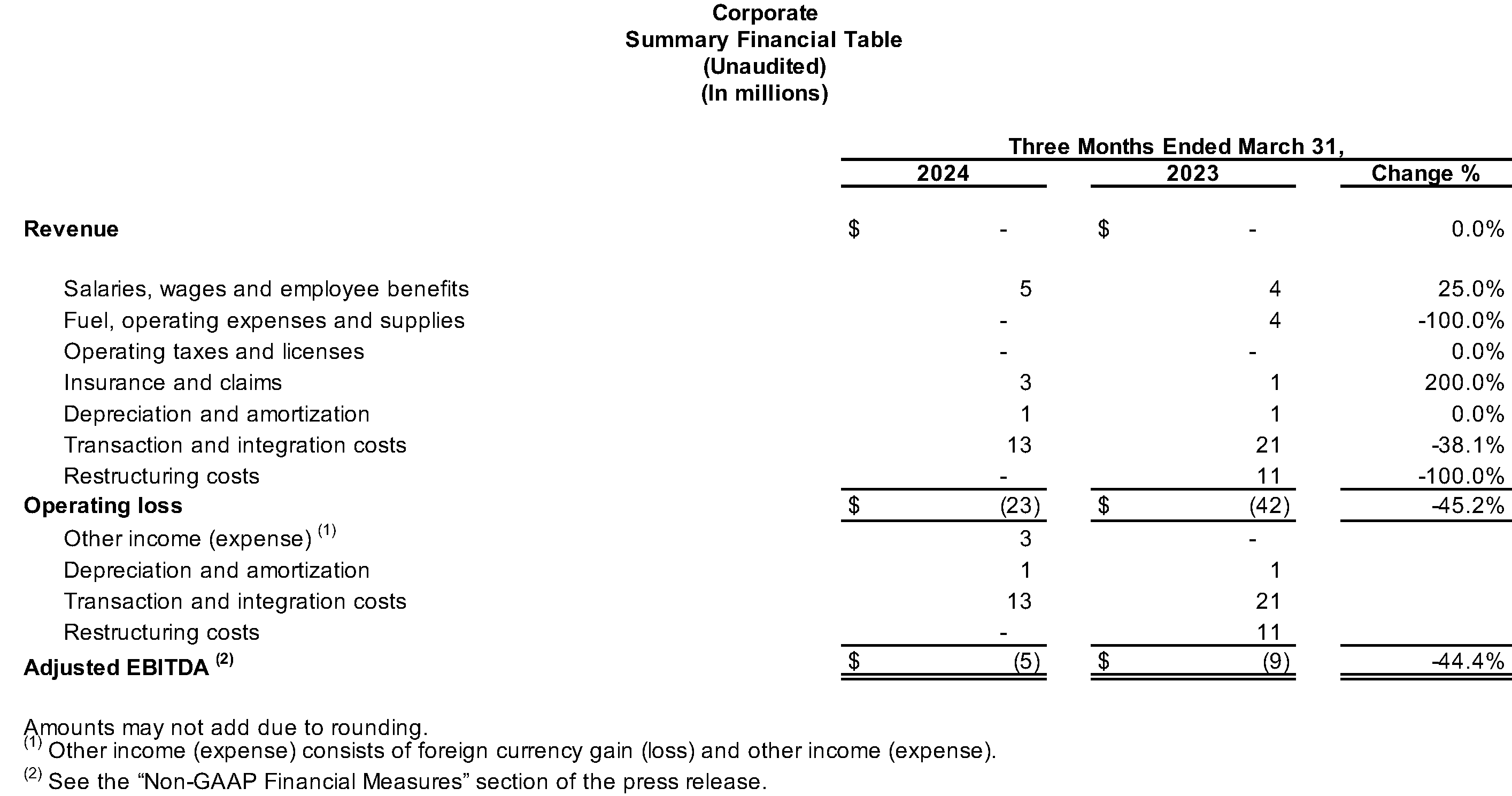

- Corporate: The segment generated an operating loss of $23 million for the first quarter 2024, compared with a loss of $42 million for the same period in 2023. The year-over-year improvement in operating loss was due primarily to an $8 million reduction in transaction and integration costs and an $11 million reduction in restructuring costs.

Adjusted EBITDA, a non-GAAP financial measure, was a loss of $5 million for the first quarter 2024, compared with a loss of $9 million for the same period in 2023, reflecting a year-over-year improvement from the company’s continued rationalization of corporate overhead costs.

Conference Call

The company will hold a conference call on Friday, May 3, 2024, at 8:30 a.m. Eastern Time. Participants can call toll-free (from US/Canada) 1-877-269-7756; international callers dial +1-201-689-7817. A live webcast of the conference will be available on the investor relations area of the company’s website, xpo.com/investors. The conference will be archived until June 2, 2024. To access the replay by phone, call toll-free (from US/Canada) 1-877-660-6853; international callers dial +1-201-612-7415. Use participant passcode 13745666.

About XPO

XPO, Inc. (NYSE: XPO) is a leader in asset-based less-than-truckload (LTL) freight transportation in North America. The company’s customer-focused organization efficiently moves 18 billion pounds of freight per year, enabled by its proprietary technology. XPO serves approximately 52,000 customers with 610 locations and 39,000 employees in North America and Europe, with headquarters in Greenwich, Conn., USA. Visit xpo.com for more information, and connect with XPO on LinkedIn, Facebook, Instagram, X and YouTube.

Non-GAAP Financial Measures

As required by the rules of the Securities and Exchange Commission (“SEC”), we provide reconciliations of the non-GAAP financial measures contained in this press release to the most directly comparable measure under GAAP, which are set forth in the financial tables attached to this press release.

XPO’s non-GAAP financial measures in this press release include: adjusted earnings before interest, taxes, depreciation and amortization (“adjusted EBITDA”) on a consolidated basis and for corporate; adjusted EBITDA margin on a consolidated basis; adjusted net income from continuing operations; adjusted diluted earnings from continuing operations per share (“adjusted diluted EPS”); adjusted operating income for our North American Less-Than-Truckload and European Transportation segments; and adjusted operating ratio for our North American Less-Than-Truckload segment.

We believe that the above adjusted financial measures facilitate analysis of our ongoing business operations because they exclude items that may not be reflective of, or are unrelated to, XPO and its business segments’ core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses. Other companies may calculate these non-GAAP financial measures differently, and therefore our measures may not be comparable to similarly titled measures of other companies. These non-GAAP financial measures should only be used as supplemental measures of our operating performance.

Adjusted EBITDA, adjusted EBITDA margin, adjusted net income from continuing operations, adjusted diluted EPS, adjusted operating income and adjusted operating ratio include adjustments for transaction and integration costs, as well as restructuring costs and other adjustments as set forth in the attached tables. Transaction and integration adjustments are generally incremental costs that result from an actual or planned acquisition, divestiture or spin-off and may include transaction costs, consulting fees, stock-based compensation, retention awards, internal salaries and wages (to the extent the individuals are assigned full-time to integration and transformation activities) and certain costs related to integrating and converging IT systems. Restructuring costs primarily relate to severance costs associated with business optimization initiatives. Management uses these non-GAAP financial measures in making financial, operating and planning decisions and evaluating XPO’s and each business segment’s ongoing performance.

We believe that adjusted EBITDA and adjusted EBITDA margin improve comparability from period to period by removing the impact of our capital structure (interest and financing expenses), asset base (depreciation and amortization), tax impacts and other adjustments as set out in the attached tables that management has determined are not reflective of core operating activities and thereby assist investors with assessing trends in our underlying businesses. We believe that adjusted net income from continuing operations and adjusted diluted EPS improve the comparability of our operating results from period to period by removing the impact of certain costs and gains that management has determined are not reflective of our core operating activities, including amortization of acquisition-related intangible assets, transaction and integration costs, restructuring costs and other adjustments as set out in the attached tables. We believe that adjusted operating income and adjusted operating ratio improve the comparability of our operating results from period to period by removing the impact of certain transaction and integration costs and restructuring costs, as well as amortization expenses as set out in the attached tables.

Forward-looking Statements

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. In some cases, forward-looking statements can be identified by the use of forward-looking terms such as “anticipate,” “estimate,” “believe,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “should,” “will,” “expect,” “objective,” “projection,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target,” “trajectory” or the negative of these terms or other comparable terms. These forward-looking statements are based on certain assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances.

These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Factors that might cause or contribute to a material difference include the risks discussed in our filings with the SEC, and the following: the effects of business, economic, political, legal, and regulatory impacts or conflicts upon our operations; supply chain disruptions and shortages, strains on production or extraction of raw materials, cost inflation and labor and equipment shortages; our ability to align our investments in capital assets, including equipment, service centers, and warehouses to our customers’ demands; our ability to implement our cost and revenue initiatives; the effectiveness of our action plan, and other management actions, to improve our North American LTL business; our ability to benefit from a sale, spin-off or other divestiture of one or more business units or to successfully integrate and realize anticipated synergies, cost savings and profit opportunities from acquired companies; goodwill impairment; issues related to compliance with data protection laws, competition laws, and intellectual property laws; fluctuations in currency exchange rates, fuel prices and fuel surcharges; the expected benefits of the spin-offs of GXO Logistics, Inc. and RXO, Inc.; our ability to develop and implement suitable information technology systems; the impact of potential cyber-attacks and information technology or data security breaches or failures; our indebtedness; our ability to raise debt and equity capital; fluctuations in interest rates; seasonal fluctuations; our ability to maintain positive relationships with our network of third-party transportation providers; our ability to attract and retain key employees including qualified drivers; labor matters; litigation; and competition and pricing pressures.

All forward-looking statements set forth in this release are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to or effects on us or our business or operations. Forward-looking statements set forth in this release speak only as of the date hereof, and we do not undertake any obligation to update forward-looking statements except to the extent required by law.