XPO Reports Second Quarter 2025 Results

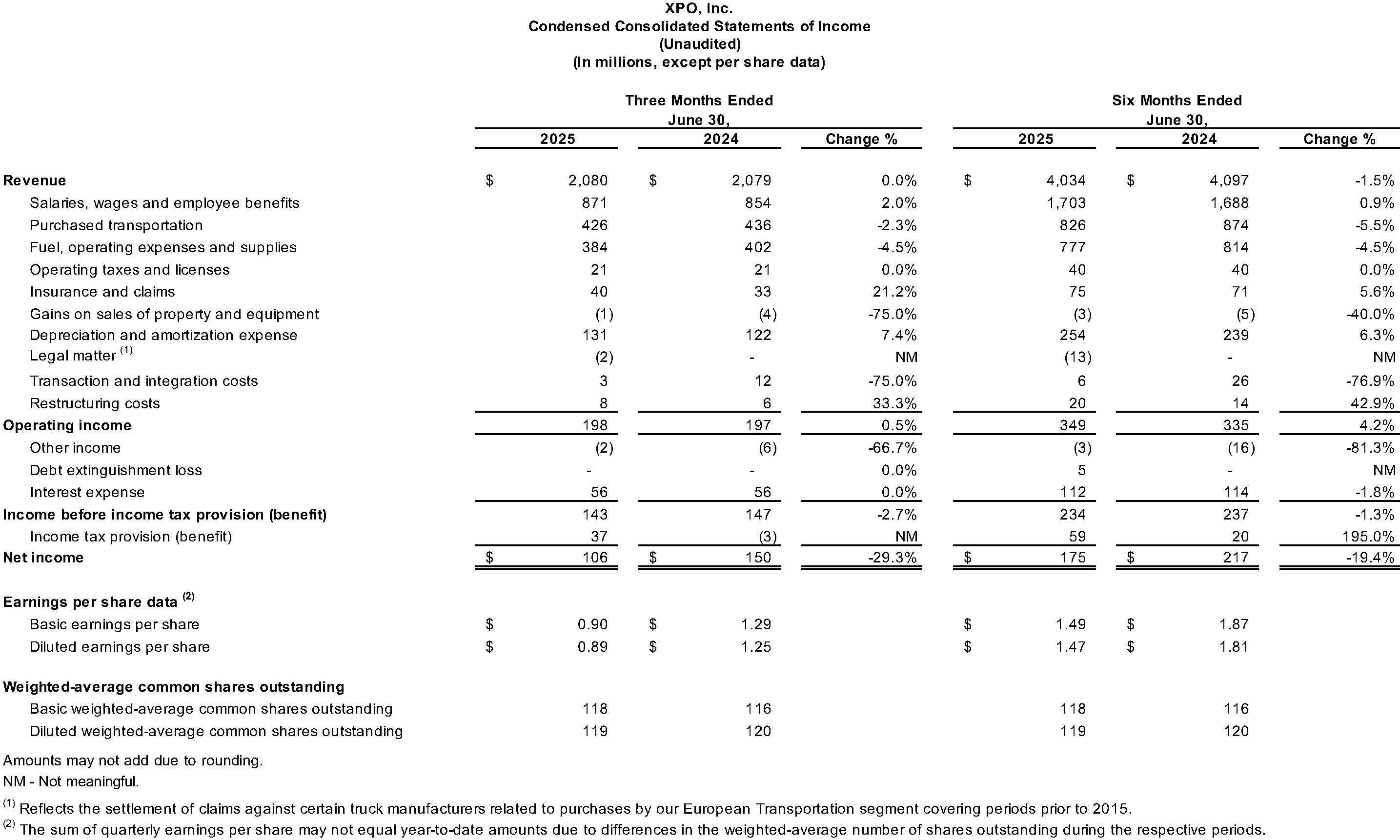

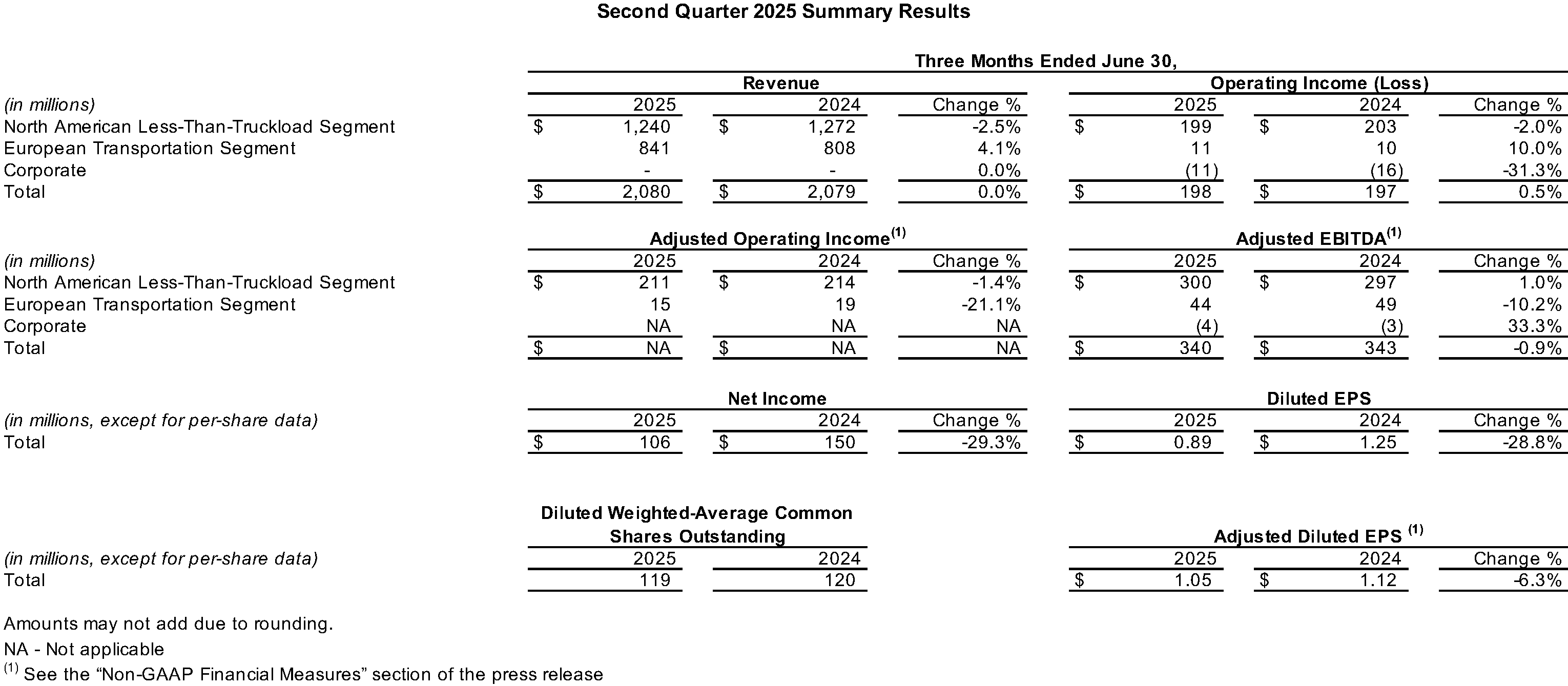

XPO (NYSE: XPO) today announced its financial results for the second quarter 2025. The company reported diluted earnings per share of $0.89, compared with $1.25 for the same period in 2024, and adjusted diluted earnings per share of $1.05, compared with $1.12 for the same period in 2024.

Mario Harik, chief executive officer of XPO, said, “We delivered strong results in the second quarter, with adjusted EBITDA of $340 million and adjusted diluted EPS of $1.05, both exceeding expectations.

“In our North American LTL business, we achieved an adjusted operating ratio of 82.9%, reflecting an industry-best year-over-year improvement of 30 basis points. While our tonnage declined in the soft freight environment, our world-class service culture drove above-market pricing growth and share gains with local customers. We grew yield, excluding fuel, by 6.1% and increased revenue per shipment by 5.6% from the prior year, with sequential growth in both metrics. On the cost side, we reduced purchased transportation expense by 53% as we insourced linehaul miles to a record level. And we generated another gain in labor productivity, supported by our proprietary technology.”

Harik continued, “We’re executing at a high level and consistently outperforming the industry, with a strategy that positions us to deliver long-term margin expansion and earnings growth.”

Second Quarter Highlights

For the second quarter 2025, the company generated revenue of $2.08 billion, compared with $2.08 billion for the same period in 2024.

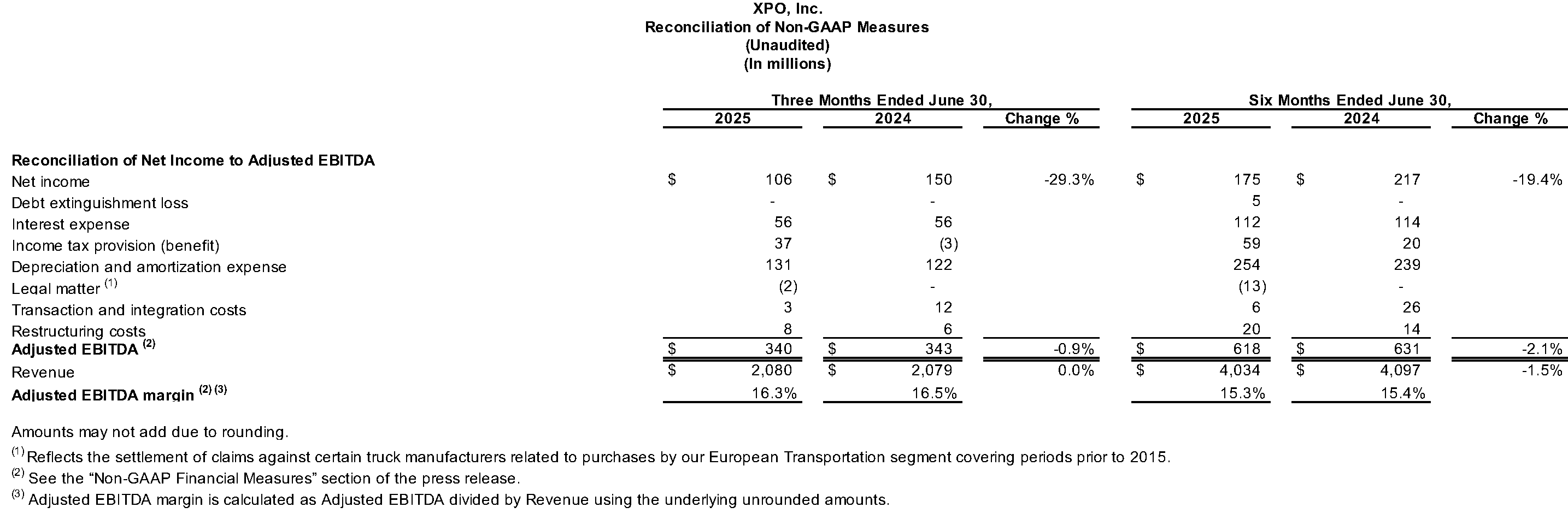

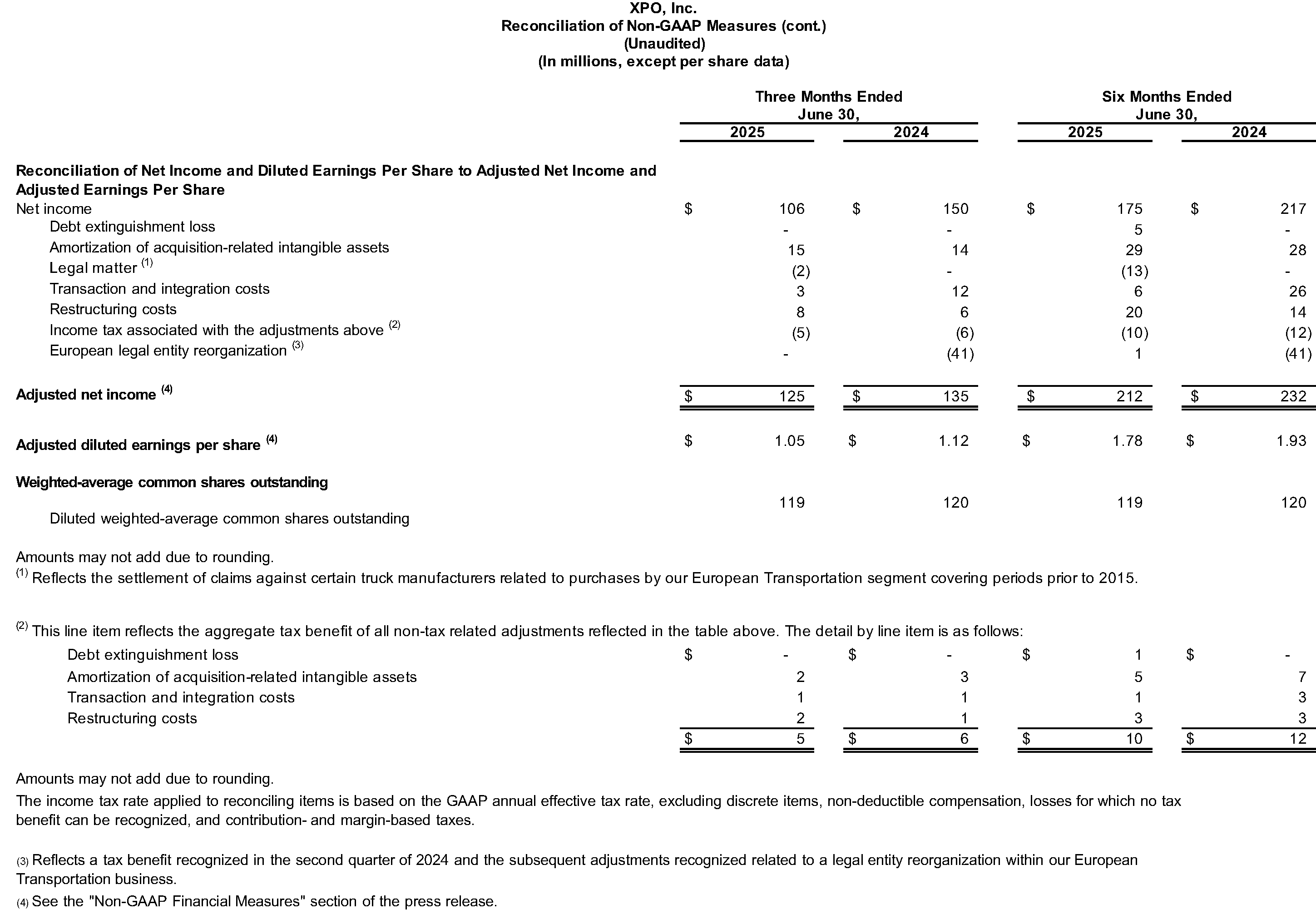

Operating income was $198 million for the second quarter, compared with $197 million for the same period in 2024. Net income was $106 million for the second quarter, compared with $150 million for the same period in 2024, as the company lapped a one-time tax benefit related to the European business. Diluted earnings per share was $0.89 for the second quarter, compared with $1.25 for the same period in 2024.

Adjusted net income, a non-GAAP financial measure, was $125 million for the second quarter, compared with $135 million for the same period in 2024. Adjusted diluted EPS, a non-GAAP financial measure, was $1.05 for the second quarter, compared with $1.12 for the same period in 2024.

Adjusted earnings before interest, taxes, depreciation and amortization (“adjusted EBITDA”), a non-GAAP financial measure, was $340 million for the second quarter, compared with $343 million for the same period in 2024.

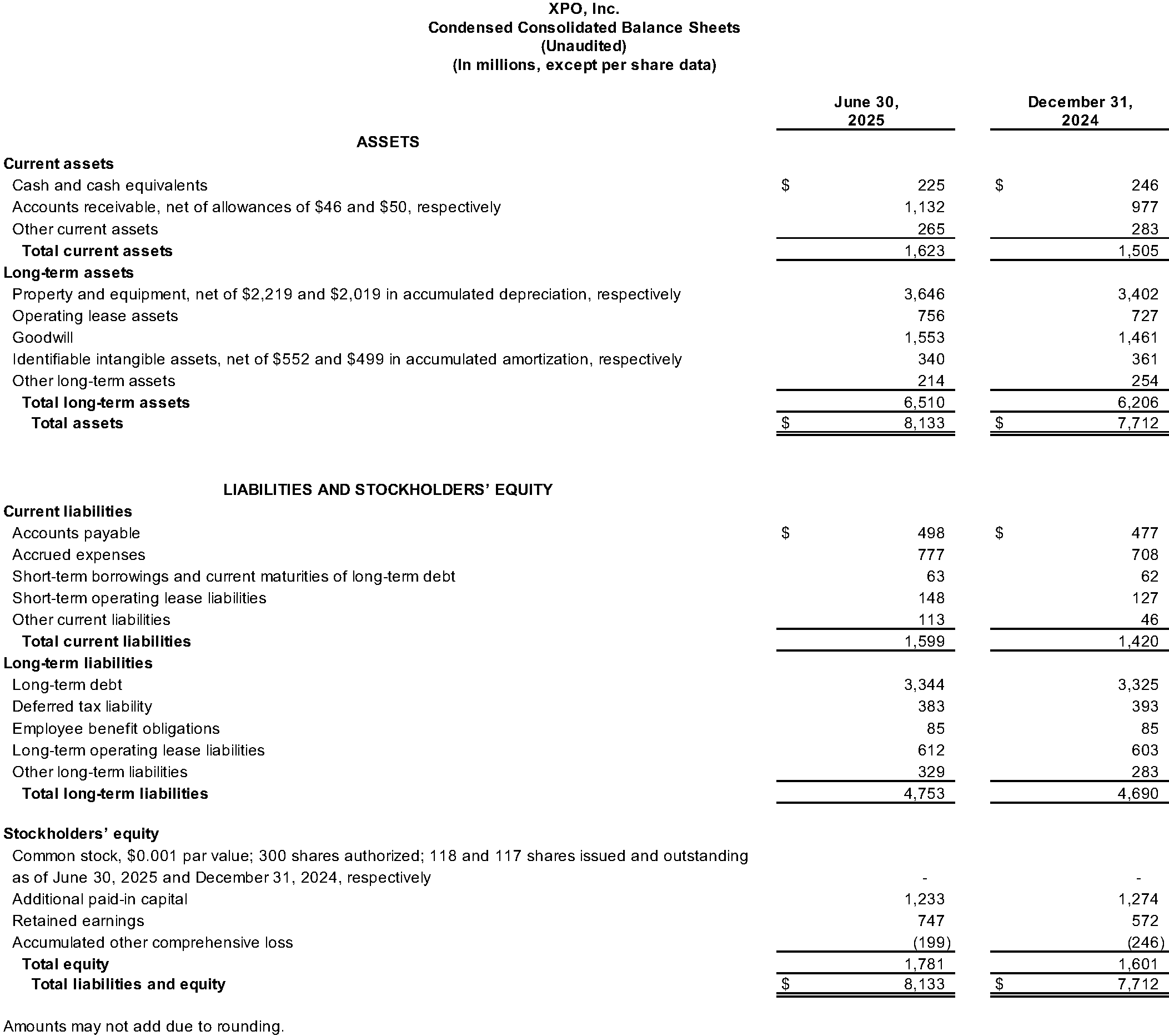

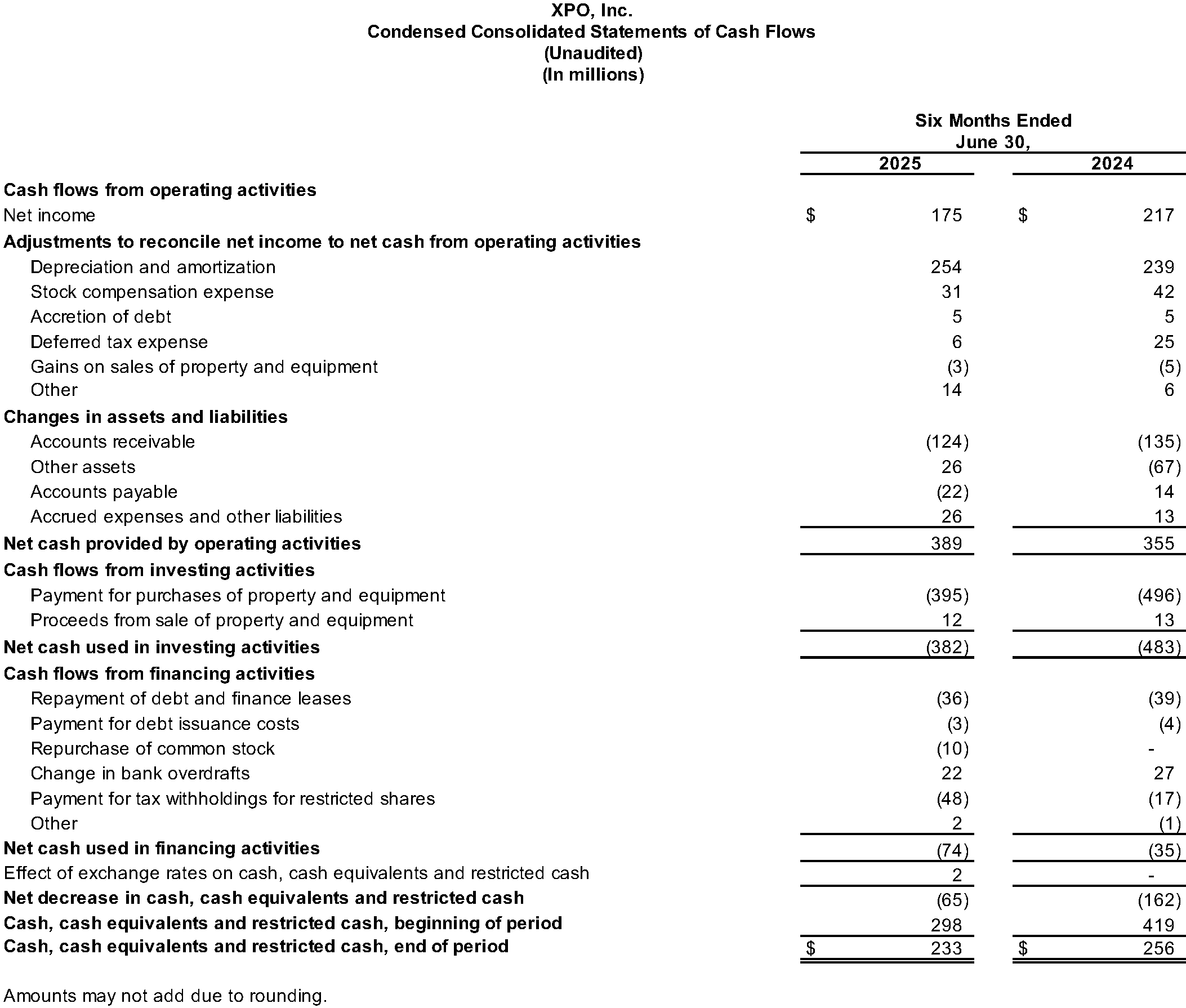

The company generated $247 million of cash flow from operating activities in the second quarter and ended the quarter with $225 million of cash and cash equivalents on hand, after $191 million of net capital expenditures.

Results by Business Segment

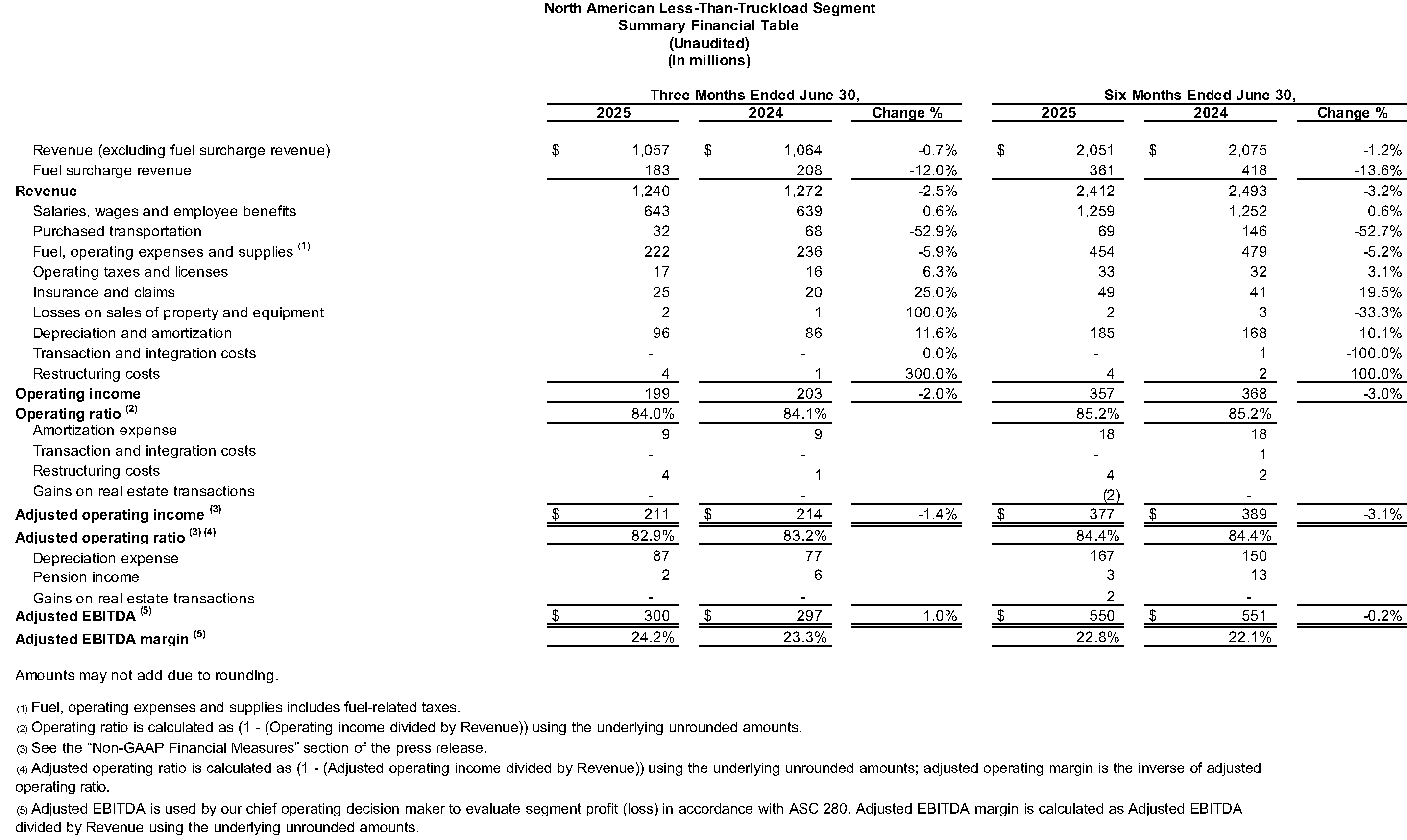

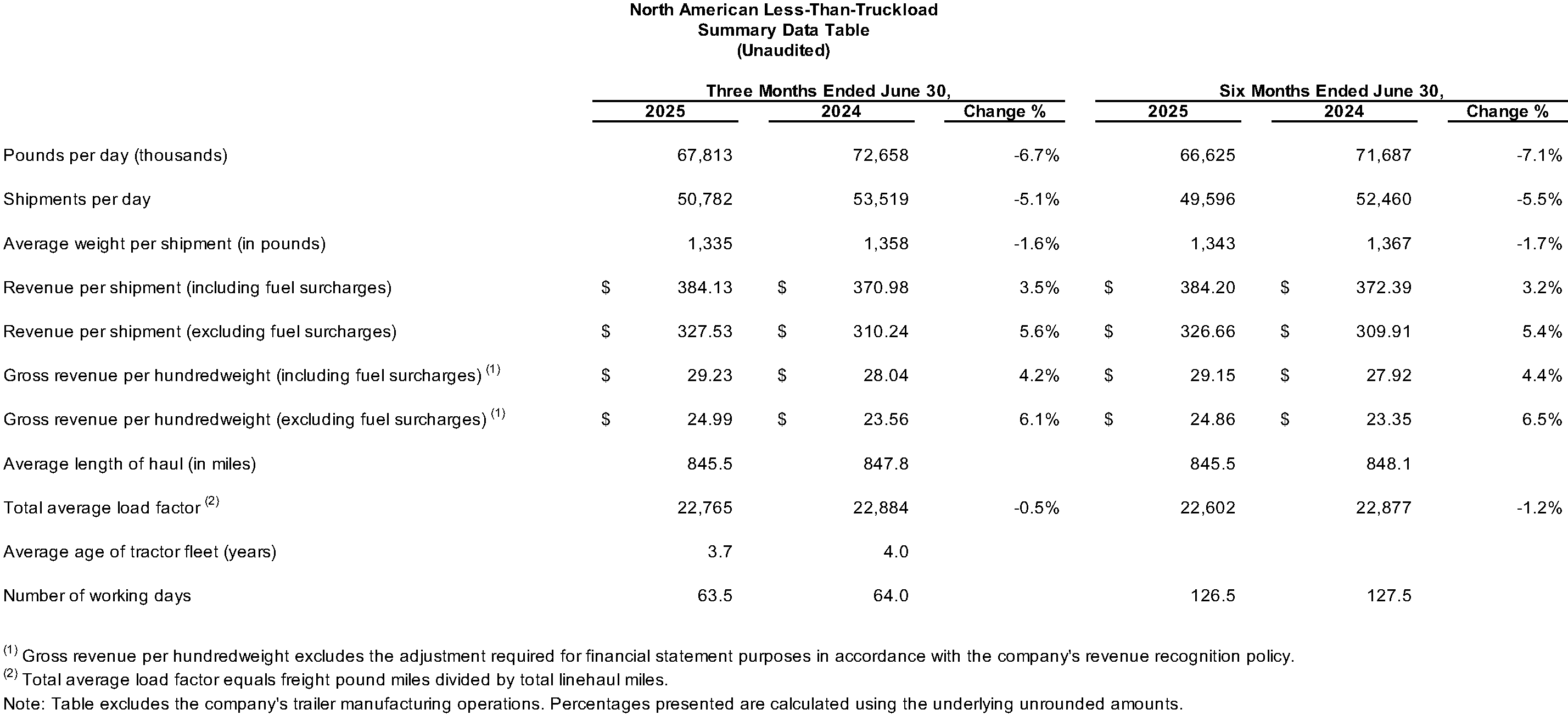

- North American Less-Than-Truckload (LTL): The segment generated revenue of $1.24 billion for the second quarter 2025, compared with $1.27 billion for the same period in 2024. On a year-over-year basis, shipments per day decreased 5.1%, tonnage per day decreased 6.7%, while yield, excluding fuel, increased 6.1%. Including fuel, yield increased 4.2%.

Operating income was $199 million for the second quarter, compared with $203 million for the same period in 2024. Adjusted operating income, a non-GAAP financial measure, was $211 million for the second quarter, compared with $214 million for the same period in 2024. Adjusted operating ratio, a non-GAAP financial measure, was 82.9%, reflecting a year-over-year improvement of 30 basis points.

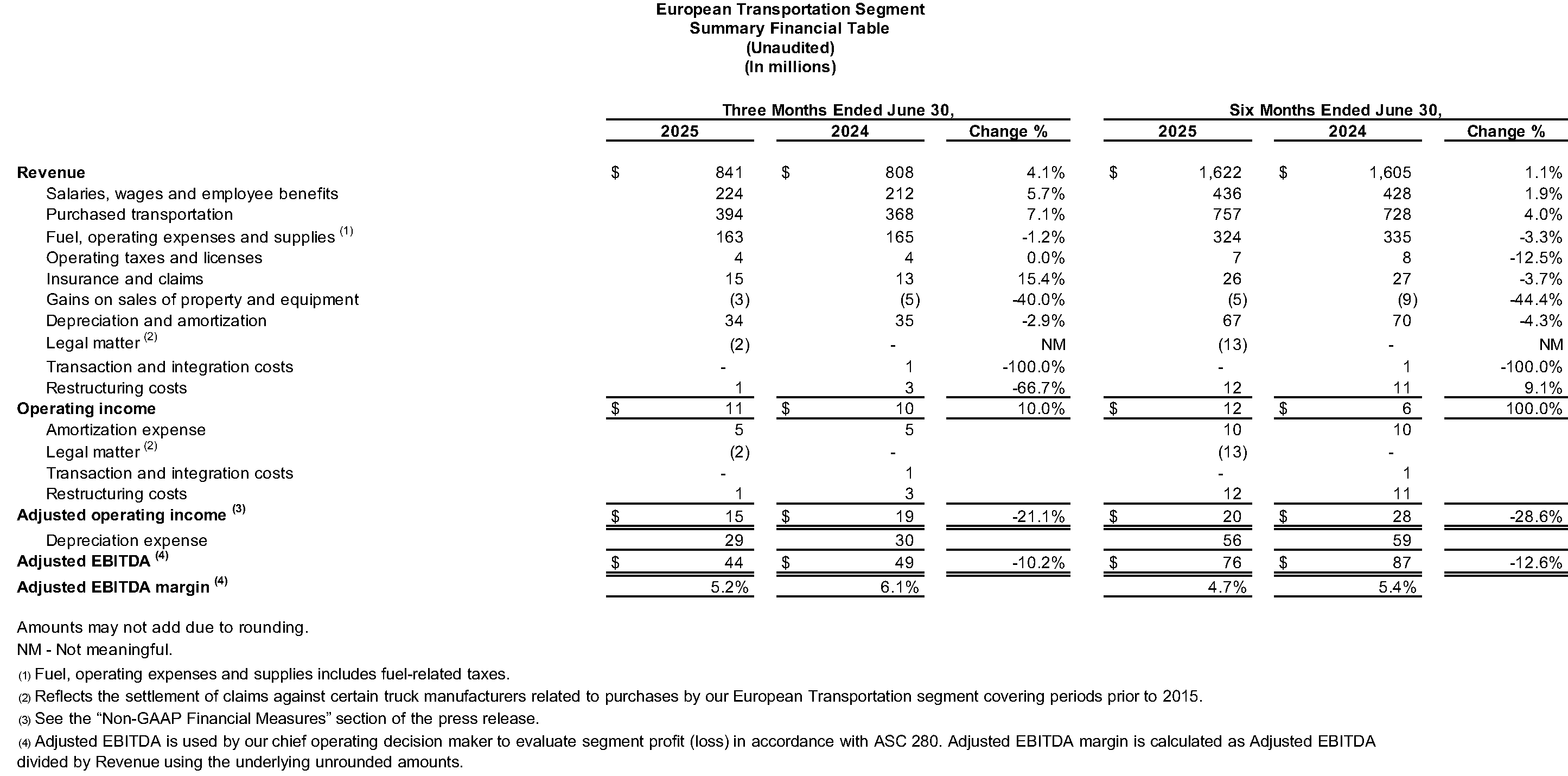

Adjusted EBITDA for the second quarter was $300 million, compared with $297 million for the same period in 2024. The year-over-year increase in adjusted EBITDA was due primarily to yield growth and lower purchased transportation costs, partially offset by lower fuel surcharge revenue, lower tonnage per day and wage inflation. - European Transportation: The segment generated revenue of $841 million for the second quarter 2025, compared with $808 million for the same period in 2024. Operating income was $11 million for the second quarter, compared with $10 million for the same period in 2024.

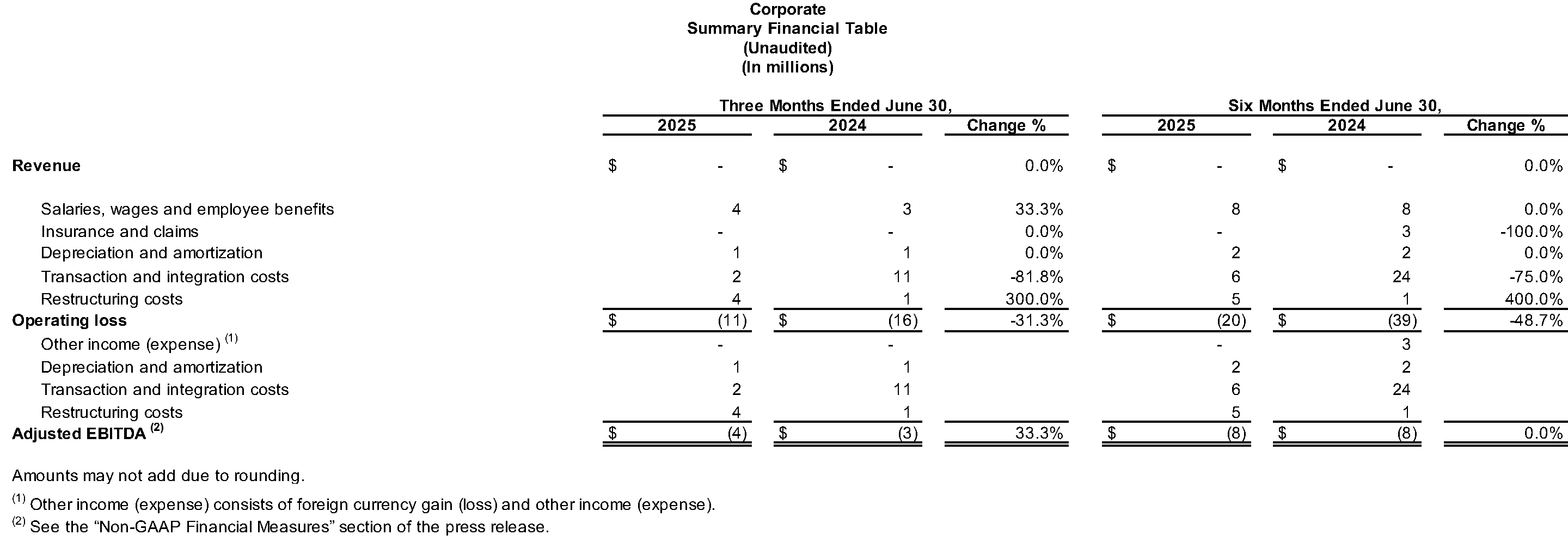

Adjusted EBITDA was $44 million for the second quarter, compared with $49 million for the same period in 2024. - Corporate: The segment generated an operating loss of $11 million for the second quarter 2025, compared with a loss of $16 million for the same period in 2024. The year-over-year improvement in operating loss was due primarily to a reduction in transaction and integration costs, partially offset by higher restructuring costs.

Adjusted EBITDA was a loss of $4 million for the second quarter 2025, compared with a loss of $3 million for the same period in 2024.

Conference Call

The company will hold a conference call on Thursday, July 31, 2025, at 8:30 a.m. Eastern Time. Participants can call toll-free (from US/Canada) 1-877-269-7756; international callers dial +1-201-689-7817. A live webcast of the conference will be available on the investor relations area of the company’s website, xpo.com/investors. The conference will be archived until August 30, 2025. To access the replay by phone, call toll-free (from US/Canada) 1-877-660-6853; international callers dial +1-201-612-7415. Use participant passcode 13754630.

About XPO

XPO, Inc. (NYSE: XPO) is a leader in asset-based less-than-truckload (LTL) freight transportation in North America. The company’s customer-focused organization efficiently moves 17 billion pounds of freight per year, enabled by its proprietary technology. XPO serves 55,000 customers with 608 locations and 38,000 employees in North America and Europe, and is headquartered in Greenwich, Conn., USA. Visit xpo.com for more information, and connect with XPO on LinkedIn, Facebook, X, Instagram and YouTube.

Non-GAAP Financial Measures

As required by the rules of the Securities and Exchange Commission (“SEC”), we provide reconciliations of the non-GAAP financial measures contained in this press release to the most directly comparable measure under GAAP, which are set forth in the financial tables attached to this press release.

XPO’s non-GAAP financial measures in this press release include: adjusted earnings before interest, taxes, depreciation and amortization (“adjusted EBITDA”) on a consolidated basis and for corporate; adjusted EBITDA margin on a consolidated basis; adjusted net income; adjusted diluted earnings per share (“adjusted diluted EPS”); adjusted operating income for our North American Less-Than-Truckload and European Transportation segments; and adjusted operating ratio for our North American Less-Than-Truckload segment.

We believe that the above adjusted financial measures facilitate analysis of our ongoing business operations because they exclude items that may not be reflective of, or are unrelated to, XPO and its business segments’ core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses. Other companies may calculate these non-GAAP financial measures differently, and therefore our measures may not be comparable to similarly titled measures of other companies. These non-GAAP financial measures should only be used as supplemental measures of our operating performance.

Adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted diluted EPS, adjusted operating income and adjusted operating ratio include adjustments for transaction and integration costs, as well as restructuring costs and other adjustments as set forth in the attached tables. Transaction and integration adjustments are generally incremental costs that result from an actual or planned acquisition, divestiture or spin-off and may include transaction costs, consulting fees, stock-based compensation, retention awards, internal salaries and wages (to the extent the individuals are assigned full-time to integration and transformation activities) and certain costs related to integrating and converging IT systems. Restructuring costs primarily relate to severance costs associated with business optimization initiatives. Management uses these non-GAAP financial measures in making financial, operating and planning decisions and evaluating XPO’s and each business segment’s ongoing performance.

We believe that adjusted EBITDA and adjusted EBITDA margin, improve comparability from period to period by removing the impact of our capital structure (interest and financing expenses), asset base (depreciation and amortization), tax impacts and other adjustments as set out in the attached tables that management has determined are not reflective of core operating activities and thereby assist investors with assessing trends in our underlying businesses. We believe that adjusted net income and adjusted diluted EPS improve the comparability of our operating results from period to period by removing the impact of certain costs and gains that management has determined are not reflective of our core operating activities, including amortization of acquisition-related intangible assets, transaction and integration costs, restructuring costs and other adjustments as set out in the attached tables. We believe that adjusted operating income and adjusted operating ratio improve the comparability of our operating results from period to period by removing the impact of certain transaction and integration costs and restructuring costs, as well as amortization expense and other adjustments as set out in the attached tables.

Forward-looking Statements

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. In some cases, forward-looking statements can be identified by the use of forward-looking terms such as “anticipate,” “estimate,” “believe,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “should,” “will,” “expect,” “objective,” “projection,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target,” “trajectory” or the negative of these terms or other comparable terms. These forward-looking statements are based on certain assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances.

These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Factors that might cause or contribute to a material difference include the risks discussed in our filings with the SEC, and the following: the effects of business, economic, political, legal, and regulatory impacts or conflicts upon our operations; supply chain disruptions and shortages, strains on production or extraction of raw materials, cost inflation and labor and equipment shortages; our ability to align our investments in capital assets, including equipment, service centers, and warehouses to our customers’ demands; our ability to implement our cost and revenue initiatives and realize growth and expansion as a result of those initiatives; the effectiveness of our action plan, and other management actions, to improve our North American LTL business; our ability to continue insourcing linehaul in ways that enhance our network efficiency and productivity; the anticipated impact of a freight market recovery on our business; our ability to benefit from a sale, spin-off or other divestiture of one or more business units or to successfully integrate and realize anticipated synergies, cost savings and profit opportunities from acquired companies; goodwill impairment; issues related to compliance with data protection laws, competition laws, and intellectual property laws; fluctuations in currency exchange rates, fuel prices and fuel surcharges; the expected benefits of the spin-offs of GXO Logistics, Inc. and RXO, Inc.; our ability to develop and implement proprietary technology and suitable information technology systems; the impact of potential cyber-attacks and information technology or data security breaches or failures; our ability to repurchase shares on favorable terms; our indebtedness; our ability to raise debt and equity capital; fluctuations in interest rates; seasonal fluctuations; our ability to maintain positive relationships with our network of third-party transportation providers; our ability to attract and retain management talent and key employees including qualified drivers; labor matters; litigation; competition; and our ability to deliver pricing growth driven by service quality.

All forward-looking statements set forth in this release are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to or effects on us or our business or operations. Forward-looking statements set forth in this release speak only as of the date hereof, and we do not undertake any obligation to update forward-looking statements except to the extent required by law.